FORM STATE of HAWAIIDEPARTMENT of TAXATION DO NOT WRITE or 2019

Filing Deadlines for Form N-30 2019

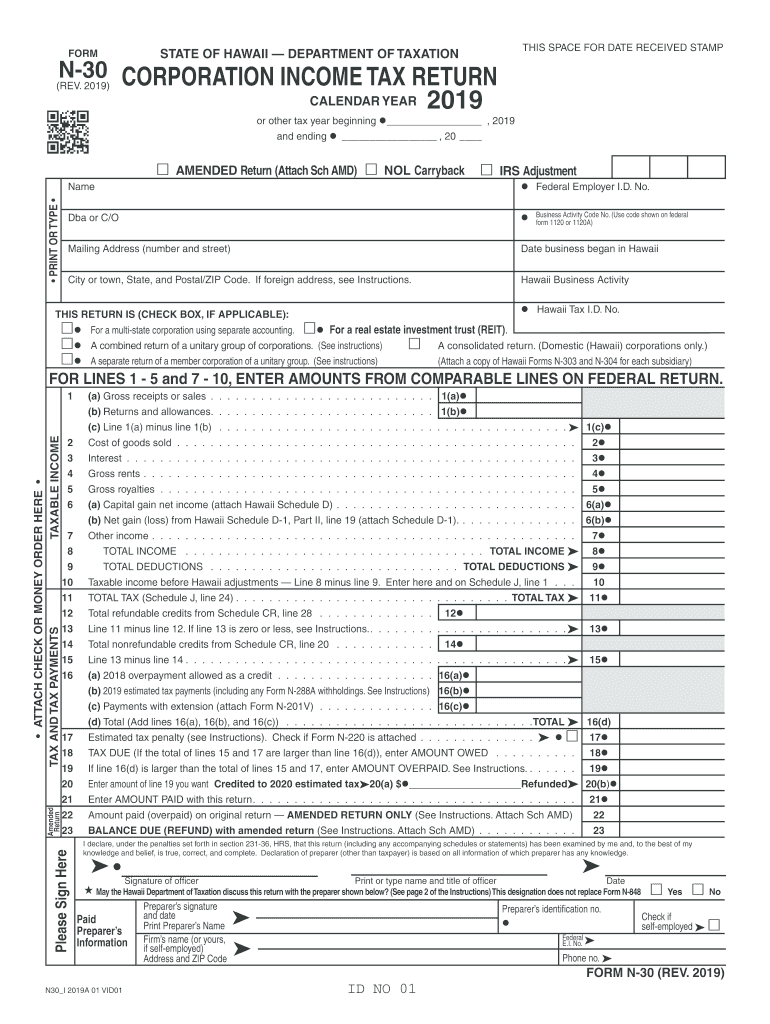

Understanding the filing deadlines for Form N-30 2019 is essential for compliance with Hawaii's tax regulations. The due date for filing this corporate income tax return typically aligns with the end of the corporation's tax year. For most corporations, this means the form is due on the fifteenth day of the fourth month following the close of the tax year. If your corporation operates on a calendar year basis, the deadline would be April 15, 2020. However, if your corporation has a fiscal year, be sure to check the specific date that corresponds to the end of your fiscal year.

Required Documents for Form N-30 2019

To successfully complete Form N-30 2019, you will need several key documents. These include:

- Your corporation's financial statements, including income statements and balance sheets.

- Records of all income received during the tax year.

- Documentation of any deductions or credits your corporation is eligible for.

- Prior year tax returns for reference and consistency checks.

Having these documents organized will facilitate a smoother filing process and help ensure accuracy in your reported figures.

Form Submission Methods for N-30 2019

Form N-30 2019 can be submitted through various methods, catering to different preferences and needs. Corporations can choose to file electronically, which is often the fastest and most efficient option. Alternatively, you can submit the form by mail, ensuring that it is sent to the appropriate address as specified by the Hawaii Department of Taxation. In-person submissions are also an option, allowing for direct interaction with tax officials if you have questions or need assistance.

Penalties for Non-Compliance with Form N-30 2019

Failure to file Form N-30 2019 by the deadline may result in significant penalties. The Hawaii Department of Taxation imposes fines based on the amount of tax owed, and interest may accrue on any unpaid taxes. Additionally, late filings can lead to complications in maintaining good standing for your corporation, affecting future business operations. It is crucial to adhere to the filing requirements to avoid these potential penalties.

Digital vs. Paper Version of Form N-30 2019

When deciding between the digital and paper versions of Form N-30 2019, consider the benefits of each. The digital version allows for easier data entry, automatic calculations, and faster submission. It also minimizes the risk of errors that can occur with manual entry. On the other hand, some may prefer the paper version for its tangible nature and the ability to review the form in a physical format. Regardless of the choice, ensure that the completed form is submitted accurately and on time.

IRS Guidelines for Form N-30 2019

While Form N-30 is specific to Hawaii, it is essential to be aware of how it aligns with IRS guidelines. Corporations filing Form N-30 must also comply with federal tax regulations. This includes accurately reporting income, deductions, and credits as outlined by the IRS. Familiarizing yourself with both state and federal requirements will help ensure comprehensive compliance and avoid discrepancies that could lead to audits or penalties.

Quick guide on how to complete form state of hawaiidepartment of taxation do not write or

Complete FORM STATE OF HAWAIIDEPARTMENT OF TAXATION DO NOT WRITE OR effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without hindrances. Manage FORM STATE OF HAWAIIDEPARTMENT OF TAXATION DO NOT WRITE OR on any device with the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to edit and eSign FORM STATE OF HAWAIIDEPARTMENT OF TAXATION DO NOT WRITE OR effortlessly

- Locate FORM STATE OF HAWAIIDEPARTMENT OF TAXATION DO NOT WRITE OR and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your choice. Edit and eSign FORM STATE OF HAWAIIDEPARTMENT OF TAXATION DO NOT WRITE OR while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form state of hawaiidepartment of taxation do not write or

Create this form in 5 minutes!

How to create an eSignature for the form state of hawaiidepartment of taxation do not write or

The way to make an eSignature for a PDF online

The way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it relate to n 30 2019?

airSlate SignNow is a powerful e-signature solution that empowers businesses to send and sign documents electronically. With the introduction of enhancements in n 30 2019, users can leverage more features for a seamless signing experience.

-

What are the key features of airSlate SignNow as of n 30 2019?

As of n 30 2019, airSlate SignNow offers robust features such as electronic signatures, document templates, and real-time tracking. These features allow businesses to streamline their document workflow efficiently.

-

How does airSlate SignNow ensure security and compliance since n 30 2019?

airSlate SignNow employs advanced security protocols and complies with industry regulations since n 30 2019. This ensures that your documents are secure, and your business remains compliant with e-signature laws.

-

What pricing plans does airSlate SignNow offer, particularly around n 30 2019?

airSlate SignNow offers competitive pricing plans that cater to various business needs around n 30 2019. Users can choose from different plans based on the features they require, ensuring cost-effectiveness for businesses of all sizes.

-

Can airSlate SignNow integrate with other applications as of n 30 2019?

Yes, airSlate SignNow supports integrations with numerous applications as of n 30 2019. This includes popular tools like Google Workspace, Salesforce, and Microsoft Office, enhancing workflow efficiency.

-

What benefits can businesses expect from using airSlate SignNow since n 30 2019?

Businesses can experience improved efficiency, faster document turnaround times, and cost savings since n 30 2019. By using airSlate SignNow, teams can focus more on core activities instead of manual paperwork.

-

Is airSlate SignNow user-friendly for new customers as of n 30 2019?

Absolutely! airSlate SignNow has been designed with ease of use in mind, especially for new customers since n 30 2019. The intuitive interface ensures that users can quickly adapt and start utilizing e-signatures with minimal learning curve.

Get more for FORM STATE OF HAWAIIDEPARTMENT OF TAXATION DO NOT WRITE OR

- Release of mortgage by corporation utah form

- Release of mortgage individual utah form

- Partial release of property from deed of trust for corporation utah form

- Partial release of property from deed of trust for individual utah form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy utah form

- Warranty deed for parents to child with reservation of life estate utah form

- Warranty deed for separate or joint property to joint tenancy utah form

- Warranty deed for separate property of one spouse to both as joint tenants utah form

Find out other FORM STATE OF HAWAIIDEPARTMENT OF TAXATION DO NOT WRITE OR

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document