Form ST 810 New York State and Local Quarterly Sales and Use Tax Return for Part Quarterly Filers Revised 1124 2024-2026

Understanding the ST 810 Form

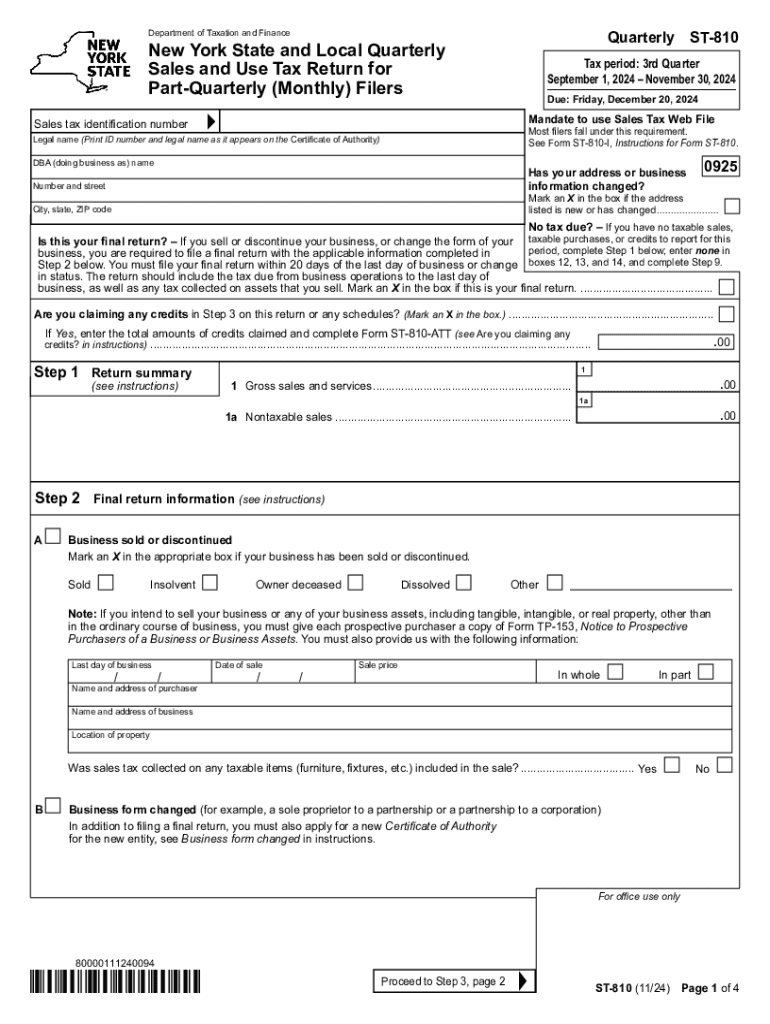

The ST 810 form is the New York State and Local Quarterly Sales and Use Tax Return designed specifically for businesses that need to report their sales and use tax obligations. This form is essential for those who are required to file quarterly, allowing them to detail their taxable sales, exempt sales, and the amount of tax they owe to the state. It is crucial for maintaining compliance with New York tax regulations and ensuring accurate reporting of sales activities.

Steps to Complete the ST 810 Form

Completing the ST 810 form requires careful attention to detail. Here are the key steps involved:

- Gather necessary documentation, including sales records and exemption certificates.

- Fill out the business information section, including the name, address, and identification number.

- Report total sales, taxable sales, and exempt sales in the designated sections.

- Calculate the total tax due based on the reported figures.

- Review the completed form for accuracy before submission.

How to Obtain the ST 810 Form

The ST 810 form can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing businesses to print and fill it out manually. Additionally, businesses may also request a physical copy through their local tax office if needed.

Filing Deadlines and Important Dates

It is important for businesses to be aware of the filing deadlines associated with the ST 810 form. Generally, the form must be submitted on or before the last day of the month following the end of the quarter. For example, the due date for the first quarter (January to March) is typically April 30. Keeping track of these deadlines helps avoid penalties and ensures compliance with New York tax laws.

Legal Use of the ST 810 Form

The ST 810 form is legally required for businesses that engage in sales of taxable goods and services in New York. Filing this form accurately is essential for maintaining good standing with state tax authorities. Failure to file or inaccuracies in reporting can lead to penalties, interest on unpaid taxes, and potential audits.

Key Elements of the ST 810 Form

The ST 810 form includes several key elements that businesses must complete:

- Business Identification: Name, address, and tax identification number.

- Sales Information: Total sales, taxable sales, and exempt sales.

- Tax Calculation: Total tax due based on reported sales.

- Signature: Authorized signature certifying the accuracy of the information provided.

Quick guide on how to complete form st 810 new york state and local quarterly sales and use tax return for part quarterly filers revised 1124

Effortlessly Prepare Form ST 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filers Revised 1124 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form ST 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filers Revised 1124 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

Easy Steps to Modify and eSign Form ST 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filers Revised 1124 with Ease

- Locate Form ST 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filers Revised 1124 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form ST 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filers Revised 1124 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 810 new york state and local quarterly sales and use tax return for part quarterly filers revised 1124

Create this form in 5 minutes!

How to create an eSignature for the form st 810 new york state and local quarterly sales and use tax return for part quarterly filers revised 1124

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 810 form and how is it used?

The ST 810 form is a sales tax exemption certificate used in various states to allow eligible purchasers to buy goods without paying sales tax. Businesses can utilize the ST 810 form to streamline their purchasing process and ensure compliance with tax regulations. By using airSlate SignNow, you can easily create, send, and eSign the ST 810 form, making it a hassle-free experience.

-

How can airSlate SignNow help with the ST 810 form?

airSlate SignNow provides a user-friendly platform to manage the ST 810 form efficiently. You can create templates for the ST 810 form, send them for eSignature, and store them securely in the cloud. This not only saves time but also enhances the accuracy and compliance of your documentation process.

-

Is there a cost associated with using airSlate SignNow for the ST 810 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effective solution allows you to manage the ST 810 form and other documents without breaking the bank. You can choose a plan that fits your budget while enjoying the benefits of eSigning and document management.

-

Can I integrate airSlate SignNow with other software for managing the ST 810 form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage the ST 810 form alongside your existing tools. Whether you use CRM systems, cloud storage, or accounting software, you can easily connect them to streamline your workflow.

-

What are the benefits of using airSlate SignNow for the ST 810 form?

Using airSlate SignNow for the ST 810 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning, which accelerates the approval process and helps maintain compliance with tax regulations. Additionally, you can track the status of your ST 810 forms in real-time.

-

Is it easy to create an ST 810 form using airSlate SignNow?

Yes, creating an ST 810 form with airSlate SignNow is straightforward and user-friendly. The platform offers customizable templates that you can easily modify to meet your specific needs. With just a few clicks, you can generate a professional ST 810 form ready for eSignature.

-

How secure is the information on the ST 810 form when using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the ST 810 form. The platform employs advanced encryption and security protocols to protect your sensitive information. You can confidently manage your ST 810 forms, knowing that your data is safe and secure.

Get more for Form ST 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filers Revised 1124

- Acknowledgment of paternity with declaration that child shall share in fathers estate form

- Settlement agreement 497330064 form

- Instruction to jury in a paternity case that the amount of support is not a question for the jury form

- Palliative care services agreement 497330066 form

- Sample letter congratulations new form

- Alaska court system service of summons form

- Mortgage loan extension form

- Extension loan agreement form

Find out other Form ST 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filers Revised 1124

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself