St 810 Form 2017

What is the St 810 Form

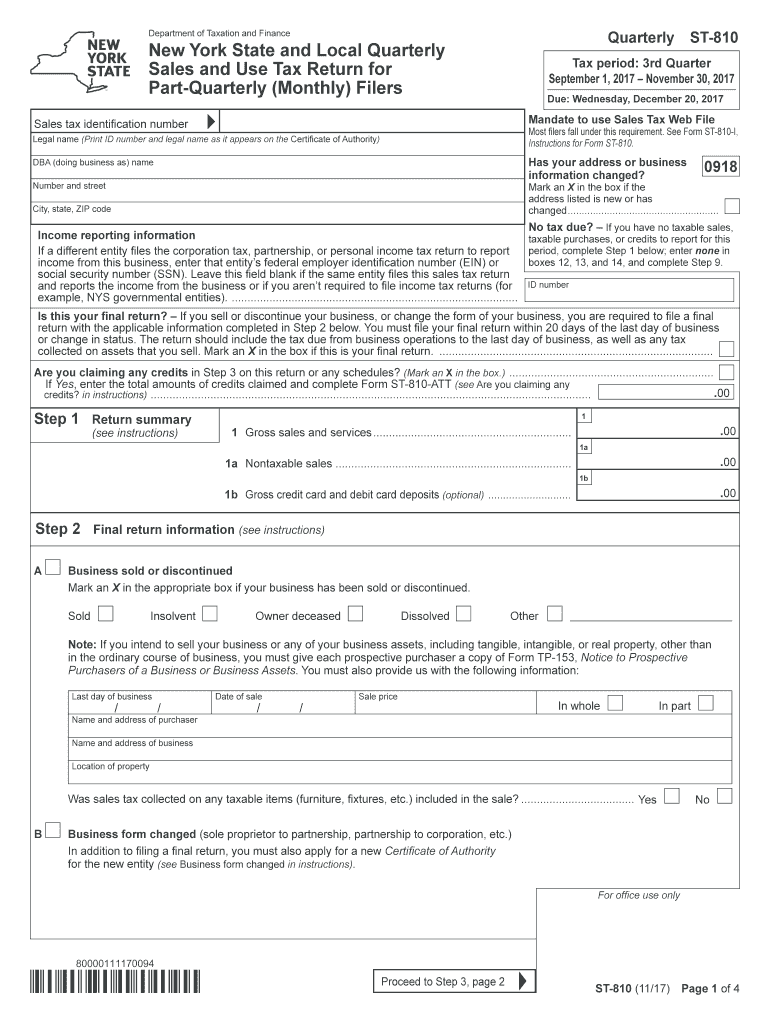

The St 810 Form is a document used primarily for tax purposes in the United States. It serves as a declaration for specific financial information that taxpayers must report to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and is often required for various financial transactions. Understanding the purpose and requirements of the St 810 Form is crucial for accurate tax reporting.

How to use the St 810 Form

Using the St 810 Form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, such as income statements and deduction records. Next, fill out the form carefully, ensuring that all fields are completed with accurate data. Once the form is filled out, review it for any errors before submitting it. Utilizing electronic signature options can streamline the process, making it easier to submit the form securely.

Steps to complete the St 810 Form

Completing the St 810 Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents.

- Access the St 810 Form online or obtain a physical copy.

- Fill in personal information, including name, address, and Social Security number.

- Input financial data accurately, ensuring all figures are correct.

- Review the completed form for any mistakes or omissions.

- Sign the form electronically or manually, as required.

- Submit the form via the preferred method, either electronically or by mail.

Legal use of the St 810 Form

The St 810 Form must be used in accordance with IRS regulations to ensure its legal validity. This includes adhering to deadlines for submission and ensuring that all information provided is truthful and accurate. Misuse of the form, such as providing false information or failing to submit it on time, can lead to penalties and legal repercussions. It is essential for taxpayers to understand their responsibilities when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the St 810 Form are critical for compliance with IRS regulations. Typically, forms must be submitted by April 15 of the following tax year. However, extensions may be available under certain circumstances. It is important for taxpayers to stay informed about any changes to deadlines, especially in light of special circumstances such as natural disasters or public health emergencies, which may affect filing requirements.

