Form St 810 New York State and Local Quarterly Sales and Use Tax Return for Part Quarterly Monthly Filers Revised 1122 2022

What is the Form ST-810?

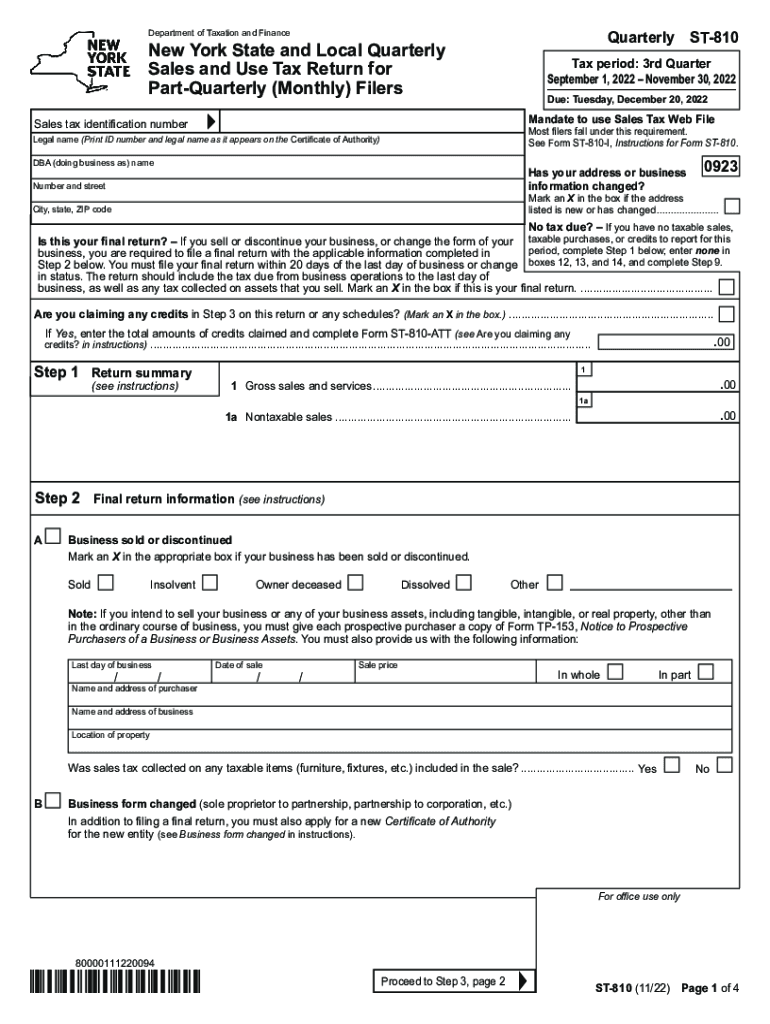

The Form ST-810 is the New York State and Local Quarterly Sales and Use Tax Return. This form is specifically designed for businesses that are required to report and remit sales and use taxes. It is applicable to both quarterly and monthly filers, depending on the volume of taxable sales. The form captures essential information regarding sales tax collected, exempt sales, and any use tax owed. Understanding this form is crucial for compliance with New York tax regulations.

How to Use the Form ST-810

Using the Form ST-810 involves several key steps. First, gather all necessary financial records, including sales receipts and tax-exempt purchase documentation. Next, accurately complete each section of the form, ensuring that all figures are correct and reflect your business's sales activity for the reporting period. Once completed, the form must be submitted to the New York State Department of Taxation and Finance by the specified deadline. Failure to submit the form accurately and on time may result in penalties.

Steps to Complete the Form ST-810

Completing the Form ST-810 requires careful attention to detail. Follow these steps:

- Enter your business information, including name, address, and identification number.

- Report total sales for the period, distinguishing between taxable and exempt sales.

- Calculate the total sales tax collected and any use tax due.

- Include any adjustments for previous periods, if applicable.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form ST-810 vary based on your reporting frequency. Quarterly filers typically must submit the form by the 20th of the month following the end of the quarter, while monthly filers must submit by the 20th of the following month. It is essential to stay informed about these deadlines to avoid late fees or penalties.

Penalties for Non-Compliance

Failure to file the Form ST-810 on time or inaccuracies in reporting can lead to significant penalties. These may include late filing fees, interest on unpaid taxes, and potential audits. It is crucial for businesses to ensure compliance with all filing requirements to mitigate these risks.

Digital vs. Paper Version

The Form ST-810 can be completed and submitted either digitally or via paper. The digital version offers convenience and may expedite processing times. However, businesses should ensure they have the proper software to complete the form electronically. The paper version must be mailed to the appropriate tax office, which may take longer to process.

Quick guide on how to complete form st 810 new york state and local quarterly sales and use tax return for part quarterly monthly filers revised 1122

Prepare Form St 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1122 seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed papers, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, revise, and electronically sign your documents swiftly and without interruptions. Manage Form St 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1122 on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to modify and electronically sign Form St 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1122 with ease

- Locate Form St 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1122 and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent areas of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Adjust and electronically sign Form St 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1122 and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 810 new york state and local quarterly sales and use tax return for part quarterly monthly filers revised 1122

Create this form in 5 minutes!

People also ask

-

What is the 2022 NY form, and why is it important?

The 2022 NY form refers to various tax forms and documentation required by the state of New York for compliance. It's important because filing these forms accurately and on time can help prevent penalties and ensure that you're fulfilling your tax obligations correctly.

-

How can airSlate SignNow help with the 2022 NY form process?

airSlate SignNow simplifies the process of filling out the 2022 NY form by providing templates and an easy-to-use interface for eSigning. This streamlines the workflow, ensuring that all parties can sign documents quickly and securely, which is especially beneficial during tax season.

-

Is there a cost for using airSlate SignNow for the 2022 NY form?

Yes, airSlate SignNow offers several pricing plans tailored to different needs, starting with a free trial. Once you assess its features for the 2022 NY form and other needs, you can choose a plan that best fits your budget while benefiting from its cost-effective solutions.

-

What features does airSlate SignNow offer for handling the 2022 NY form?

airSlate SignNow provides features such as document templates, eSignature capabilities, and real-time collaboration, all of which are essential for managing the 2022 NY form. These tools help ensure that all necessary documents are completed efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for the 2022 NY form?

Absolutely! airSlate SignNow supports various integrations with popular business applications, which can enhance your workflow while managing the 2022 NY form. This allows for seamless operations between different platforms and improves overall productivity.

-

How secure is airSlate SignNow when dealing with sensitive information on the 2022 NY form?

airSlate SignNow prioritizes security with encryption protocols and secure cloud storage, ensuring that sensitive information on your 2022 NY form remains protected. Their compliance with industry standards also gives users peace of mind when submitting important documents.

-

What are the benefits of using airSlate SignNow for the 2022 NY form?

Using airSlate SignNow for the 2022 NY form offers numerous benefits, including improved efficiency, reduced processing time, and enhanced accuracy. By automating the signing process, you can focus on your core business activities instead of getting bogged down in paperwork.

Get more for Form St 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1122

- New mexico paternity form

- Bill of sale in connection with sale of business by individual or corporate seller new mexico form

- Office lease agreement new mexico form

- Commercial sublease new mexico form

- Residential lease renewal agreement new mexico form

- Notice to lessor exercising option to purchase new mexico form

- Assignment of lease and rent from borrower to lender new mexico form

- Assignment of lease from lessor with notice of assignment new mexico form

Find out other Form St 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1122

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement