New York Tax St 810 Sales Form 2014

What is the New York Tax ST-810 Sales Form

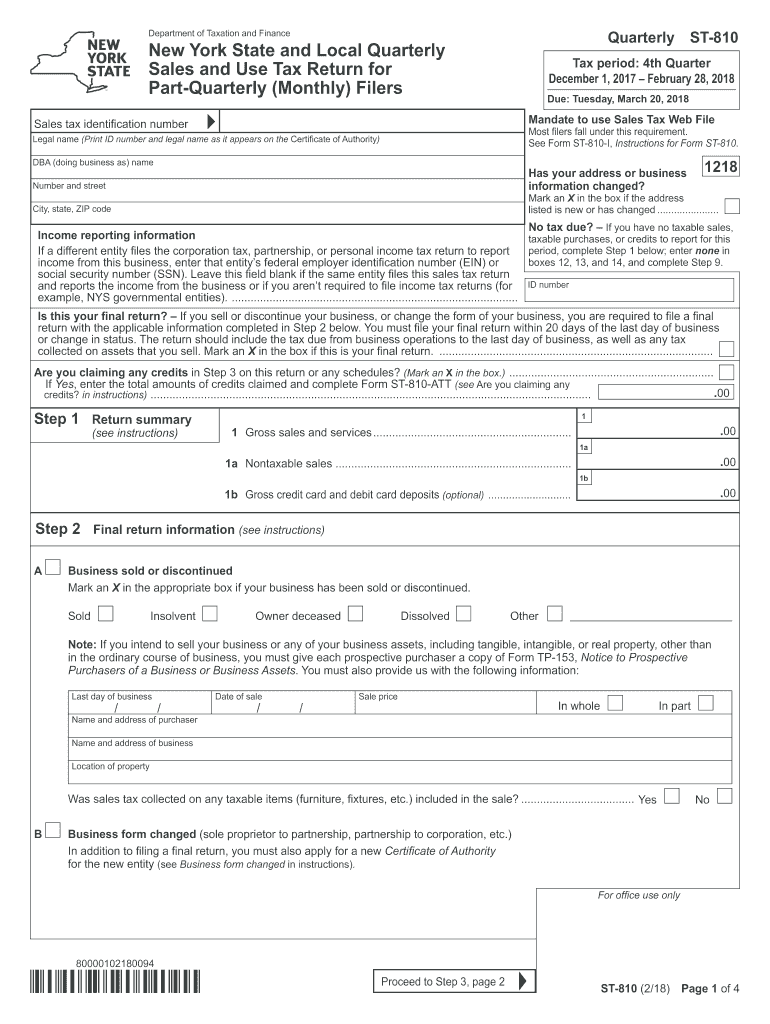

The New York Tax ST-810 Sales Form is a crucial document used for claiming a sales tax exemption on certain purchases made by eligible organizations. This form is primarily utilized by exempt entities, such as nonprofit organizations, government agencies, and certain educational institutions, to document their tax-exempt status when making purchases in New York State. By providing this form to vendors, these organizations can avoid paying sales tax on qualifying transactions, thereby reducing their overall expenses.

How to Use the New York Tax ST-810 Sales Form

Using the New York Tax ST-810 Sales Form involves several steps to ensure compliance and proper documentation. First, eligible organizations must complete the form accurately, providing their name, address, and the reason for the exemption. Once filled out, the form should be presented to the vendor at the time of purchase. Vendors are required to keep a copy of the form for their records, which helps in verifying the tax-exempt status of the purchaser. It is essential for organizations to ensure that the form is used only for eligible purchases to avoid penalties.

Steps to Complete the New York Tax ST-810 Sales Form

Completing the New York Tax ST-810 Sales Form requires careful attention to detail. Follow these steps:

- Begin by entering the name and address of the exempt organization at the top of the form.

- Specify the type of organization and the reason for the exemption in the designated sections.

- Provide the vendor's name and address where the form will be presented.

- Sign and date the form to validate it.

- Make copies for your records and provide the original to the vendor at the time of purchase.

Legal Use of the New York Tax ST-810 Sales Form

The legal use of the New York Tax ST-810 Sales Form is governed by New York State tax laws. Organizations must ensure they meet the eligibility criteria to use the form legitimately. Misuse of the form, such as using it for ineligible purchases or providing false information, can lead to penalties, including fines and back taxes owed. It is vital for organizations to understand their responsibilities and maintain accurate records to support their tax-exempt status.

Filing Deadlines / Important Dates

While the New York Tax ST-810 Sales Form is not submitted to a tax authority, organizations should be aware of important deadlines related to their overall tax-exempt status. It is advisable to keep track of any renewals or reporting requirements that may apply to maintain eligibility for sales tax exemptions. Organizations should also be mindful of any changes in tax laws that could affect their use of the form.

Form Submission Methods (Online / Mail / In-Person)

The New York Tax ST-810 Sales Form is not submitted to a tax authority in the traditional sense; instead, it is presented to vendors at the time of purchase. Organizations need to ensure that they provide the completed form directly to the vendor, either in person or via mail if necessary. Vendors are responsible for retaining the form for their records, which may be requested during audits.

Quick guide on how to complete new york tax st 810 sales 2014 form

Your assistance manual on how to prepare your New York Tax St 810 Sales Form

If you’re curious about how to generate and submit your New York Tax St 810 Sales Form, here are some brief instructions on how to streamline the tax submission process.

To begin, simply create an airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that permits you to modify, generate, and finalize your income tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and revisit to change entries as necessary. Enhance your tax management with cutting-edge PDF editing, eSigning, and seamless sharing.

Follow the steps below to complete your New York Tax St 810 Sales Form in a few minutes:

- Establish your account and start working on PDFs in just a few minutes.

- Utilize our directory to discover any IRS tax form; browse through variations and schedules.

- Select Get form to access your New York Tax St 810 Sales Form in our editor.

- Input the required fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and rectify any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that submitting in paper form may lead to return errors and delay refunds. Always verify the IRS website for filing regulations specific to your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct new york tax st 810 sales 2014 form

FAQs

-

What is the New York sales tax in 2014, and how does it differ in New York City?

NYC is 8.75% not sure about NY State

-

Which forms do I need to fill in order to file New York state taxes?

You must determine your New York State residency status. You need to answer these questions:Did you live in an on-campus apartment or an apartment or house off-campus in New York State in 2012?Did you maintain, or rent, the on-campus apartment or off-campus residence for at least 11 months in 2012?Were you physically present in New York State for at least 183 days in 2012?If the answers to all three questions are "Yes", and you were not a full-time undergraduate student (which as an F-1 OPT I assume you were not), you are a New York State resident for tax purposes. Otherwise you are a nonresident.You file Form IT-201, http://www.tax.ny.gov/pdf/curren..., if you are a resident of New York State, Form IT-203, http://www.tax.ny.gov/pdf/curren..., if you are not.

-

As an employer, what legal and tax forms am I required to have a new employee to fill out?

I-9, W-4, state W-4, and some sort of state new hire form. The New hire form is for dead beat parents. Don’t inform the state in time and guess what? You become personally liable for what should have been garnished from their wages.From the sound of your question I infer that you are trying to make this a DIY project. DO NOT. There are just too many things that you can F up. Seek yea a CPA or at least a payroll service YESTERDAY.

-

I am applying for a job as Interaction Designer in New York, the company has an online form to fill out and they ask about my current salary, I am freelancing.. What should I fill in?

As Sarah said, leave it blank or, if it's a free-form text field, put in "Freelancer".If you put in $50k and they were thinking of paying $75k, you just lost $25k/year. If you put in $75k, but their budget only allows $50k, you may have lost the job on that alone.If you don't put in anything, leave it to the interview, and tell thm that you're a freelancer and adjust your fee according to the difficulty of the job, so there's no set income. If they ask for how much you made last year, explain that that would include periods between jobs, where you made zero, so it's not a fair number.In any financial negotiation, an old saying will always hold true - he who comes up with a number first, loses. Jobs, buying houses - they're both the same. Asking "How much?" is the better side to be on. then if they say they were thinking of $50k-$75k, you can tell them that it's just a little less than you were charging, but the job looks to be VERY interesting, the company seems to be a good one to work for and you're sure that when they see what you're capable of, they'll adjust your increases. (IOW, "I'll take the $75k, but I expect to be making about $90k in a year.")They know how to play the game - show them that you do too.

-

How will the just released New York Times story of Donald Trump participating in tax fraud and schemes to funnel millions from his father Fred's estate play out?

I have just read ALL of it… there was a LOT to read…it is quite a treatise on the subject.The details are RIVETING meaning that I could not stop reading and what I read gave me chills up and down my spine. The veracity, the depth of the investigation, the thoroughness the comparatives, the scale and scope… taken at any individual level is one thing taking in the totality of it… well below I will state my conclusion…My major in University was accounting my minor was economics, My first job out of university was for a public accounting firm, I did audit work, I prepared financial statements, tax returns, and I KNOW this stuff cold…This is a tale of lies, fraud, deceit, theft, criminal wrong doing of monumental proportions and the man masquerading as PRESIDENT of the United States was thick as a thief in the middle of it. I would not want to be one of the accountants who prepared those fraudulent tax returns - their licenses to practice could be in jeopardy. The ones who actually signed those returns… are however criminals. New York State has already said they are investigating these allegations.. The interest and penalties if assessed… well there is a line in Trading places that Eddie Murphy speaks to the effect “that the best way to hurt rich people is to turn them into poor people”.He lied to EVERYONE, the public, he stole from the American Taxpayer on a scale and with specific intentions to do so that organized crime never contemplated… This family’s theft from the American treasury is so VULGAR and obscene as to defy credulity. There is no innocent explanation what so ever possible for the actions taken. This is a damning conclusion.I do not shock easily.. I have seen many things in my life, this work from the Times is beyond question the most compelling case I have ever read.This one would have been a case for the RICO statutes…Opinion | Suzanne Garment: Trump and his family could owe millions for their decades-long con jobAppalling and disgusting …. and this criminal is the President? Really? So if America knew about how he inherited all his wealth, how he committed fraud on his Taxes and how he was an adulterous asshole with a porn star and a Playboy Playmate, how he dodged the draft…and then goes and attacks John McCain - would they have elected him President? Him hiding these facts - was a fraud upon the American People…. So please do not call him legitimate in my presence.As vile as his sexual peccadilloes are, his financial background and that of his Father and siblings is every bit as vile…reprehensible - the audacity of this man to stand as President is so wrong on so many levels… and he has the chutzpah to express his opinions on other peoples behaviour? How DARE he… He is not a judge of other people- he is to be judged, he is subject to America’s judgement.Just in case you wanted to know what I really thought…

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

A Startup CEO take a sales prospect out to a New York Knicks game and spends $500 on the tickets. How much of the $500 spent is Tax Deductible for the business?

Beginning in 2018, after the TCJA reforms, none of it.Only 50% of business meals are deductible.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the new york tax st 810 sales 2014 form

How to generate an eSignature for the New York Tax St 810 Sales 2014 Form online

How to create an electronic signature for the New York Tax St 810 Sales 2014 Form in Google Chrome

How to generate an electronic signature for putting it on the New York Tax St 810 Sales 2014 Form in Gmail

How to generate an eSignature for the New York Tax St 810 Sales 2014 Form straight from your smartphone

How to create an electronic signature for the New York Tax St 810 Sales 2014 Form on iOS devices

How to create an eSignature for the New York Tax St 810 Sales 2014 Form on Android

People also ask

-

What is the New York Tax St 810 Sales Form?

The New York Tax St 810 Sales Form is a document used by businesses in New York to claim exemption from sales tax on purchases. Understanding how to properly fill out this form is essential for businesses seeking tax relief. airSlate SignNow provides an easy platform to eSign and send this form securely.

-

How can airSlate SignNow help with the New York Tax St 810 Sales Form?

With airSlate SignNow, users can easily upload, fill out, and eSign the New York Tax St 810 Sales Form digitally. This streamlines the process, reduces paperwork, and ensures compliance with state requirements. Additionally, our platform offers a user-friendly interface for quick access and submission.

-

Is there a cost associated with using airSlate SignNow for the New York Tax St 810 Sales Form?

Yes, airSlate SignNow offers various pricing plans tailored to fit the needs of businesses. Depending on your usage requirements, you can choose a plan that allows you to efficiently handle the New York Tax St 810 Sales Form without overspending. We also provide a free trial, so you can explore our features before committing.

-

Can I integrate airSlate SignNow with other tools to manage the New York Tax St 810 Sales Form?

Absolutely! airSlate SignNow offers integrations with various applications, including CRM and accounting software. This allows for seamless management of the New York Tax St 810 Sales Form and contributes to a more efficient workflow across your business.

-

What are the main benefits of using airSlate SignNow for the New York Tax St 810 Sales Form?

The main benefits include time efficiency, cost-effectiveness, and enhanced security. With airSlate SignNow, you can quickly complete and send the New York Tax St 810 Sales Form, saving you time during tax season. Additionally, the platform encrypts sensitive information, ensuring your data remains safe.

-

Are there any specific features of airSlate SignNow that support the New York Tax St 810 Sales Form?

Yes, key features include customizable templates, automated workflows, and real-time tracking. These tools ensure that the New York Tax St 810 Sales Form is handled efficiently from start to finish. You can also receive notifications when the document is signed, keeping you informed every step of the way.

-

Is it easy to get started with airSlate SignNow for the New York Tax St 810 Sales Form?

Yes, starting with airSlate SignNow is incredibly easy! Simply sign up for our platform, and you'll have access to helpful guides and templates for the New York Tax St 810 Sales Form. The intuitive interface allows users of all skill levels to get up to speed quickly.

Get more for New York Tax St 810 Sales Form

- Drain cleaner restricted registrant verification of training affidavit answers form

- Reserve an appointment harris county clerks office form

- Pdf texas hazlewood act exemption application for continued form

- Daily building and grounds checklist form

- Fillable online duke clacs form to approve courses for

- Harris county appraisal district form 21mh 082011 hcad

- Seguin permits form

- Pwd 790 form

Find out other New York Tax St 810 Sales Form

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement