Form N 30, Rev , Corporation Income Tax Return Forms Fillable 2022

What is the Form N-30, Corporation Income Tax Return?

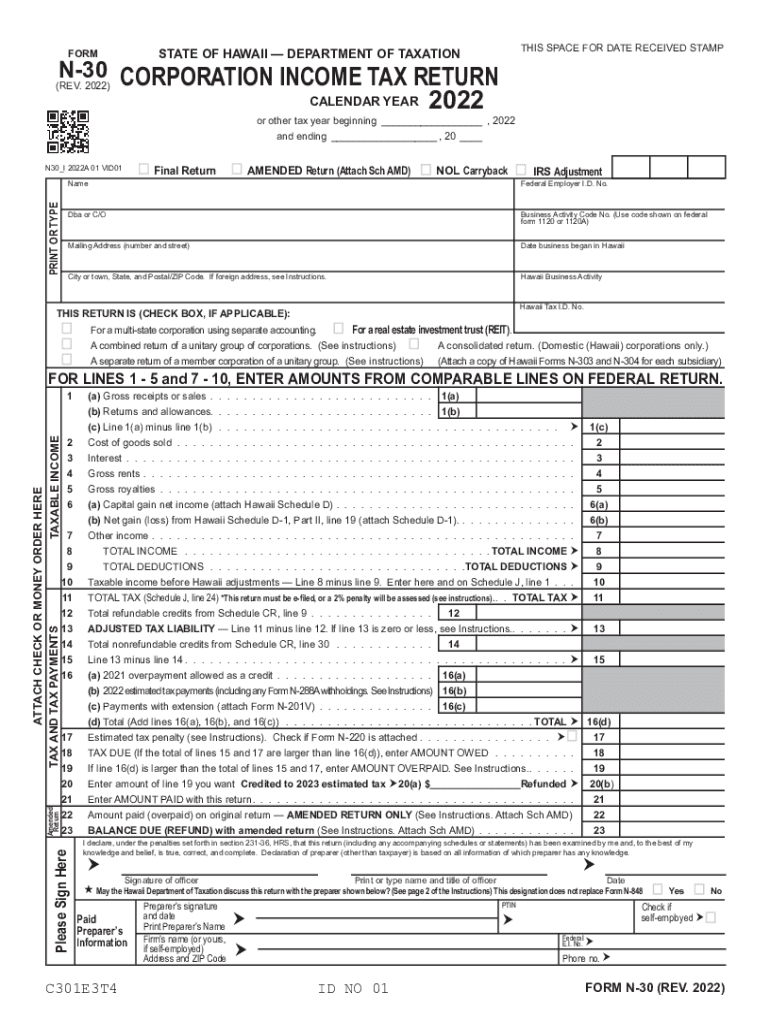

The Form N-30 is a crucial document required for corporations operating in Hawaii to report their income, deductions, and tax liability to the state. This form is specifically designed for corporations subject to Hawaii state income tax. It encompasses all necessary financial information, ensuring compliance with state tax regulations. The form must be accurately filled out and submitted by the designated deadlines to avoid penalties and ensure proper tax processing.

Steps to Complete the Form N-30

Completing the Form N-30 involves several key steps to ensure accuracy and compliance with Hawaii's tax regulations. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, follow these steps:

- Begin by entering the corporation's identifying information, including name, address, and federal employer identification number (EIN).

- Report total income and allowable deductions in the appropriate sections of the form.

- Calculate the taxable income by subtracting deductions from total income.

- Determine the tax liability based on the applicable Hawaii state income tax rate.

- Review the completed form for accuracy before submission.

Filing Deadlines for Form N-30

Timely filing of the Form N-30 is essential to avoid penalties. The due date for filing is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due on April 15. If additional time is needed, corporations may file for an extension, which extends the deadline but does not extend the time to pay any taxes owed.

Form Submission Methods

Corporations can submit the Form N-30 through various methods, ensuring flexibility and convenience. The available submission methods include:

- Online: Corporations can file electronically through the Hawaii Department of Taxation's online portal, which provides a streamlined process.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Hawaii Department of Taxation.

- In-Person: Corporations may also choose to deliver the form in person at designated tax offices.

Key Elements of the Form N-30

The Form N-30 includes several key elements that are vital for accurate tax reporting. These elements consist of:

- Income Reporting: Corporations must report all sources of income, including sales, services, and other revenue streams.

- Deductions: Allowable deductions, such as business expenses and depreciation, can significantly impact taxable income.

- Tax Calculation: The form includes sections for calculating the total tax owed based on the corporation's taxable income.

- Signature Section: An authorized representative must sign the form, affirming the accuracy of the information provided.

Penalties for Non-Compliance

Failure to file the Form N-30 or inaccuracies in the submission can lead to significant penalties. These may include:

- Late Filing Penalties: Corporations may incur fines for not submitting the form by the due date.

- Accuracy-Related Penalties: If the reported income or deductions are incorrect, additional penalties may apply.

- Interest Charges: Unpaid taxes may accrue interest until fully paid, increasing the total amount owed.

Quick guide on how to complete form n 30 rev 2022 corporation income tax return forms 2022 fillable

Easily Prepare Form N 30, Rev , Corporation Income Tax Return Forms Fillable on Any Device

Managing documents online has gained popularity among both businesses and individuals. It offers a perfect environmentally-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources you need to swiftly create, modify, and eSign your documents without any interruptions. Manage Form N 30, Rev , Corporation Income Tax Return Forms Fillable on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Form N 30, Rev , Corporation Income Tax Return Forms Fillable effortlessly

- Obtain Form N 30, Rev , Corporation Income Tax Return Forms Fillable and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device of your choice. Modify and eSign Form N 30, Rev , Corporation Income Tax Return Forms Fillable and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 30 rev 2022 corporation income tax return forms 2022 fillable

Create this form in 5 minutes!

How to create an eSignature for the form n 30 rev 2022 corporation income tax return forms 2022 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with Hawaii income tax documents?

airSlate SignNow is an eSignature solution that enables businesses to efficiently send and sign documents electronically. When dealing with Hawaii income tax documents, this platform simplifies the process, ensuring compliance and security, while saving you valuable time and resources.

-

How does airSlate SignNow facilitate the filing of Hawaii income tax forms?

With airSlate SignNow, you can easily prepare, send, and receive signed Hawaii income tax forms online. This streamlines the documentation process, making it quicker to file your taxes while ensuring that all signatures and approvals are handled electronically.

-

What are the pricing plans available for airSlate SignNow users focused on Hawaii income tax?

airSlate SignNow offers flexible pricing plans tailored to fit businesses of all sizes. Each plan provides access to essential features for managing Hawaii income tax documents, allowing users to choose the best option based on their eSigning needs.

-

What features does airSlate SignNow offer for managing Hawaii income tax documents?

airSlate SignNow includes features such as customizable templates, secure document storage, and real-time tracking, catering specifically to Hawaii income tax documents. These tools help ensure that your tax-related paperwork is completed accurately and on time.

-

Is airSlate SignNow compliant with Hawaii income tax regulations?

Yes, airSlate SignNow is built with compliance in mind, adhering to necessary regulations surrounding electronic signatures. This is particularly relevant for Hawaii income tax documents, which require a reliable and legally-binding eSigning solution.

-

Can airSlate SignNow integrate with other financial software for Hawaii income tax management?

Absolutely! airSlate SignNow integrates seamlessly with various financial and accounting software. This allows you to streamline your workflow when handling Hawaii income tax documents, enhancing productivity and efficiency.

-

What benefits does airSlate SignNow provide for businesses handling Hawaii income tax submissions?

Using airSlate SignNow for Hawaii income tax submissions can lead to faster processing times, lower costs, and fewer errors. The ease of electronic signatures not only speeds up compliance but also reduces the risk of lost documents.

Get more for Form N 30, Rev , Corporation Income Tax Return Forms Fillable

- Quitclaim deed from husband to himself and wife south dakota form

- Quitclaim deed from husband and wife to husband and wife south dakota form

- South dakota deed 497326109 form

- South dakota property form

- South dakota property 497326111 form

- South dakota property 497326112 form

- Quitclaim deed from husband and wife to an individual south dakota form

- South dakota warranty deed form

Find out other Form N 30, Rev , Corporation Income Tax Return Forms Fillable

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe