Kansas Tag Refund Worksheet 2016-2026

What is the Kansas Tag Refund Worksheet?

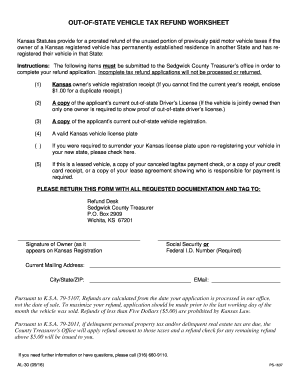

The Kansas Tag Refund Worksheet, also known as the Kansas PS1637, is a document used by vehicle owners in Sedgwick County to request a refund for vehicle registration fees. This form is essential for individuals who have sold or transferred ownership of their vehicle, allowing them to reclaim a portion of the fees paid for the vehicle's registration. Understanding the purpose of this worksheet is crucial for ensuring that you receive any eligible refunds in a timely manner.

How to use the Kansas Tag Refund Worksheet

Using the Kansas Tag Refund Worksheet involves several steps to ensure accurate completion. First, gather all necessary information, including the vehicle's title, proof of ownership transfer, and any previous registration documents. Next, fill out the worksheet by providing details such as the vehicle's identification number (VIN), the date of sale or transfer, and the amount paid for registration. Finally, submit the completed worksheet to the appropriate Sedgwick County office, either online or via mail, depending on your preference.

Steps to complete the Kansas Tag Refund Worksheet

Completing the Kansas Tag Refund Worksheet requires careful attention to detail. Follow these steps:

- Begin by downloading the Kansas PS1637 form from a reliable source.

- Fill in your personal information, including your name, address, and contact details.

- Provide the vehicle's VIN and registration details.

- Indicate the reason for the refund request, such as sale or transfer of ownership.

- Attach any supporting documents, such as a copy of the title transfer.

- Review the completed form for accuracy before submission.

Legal use of the Kansas Tag Refund Worksheet

The Kansas Tag Refund Worksheet is legally binding when completed accurately and submitted according to state regulations. To ensure compliance, it is important to adhere to the guidelines set forth by the Kansas Department of Revenue. This includes providing truthful information and submitting the form within the designated time frame after the vehicle's sale or transfer. Failure to comply with these legal requirements may result in delays or denial of your refund request.

Key elements of the Kansas Tag Refund Worksheet

Several key elements must be included in the Kansas Tag Refund Worksheet to ensure its validity. These elements include:

- Personal identification details of the requester.

- Vehicle information, including the VIN and registration number.

- Reason for the refund request.

- Documentation of the vehicle's sale or transfer.

- Signature of the requester, affirming the accuracy of the information provided.

Required Documents

To successfully process the Kansas Tag Refund Worksheet, certain documents are required. These typically include:

- A copy of the vehicle title showing the transfer of ownership.

- Proof of payment for the original registration fees.

- Any additional documentation that supports the refund request, such as receipts or correspondence with the DMV.

Quick guide on how to complete kansas tag refund worksheet

Complete Kansas Tag Refund Worksheet effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents promptly without delays. Manage Kansas Tag Refund Worksheet on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Kansas Tag Refund Worksheet without difficulty

- Obtain Kansas Tag Refund Worksheet and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact confidential information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to finalize your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow effectively addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign Kansas Tag Refund Worksheet and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas tag refund worksheet

Create this form in 5 minutes!

People also ask

-

What is Kansas PS1637 and how does it relate to airSlate SignNow?

Kansas PS1637 refers to the state legislation that emphasizes the importance of electronic signatures in the state of Kansas. By utilizing airSlate SignNow, businesses can ensure compliance with this legislation while enjoying a reliable eSignature solution that simplifies the signing process.

-

How does airSlate SignNow ensure compliance with Kansas PS1637?

airSlate SignNow is designed to meet the requirements of Kansas PS1637 by offering secure and legally binding electronic signatures. Our platform uses advanced encryption and authentication features to safeguard documents, ensuring that your transactions are compliant and protected.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans to accommodate businesses of all sizes, including features tailored to meet the needs of users in Kansas under PS1637. You can choose from various subscription levels, allowing you to find the perfect fit balancing cost and functionality.

-

What features does airSlate SignNow offer that support Kansas PS1637 compliance?

Key features of airSlate SignNow that align with Kansas PS1637 include customizable templates, the ability to track document status, and multi-signature support. These capabilities help streamline your workflow while ensuring all electronic documents are legally recognized.

-

What benefits can businesses in Kansas gain from using airSlate SignNow?

By using airSlate SignNow, businesses in Kansas can enhance their efficiency, reduce paper usage, and accelerate transaction times, all while remaining compliant with Kansas PS1637. This cost-effective solution allows for quicker document turnaround and improved customer satisfaction.

-

Can airSlate SignNow integrate with other software for Kansas PS1637 users?

Yes, airSlate SignNow offers seamless integrations with a variety of applications and services, making it easier for Kansas PS1637 users to incorporate it into their existing workflows. This ensures a smooth transition and enhances overall productivity while staying compliant with state regulations.

-

Is airSlate SignNow user-friendly for those new to electronic signatures?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, making it accessible for anyone, including those unfamiliar with electronic signatures. This ease of use aligns with the goals of Kansas PS1637, allowing businesses to adopt eSigning without extensive training.

Get more for Kansas Tag Refund Worksheet

- Aqha stallion breeding report form

- Rossman realty property management llc form

- Mony life insurance company mony change of beneficiary form

- Bus pass application form

- Vaccine exemption letter pdf maryland form

- Haiku template printable form

- Application for registration of aircraft and report of excise tax form

- Sales tax vendor liability notice rules and forms

Find out other Kansas Tag Refund Worksheet

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template