Form Submission Methods

The St 810 Form can be submitted through various methods, providing flexibility for taxpayers. Common submission methods include:

- Online submission through authorized e-filing platforms.

- Mailing a physical copy to the designated IRS address.

- In-person submission at local IRS offices, if applicable.

Choosing the right submission method can enhance the efficiency of the filing process and ensure timely compliance.

Quick guide on how to complete st 810 2017 form

Your assistance manual on how to prepare your St 810 Form

If you’re curious about how to generate and dispatch your St 810 Form, below are a few straightforward guidelines on how to facilitate tax processing.

To begin, you simply need to set up your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that enables you to edit, create, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, check boxes, and electronic signatures, and revert to modify responses if necessary. Streamline your tax organization with sophisticated PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your St 810 Form in just a few minutes:

- Establish your account and commence working on PDFs in no time.

- Utilize our directory to obtain any IRS tax form; browse through variants and timelines.

- Click Get form to access your St 810 Form in our editor.

- Complete the necessary fillable sections with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and rectify any errors.

- Save modifications, print your version, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that filing on paper may elevate return mistakes and postpone refunds. Naturally, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct st 810 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the st 810 2017 form

How to make an eSignature for the St 810 2017 Form in the online mode

How to make an eSignature for the St 810 2017 Form in Google Chrome

How to generate an eSignature for signing the St 810 2017 Form in Gmail

How to make an electronic signature for the St 810 2017 Form right from your smart phone

How to make an eSignature for the St 810 2017 Form on iOS

How to generate an electronic signature for the St 810 2017 Form on Android devices

People also ask

-

What is the St 810 Form, and how can airSlate SignNow help?

The St 810 Form is a document used for tax purposes that requires electronic signature and submission. With airSlate SignNow, you can easily create, send, and eSign the St 810 Form, streamlining your workflow and ensuring compliance with tax regulations.

-

How much does it cost to use airSlate SignNow for the St 810 Form?

airSlate SignNow offers several pricing plans starting from a basic package that suits small businesses to advanced options for larger organizations. Regardless of your plan, you can efficiently manage the St 810 Form and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing the St 810 Form?

airSlate SignNow includes features such as customizable templates, audit trails, and automated reminders to help you manage the St 810 Form effectively. These tools ensure that your document is completed accurately and on time, providing peace of mind.

-

Can I integrate airSlate SignNow with other software for the St 810 Form?

Yes, airSlate SignNow provides seamless integrations with various platforms, including CRM systems and cloud storage services, to enhance your workflow for the St 810 Form. This allows you to incorporate electronic signatures into your existing processes effortlessly.

-

Is it secure to eSign the St 810 Form with airSlate SignNow?

Absolutely! airSlate SignNow uses industry-leading security measures, including encryption and secure storage, to protect your documents, including the St 810 Form. You can confidently send and eSign your forms knowing that your data is safe.

-

How do I create a St 810 Form using airSlate SignNow?

Creating a St 810 Form with airSlate SignNow is simple and intuitive. You can either upload an existing document or use our template library to generate a new St 810 Form, customize it to fit your needs, and send it for signatures.

-

What are the benefits of using airSlate SignNow for the St 810 Form?

Using airSlate SignNow for the St 810 Form offers numerous benefits, including faster turnaround times, reduced paper usage, and improved accuracy. These advantages can lead to increased efficiency in your business processes.

Get more for St 810 Form

- Estimate request form fryer roofing

- Vsd 190 251254891 form

- Deepa paul a study on the banking habits of the people of kerala thesis shodhganga inflibnet ac form

- Lasc civ 279 form

- Form w concentrated animal feeding operation

- Updated header for policy 5600 f4 5 24 1 form

- 156 water street exeter nh 03833 form

Find out other St 810 Form

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online