Form N 30, Rev , Corporation Income Tax Return 2024-2026

What is the Form N-30, Rev, Corporation Income Tax Return

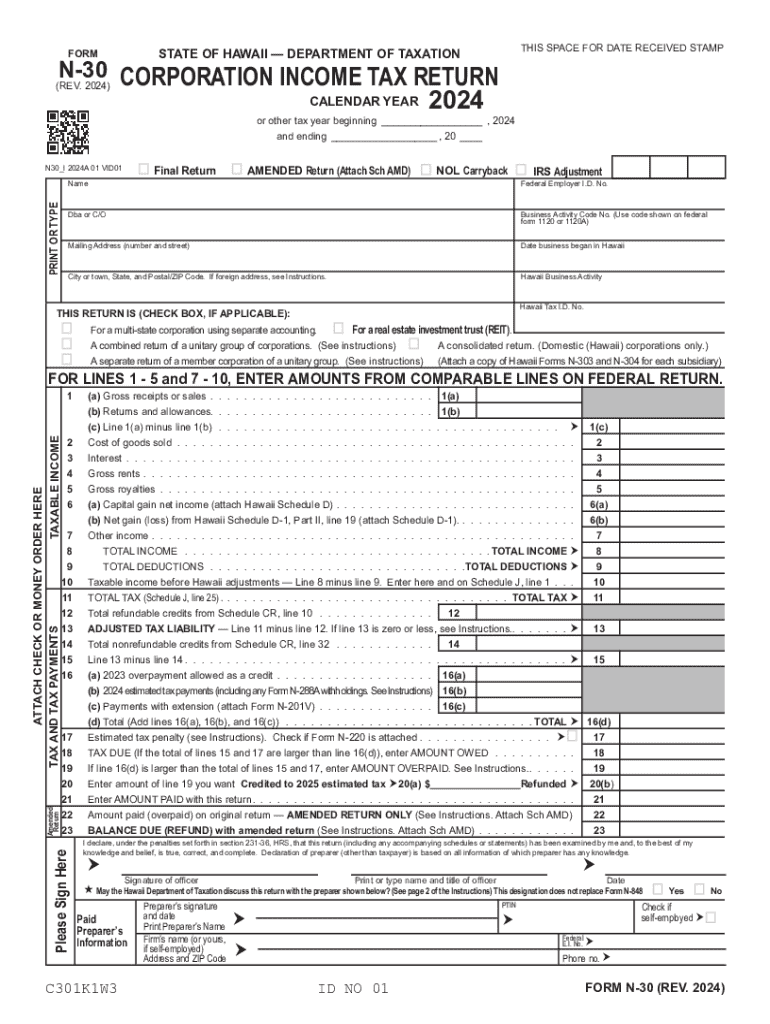

The Form N-30, Rev, serves as the Corporation Income Tax Return for businesses operating in Hawaii. This form is essential for corporations to report their income, deductions, and tax liability to the state. It is designed for various types of corporations, including C corporations and S corporations, ensuring compliance with Hawaii's tax laws. The information provided on this form is used by the Hawaii Department of Taxation to assess the corporation's tax obligations accurately.

Steps to complete the Form N-30, Rev, Corporation Income Tax Return

Completing the Form N-30, Rev requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Begin by filling out the corporation's identifying information, such as the name, address, and federal employer identification number (EIN).

- Report total income, which includes gross receipts and other income sources.

- Detail allowable deductions, such as business expenses, cost of goods sold, and depreciation.

- Calculate the taxable income by subtracting total deductions from total income.

- Apply the appropriate tax rate to determine the tax liability.

- Complete any additional schedules or forms required for specific deductions or credits.

- Review the completed form for accuracy before submission.

Legal use of the Form N-30, Rev, Corporation Income Tax Return

The Form N-30, Rev is legally required for corporations operating in Hawaii to report their income and pay applicable taxes. Filing this form accurately and on time is crucial to avoid penalties and ensure compliance with state tax regulations. Failure to file or inaccuracies can result in legal repercussions, including fines and interest on unpaid taxes. Corporations must retain copies of the submitted form and supporting documents for their records, as they may be subject to audits by the Hawaii Department of Taxation.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the Form N-30, Rev. Typically, the return is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations may also request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents

When preparing to file the Form N-30, Rev, corporations should gather the following documents:

- Financial statements, including income statements and balance sheets.

- Records of all income received during the tax year.

- Documentation for all deductions claimed, such as receipts and invoices.

- Prior year tax returns for reference.

- Any additional schedules or forms required for specific tax situations.

Who Issues the Form

The Form N-30, Rev is issued by the Hawaii Department of Taxation. This state agency is responsible for administering and enforcing tax laws in Hawaii. The department provides guidelines and resources to assist corporations in understanding their tax obligations and completing the form accurately. Corporations can access the form and related instructions directly from the Hawaii Department of Taxation's official website or through authorized tax professionals.

Create this form in 5 minutes or less

Find and fill out the correct form n 30 rev corporation income tax return

Create this form in 5 minutes!

How to create an eSignature for the form n 30 rev corporation income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Hawaii N 303 Fill?

Hawaii N 303 Fill is a specialized document management solution that allows businesses to streamline their eSigning processes. With airSlate SignNow, you can easily create, send, and manage documents, ensuring compliance and efficiency in your operations.

-

How much does Hawaii N 303 Fill cost?

The pricing for Hawaii N 303 Fill varies based on the features and number of users. airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, ensuring you get the best value for your investment in document management.

-

What features does Hawaii N 303 Fill offer?

Hawaii N 303 Fill includes features such as customizable templates, real-time tracking, and secure eSigning capabilities. These features help businesses enhance their workflow and improve document turnaround times.

-

How can Hawaii N 303 Fill benefit my business?

By using Hawaii N 303 Fill, your business can reduce paperwork, save time, and improve overall efficiency. The easy-to-use interface allows for quick document processing, which can lead to faster decision-making and increased productivity.

-

Is Hawaii N 303 Fill easy to integrate with other tools?

Yes, Hawaii N 303 Fill is designed to seamlessly integrate with various business applications. This allows you to connect your existing tools and enhance your document management processes without any hassle.

-

Can I customize documents with Hawaii N 303 Fill?

Absolutely! Hawaii N 303 Fill allows you to customize documents to fit your specific needs. You can add logos, adjust layouts, and create templates that reflect your brand, making your documents more professional.

-

Is Hawaii N 303 Fill secure for sensitive documents?

Yes, Hawaii N 303 Fill prioritizes security and compliance. It employs advanced encryption and authentication measures to ensure that your sensitive documents are protected throughout the signing process.

Get more for Form N 30, Rev , Corporation Income Tax Return

- Official form 106sum

- Maecd 2651f donn es lappui de la demande de paiement pour travaux achev s form

- Cosigner agreement dated addendum to rental agreement form

- Randall gear property management form

- Form tp 58421096real estate transfer tax return for

- Special recreation permit post use report blm blm form

- Church hall rental policy and contract form

- Divorce process harris family law group form

Find out other Form N 30, Rev , Corporation Income Tax Return

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy