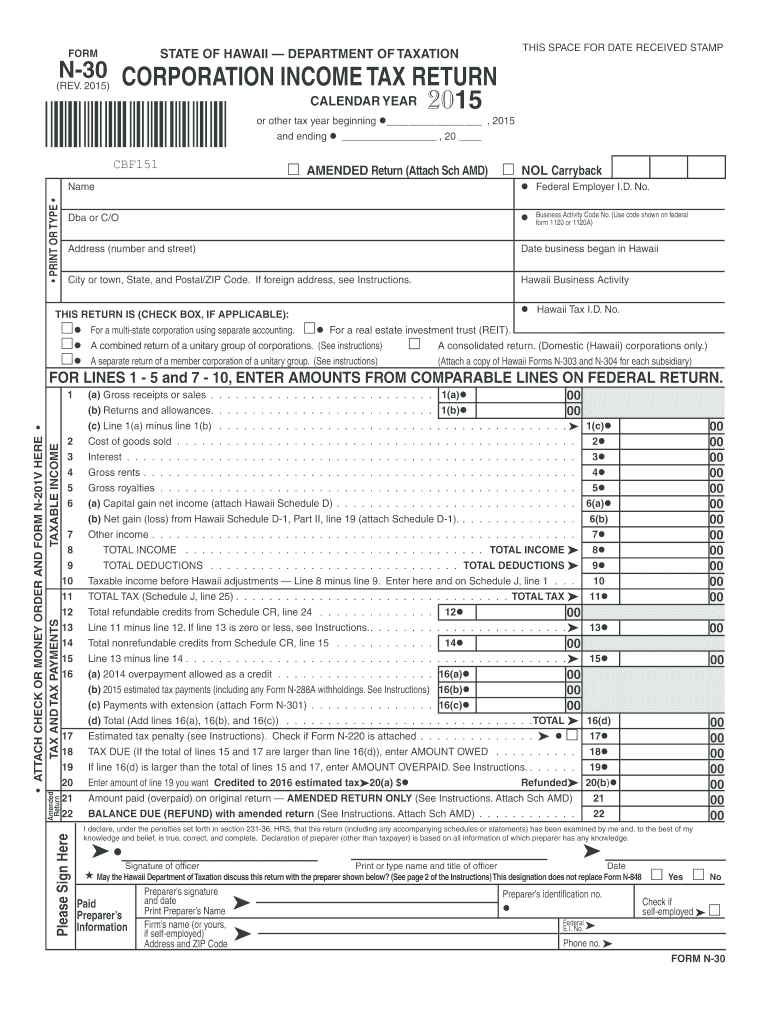

Form N 30 2015

What is the Form N-30

The Form N-30 is a tax form utilized in the United States, specifically designed for certain tax reporting purposes. This form is essential for individuals and businesses to accurately report their income and ensure compliance with federal tax regulations. It contains various sections where taxpayers must provide detailed information about their financial activities, including income sources, deductions, and credits. Understanding the purpose of the Form N-30 is crucial for effective tax reporting and to avoid potential penalties.

How to use the Form N-30

Using the Form N-30 involves several key steps to ensure accurate completion. Taxpayers should first gather all necessary financial documents, including income statements, expense records, and any relevant tax credits. Once the required information is compiled, individuals can begin filling out the form, ensuring that each section is completed accurately. After completing the form, it is important to review all entries for accuracy before submission. This helps prevent errors that could lead to delays or issues with the IRS.

Steps to complete the Form N-30

Completing the Form N-30 requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Gather all necessary documents, including W-2s, 1099s, and receipts for deductions.

- Begin filling out the form by entering personal information, such as name, address, and Social Security number.

- Report income from all sources in the designated sections, ensuring that all amounts are correctly calculated.

- Include any deductions or credits you are eligible for, as these can significantly impact your tax liability.

- Review the completed form for accuracy, checking all figures and information.

- Submit the form electronically or by mail, following the guidelines provided by the IRS.

Legal use of the Form N-30

The legal use of the Form N-30 is governed by IRS regulations, which outline the requirements for accurate reporting and compliance. Taxpayers must ensure that the information provided on the form is truthful and complete, as inaccuracies can lead to penalties or audits. Additionally, the IRS allows for electronic signatures on the Form N-30, making the submission process more efficient while still maintaining legal validity. It is important to stay informed about any changes in regulations that may affect the use of this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form N-30 are critical to avoid late penalties. Typically, the form must be submitted by April 15 of the tax year, although extensions may be available under certain circumstances. Taxpayers should also be aware of any state-specific deadlines that may apply. Keeping track of these important dates ensures timely filing and compliance with tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Form N-30 can be submitted through various methods, providing flexibility for taxpayers. The options include:

- Online Submission: Many taxpayers prefer to file electronically, which is often faster and more secure.

- Mail: The form can be printed and mailed to the appropriate IRS address, ensuring that it is sent well before the deadline.

- In-Person: Some individuals may choose to file in person at designated IRS offices, although this option may be less common.

Quick guide on how to complete form n 30 2015

Your assistance manual on how to prepare your Form N 30

If you are wondering how to develop and file your Form N 30, here are a few brief recommendations on how to simplify tax processing.

To begin, you simply need to establish your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely intuitive and robust document solution that allows you to modify, draft, and finalize your tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to adjust responses as necessary. Enhance your tax handling with sophisticated PDF editing, eSigning, and convenient sharing options.

Follow the instructions below to complete your Form N 30 in moments:

- Set up your account and start working on PDFs in no time.

- Utilize our directory to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to access your Form N 30 in our editor.

- Fill in the required editable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally binding eSignature (if required).

- Review your document and rectify any mistakes.

- Save modifications, print your version, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper may increase return errors and delay refunds. Furthermore, before e-filing your taxes, verify the IRS website for declaration guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form n 30 2015

FAQs

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

If I publish on Smashwords and tick on the option to take a 30 percent tax, do I still need to fill out the tax form?

If you want to get any of that tax money back in your pocket, you will have to fill out the forms.Are you a US citizen? If not, you will need to obtain an ITIN using IRS form W-7. This will allow you to file the appropriate US tax return forms and claim a refund. Depending on your country of residence, the refund could be up to 100% of the tax collected. With an ITIN, you will usually be exempt from the 30% withholding and will not be required to fill out any US tax returns at the end of the year (unless you actually reside in the US, but that is a far more complicated situation). The ITIN application process can be a royal pain in the behind, especially if you wait until after the taxes have been withheld.If your book only makes a few dollars, the hassle is not worth it. But if you hit the self-publishing lottery, you will definitely want to apply for that refund.

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

Create this form in 5 minutes!

How to create an eSignature for the form n 30 2015

How to generate an eSignature for the Form N 30 2015 online

How to generate an electronic signature for your Form N 30 2015 in Google Chrome

How to make an electronic signature for putting it on the Form N 30 2015 in Gmail

How to create an eSignature for the Form N 30 2015 straight from your smartphone

How to create an eSignature for the Form N 30 2015 on iOS

How to make an electronic signature for the Form N 30 2015 on Android devices

People also ask

-

What is Form N 30 and how can airSlate SignNow help?

Form N 30 is a document used for specific administrative purposes, and airSlate SignNow simplifies the process of managing such forms. With our platform, you can easily create, send, and eSign Form N 30, ensuring a seamless workflow for your business needs.

-

Is airSlate SignNow a cost-effective solution for handling Form N 30?

Yes, airSlate SignNow offers a cost-effective solution for managing Form N 30 and other documents. Our competitive pricing plans are designed to provide value while ensuring that businesses can efficiently handle their signing and document management needs.

-

What features does airSlate SignNow offer for Form N 30?

airSlate SignNow includes features specifically designed to enhance the handling of Form N 30. These features include customizable templates, automated workflows, and secure eSigning capabilities that streamline the entire process.

-

Can I integrate airSlate SignNow with other applications for Form N 30 management?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage Form N 30 alongside your existing tools. This integration capability enhances productivity and ensures that all your document workflows are connected.

-

Is it easy to eSign Form N 30 using airSlate SignNow?

Yes, eSigning Form N 30 with airSlate SignNow is incredibly easy. Our user-friendly interface allows users to sign documents quickly from any device, making the process straightforward and efficient.

-

What are the benefits of using airSlate SignNow for Form N 30?

The benefits of using airSlate SignNow for Form N 30 include increased efficiency, improved accuracy, and enhanced security. By utilizing our platform, businesses can save time and reduce errors in their document management processes.

-

How does airSlate SignNow ensure the security of my Form N 30?

airSlate SignNow prioritizes security when handling Form N 30. Our platform uses advanced encryption and compliance measures to ensure that your documents are safe and secure throughout the signing process.

Get more for Form N 30

- Personal injuries application personal injuries application form

- Formsqueensland civil and administrative tribunal

- Application to discharge form

- B check if a form fill out and sign printable pdf

- Form 749 revised 9 2014 personalized license plate application mvc not for motorcycles submit all original or replacement

- Submit all original or replacement applications to the form

- Application for firefighter license plates oklahoma ok form

- Firefighter plate application iowa fire chiefs form

Find out other Form N 30

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure