Form N 30, Rev , Corporation Income Tax Return Forms Fillable 2020

What is the Form N-30, Corporation Income Tax Return

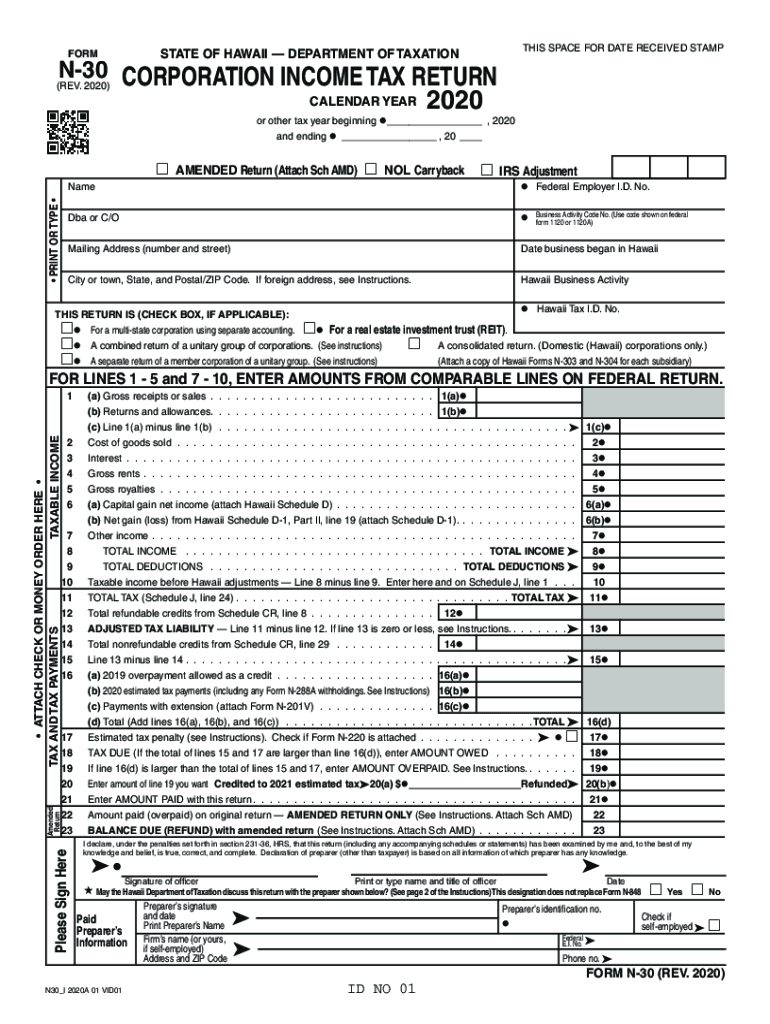

The Form N-30 is a crucial document for corporations operating in Hawaii, serving as the state's Corporation Income Tax Return. This form is used to report the income, deductions, and credits of corporations, ensuring compliance with Hawaii's tax regulations. It is essential for businesses to accurately complete this form to determine their tax liability and fulfill their legal obligations. The N-30 is specifically designed for corporations, including C corporations and S corporations, and must be filed annually.

Steps to Complete the Form N-30

Completing the Form N-30 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, begin filling out the form by entering the corporation's identifying information, such as the name, address, and federal employer identification number (EIN). Follow the instructions carefully to report the total income, allowable deductions, and any applicable tax credits. Finally, review the completed form for accuracy before submitting it to the state.

Legal Use of the Form N-30

The legal use of the Form N-30 is governed by Hawaii state tax laws. Corporations are required to file this form to report their income and pay any taxes owed. Failing to file the N-30 can result in penalties, interest, and potential legal repercussions. It is important for businesses to understand the legal implications of this form and ensure that it is completed accurately and submitted on time to avoid any compliance issues.

Filing Deadlines for the Form N-30

Corporations must be aware of the filing deadlines for the Form N-30 to ensure timely compliance. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations should also consider any extensions available for filing to avoid penalties.

Form Submission Methods

The Form N-30 can be submitted through various methods, providing flexibility for corporations. Businesses have the option to file electronically using approved e-filing systems, which can expedite processing and reduce errors. Alternatively, the form can be mailed to the appropriate state tax office. Corporations should ensure that they use the correct mailing address and consider certified mail for tracking purposes. In-person submissions may also be possible at designated tax offices.

Key Elements of the Form N-30

Understanding the key elements of the Form N-30 is essential for accurate completion. The form includes sections for reporting gross income, deductions, and credits. Corporations must detail their income sources, including sales, dividends, and interest. Additionally, it requires information about allowable deductions, such as business expenses and losses. Tax credits available to corporations, such as those for research and development, should also be reported. Each section must be completed thoroughly to ensure compliance with state tax laws.

Quick guide on how to complete form n 30 rev 2020 corporation income tax return forms 2020 fillable

Effortlessly Prepare Form N 30, Rev , Corporation Income Tax Return Forms Fillable on Any Device

The management of documents online has become increasingly favored by both organizations and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right template and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and without issues. Manage Form N 30, Rev , Corporation Income Tax Return Forms Fillable on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Edit and Electronically Sign Form N 30, Rev , Corporation Income Tax Return Forms Fillable with Ease

- Locate Form N 30, Rev , Corporation Income Tax Return Forms Fillable and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information and then click on the Done button to finalize your updates.

- Choose your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Modify and electronically sign Form N 30, Rev , Corporation Income Tax Return Forms Fillable and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 30 rev 2020 corporation income tax return forms 2020 fillable

Create this form in 5 minutes!

How to create an eSignature for the form n 30 rev 2020 corporation income tax return forms 2020 fillable

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What are Hawaii n 30 instructions for using airSlate SignNow?

Hawaii n 30 instructions guide users on how to efficiently utilize airSlate SignNow for sending and eSigning documents within 30 days. These instructions provide step-by-step details on setting up your account, creating templates, and managing signatures to ensure a smooth experience.

-

How much does airSlate SignNow cost with Hawaii n 30 instructions?

The pricing for airSlate SignNow varies based on the plan you choose, but the Hawaii n 30 instructions will help you identify the best plan for your needs. Plans start at competitive rates, providing features that cater to both individual users and businesses looking for an all-in-one eSigning solution.

-

What features are included in the Hawaii n 30 instructions?

The Hawaii n 30 instructions include detailed information about core features such as document templates, team collaboration tools, and advanced security measures. By following these instructions, users can maximize their efficiency and streamline the document signing process.

-

Are there benefits to following the Hawaii n 30 instructions?

Yes, following the Hawaii n 30 instructions ensures that you fully understand how to leverage airSlate SignNow for your document needs. This knowledge can lead to faster turnaround times, fewer errors, and a more seamless eSigning experience.

-

Can I integrate airSlate SignNow while using Hawaii n 30 instructions?

Absolutely! The Hawaii n 30 instructions provide guidance on integrating airSlate SignNow with popular software such as Google Drive, Salesforce, and more. These integrations enhance your workflow and allow for a more cohesive document management strategy.

-

What makes airSlate SignNow a preferred choice in Hawaii n 30 instructions?

airSlate SignNow is preferred for its user-friendly interface, robust feature set, and cost-effective pricing options outlined in the Hawaii n 30 instructions. Users appreciate how easy it is to navigate and manage their document workflow compared to other eSigning solutions.

-

Is customer support available when following Hawaii n 30 instructions?

Yes, airSlate SignNow provides excellent customer support to assist with any inquiries related to the Hawaii n 30 instructions. Users can access resources like live chat, email support, and a comprehensive knowledge base to resolve any issues promptly.

Get more for Form N 30, Rev , Corporation Income Tax Return Forms Fillable

Find out other Form N 30, Rev , Corporation Income Tax Return Forms Fillable

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe