Ny Tax Quarterly Sales 2023

What is the NY Tax Quarterly Sales?

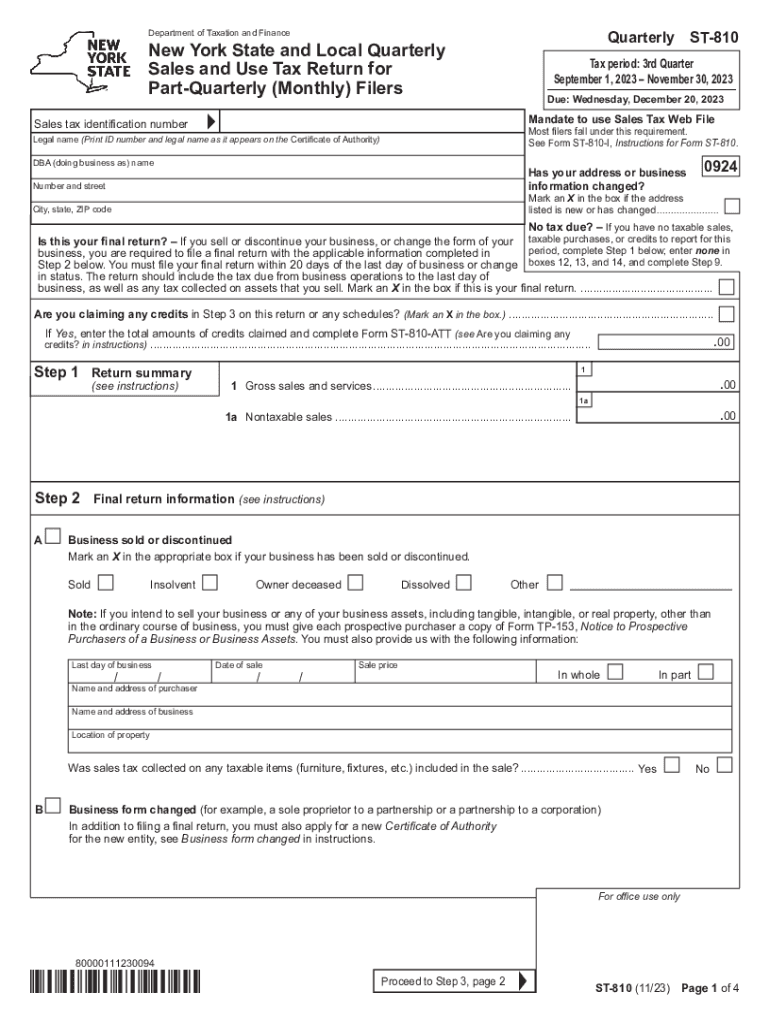

The NY Tax Quarterly Sales refers to the New York State Sales Tax Quarterly Return, commonly known as the ST-810 form. This form is used by businesses to report and remit sales tax collected during a quarterly period. It is essential for maintaining compliance with state tax regulations and ensuring that all sales tax obligations are met. The form requires detailed information about sales, tax collected, and any exemptions claimed.

Steps to Complete the NY Tax Quarterly Sales

Completing the NY Tax Quarterly Sales form involves several key steps:

- Gather sales records for the quarter, including total sales and tax collected.

- Identify any sales that are exempt from tax and document these transactions.

- Fill out the ST-810 form accurately, ensuring all required fields are completed.

- Calculate the total sales tax due based on the sales reported.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the NY Tax Quarterly Sales. The deadlines are typically set for the end of the month following the end of each quarter. For example:

- First Quarter (January - March): Due by April 30

- Second Quarter (April - June): Due by July 31

- Third Quarter (July - September): Due by October 31

- Fourth Quarter (October - December): Due by January 31 of the following year

Key Elements of the NY Tax Quarterly Sales

The ST-810 form includes several key elements that must be reported:

- Total sales for the reporting period.

- Sales tax collected from customers.

- Any exemptions claimed during the reporting period.

- Adjustments for prior periods, if applicable.

Each of these components is crucial for accurately calculating the total tax liability owed to the state.

Form Submission Methods

Businesses can submit the NY Tax Quarterly Sales form through various methods:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if necessary.

Choosing the right submission method can help ensure timely processing of the form.

Penalties for Non-Compliance

Failure to file the NY Tax Quarterly Sales form on time or inaccuracies in reporting can result in penalties. Common consequences include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid sales tax.

- Potential audits from the New York State Department of Taxation and Finance.

It is important for businesses to stay compliant to avoid these penalties and maintain a good standing with the state.

Quick guide on how to complete ny tax quarterly sales

Easily Prepare Ny Tax Quarterly Sales on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and store it securely online. airSlate SignNow provides all the necessary tools to swiftly create, edit, and eSign your documents without hassles. Handle Ny Tax Quarterly Sales on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Ny Tax Quarterly Sales Effortlessly

- Locate Ny Tax Quarterly Sales and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize essential portions of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you select. Modify and eSign Ny Tax Quarterly Sales, ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ny tax quarterly sales

Create this form in 5 minutes!

How to create an eSignature for the ny tax quarterly sales

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the '810' feature?

airSlate SignNow is a powerful platform that allows businesses to send and eSign documents seamlessly. The '810' feature enhances the document workflow by providing quick access to your signed documents, ensuring a smooth and efficient process.

-

How much does airSlate SignNow cost for users interested in the '810' feature?

Pricing for airSlate SignNow varies based on the plan you choose. However, it remains a cost-effective solution for businesses looking to leverage features like '810' for efficient document management and eSigning.

-

What benefits does the '810' feature offer for document signing?

The '810' feature streamlines the signing process by enabling quick document access and management. This benefit minimizes turnaround time for document approvals, ultimately empowering teams to be more productive.

-

Can the '810' feature integrate with other platforms?

Yes, airSlate SignNow with the '810' feature integrates seamlessly with various applications like Google Drive and Salesforce. This integration allows you to manage documents directly from your preferred tools, enhancing workflow efficiency.

-

Is the '810' feature user-friendly for new customers?

Absolutely! The '810' feature of airSlate SignNow is designed with user experience in mind. New customers will find the interface intuitive, making it easy to start sending and signing documents without a steep learning curve.

-

What types of documents can be sent using the '810' feature?

You can send a wide range of documents using airSlate SignNow with the '810' feature, including contracts, agreements, and forms. This flexibility ensures that any document requiring a signature can be handled efficiently.

-

How secure is the '810' feature for sensitive documents?

Security is a top priority with airSlate SignNow. The '810' feature includes robust encryption and authentication processes to ensure your sensitive documents are protected during transmission and storage.

Get more for Ny Tax Quarterly Sales

- Uccjea affidavit kansas form

- Cdocuments and settingsnataliekjcmy documentsksjc webdocumentsmiscellaneous formsrtfksa60_1102_noticeofextensiontofil

- Kansas counterclaim form

- Motion to extend final protection from abuse order for one kansasjudicialcouncil form

- Child support addendum kansas judicial council kansasjudicialcouncil form

- 1 motion to modify child support 2 short form domestic relations kansasjudicialcouncil

- Protection order violations matrix battered womens justice project kansasjudicialcouncil form

- In the district court of county kansas kansas judicial council kansasjudicialcouncil form

Find out other Ny Tax Quarterly Sales

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now