Form N 30, Rev , Corporation Income Tax Return Forms Fillable 2023

What is the Form N-30?

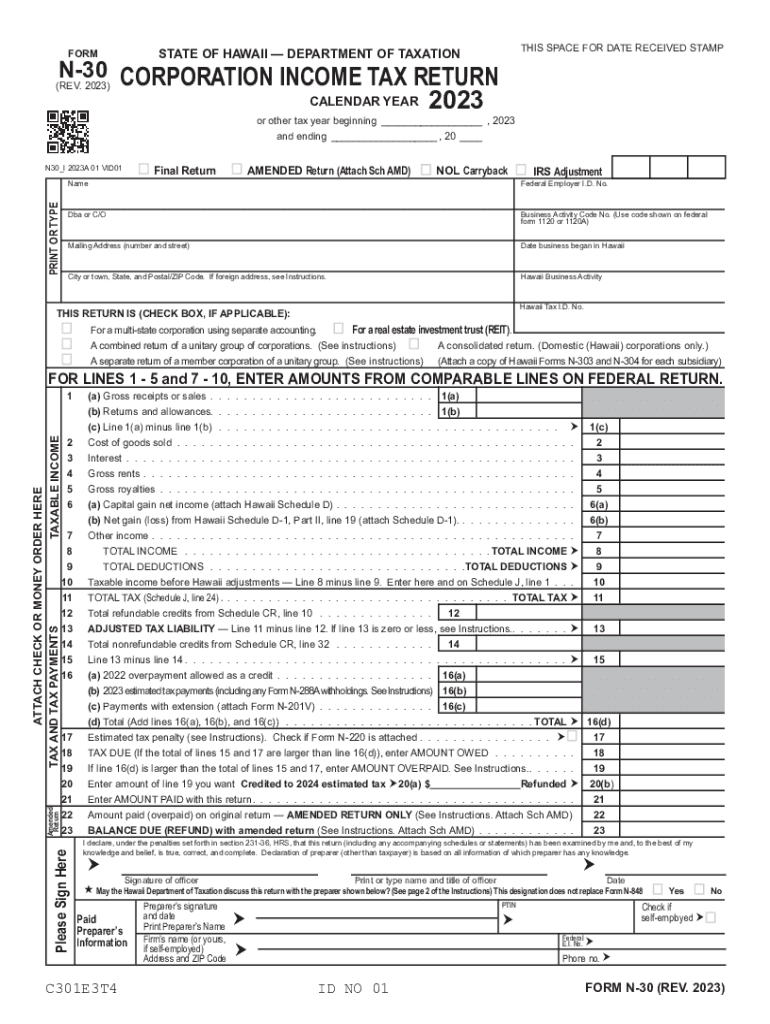

The Form N-30 is a crucial document used by corporations in Hawaii to report their income and calculate their tax obligations. This form is specifically designed for corporations, including S corporations, to declare their income, deductions, and credits. It is essential for compliance with Hawaii state tax laws and is part of the broader set of Hawaii state tax forms. Understanding the purpose and requirements of the Form N-30 is vital for any corporation operating within the state.

Steps to Complete the Form N-30

Completing the Form N-30 involves several key steps to ensure accurate reporting of financial information. First, gather all necessary financial documents, including income statements and expense records. Next, follow these steps:

- Fill in the corporation's identifying information, such as the name, address, and federal employer identification number (EIN).

- Report the total income earned during the tax year, including gross receipts and other income sources.

- Deduct allowable expenses, such as operating costs and other business-related deductions.

- Calculate the net taxable income by subtracting total deductions from total income.

- Apply any applicable tax credits to reduce the overall tax liability.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Form N-30. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. It is important to stay informed about any changes in deadlines or extensions that may apply, as timely filing helps avoid penalties.

Penalties for Non-Compliance

Failure to file the Form N-30 on time can result in significant penalties for corporations. The state of Hawaii imposes fines for late submissions, which can accumulate over time. Additionally, failure to pay any owed taxes can lead to further penalties and interest charges. Understanding these consequences underscores the importance of timely and accurate filing of the Form N-30.

Required Documents

To successfully complete the Form N-30, corporations must prepare several supporting documents. These typically include:

- Financial statements, including balance sheets and income statements.

- Records of all income sources and business expenses.

- Documentation for any tax credits claimed.

- Previous tax returns, if applicable.

Having these documents ready will streamline the completion process and ensure compliance with state requirements.

Legal Use of the Form N-30

The Form N-30 is legally mandated for corporations operating in Hawaii to report their income and tax obligations. Proper use of this form ensures compliance with state tax laws and helps avoid legal repercussions. Corporations should familiarize themselves with the legal requirements surrounding the form to ensure they meet all obligations and maintain good standing with the state.

Quick guide on how to complete form n 30 rev corporation income tax return forms fillable

Complete Form N 30, Rev , Corporation Income Tax Return Forms Fillable effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, as one can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delay. Handle Form N 30, Rev , Corporation Income Tax Return Forms Fillable on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Form N 30, Rev , Corporation Income Tax Return Forms Fillable without hassle

- Locate Form N 30, Rev , Corporation Income Tax Return Forms Fillable and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or errors warranting new document copies. airSlate SignNow covers all your document management needs in just a few clicks from any device you select. Adjust and electronically sign Form N 30, Rev , Corporation Income Tax Return Forms Fillable and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 30 rev corporation income tax return forms fillable

Create this form in 5 minutes!

How to create an eSignature for the form n 30 rev corporation income tax return forms fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Hawaii Schedule O instructions for 2021?

The Hawaii Schedule O instructions for 2021 detail how to report specific financial activities in your tax returns. These instructions provide clarity on what information is required and how to complete the form correctly. By following the Hawaii Schedule O instructions for 2021, you ensure compliance with state tax regulations and avoid potential penalties.

-

How can airSlate SignNow assist with submitting Hawaii Schedule O?

AirSlate SignNow allows you to easily eSign and send documents, including forms related to the Hawaii Schedule O instructions for 2021. Our platform streamlines the signature process, ensuring that your documents are completed efficiently. With airSlate SignNow, you can manage all your tax documents securely and electronically.

-

What features does airSlate SignNow offer for handling tax documents?

AirSlate SignNow provides robust features for handling tax documents, such as eSigning, document templates, and secure cloud storage. These features make it easy to create, send, and track your forms related to the Hawaii Schedule O instructions for 2021. Our solution is designed to enhance the efficiency of your document management process.

-

Is there a cost associated with using airSlate SignNow for Hawaii Schedule O documents?

Yes, airSlate SignNow offers various pricing plans to cater to different user needs. Depending on the features and volume of documents you need to process, you can choose a plan that suits your budget. Utilizing airSlate SignNow can be a cost-effective solution for managing your Hawaii Schedule O instructions for 2021.

-

Can I integrate airSlate SignNow with other software for easier tax management?

Absolutely! AirSlate SignNow integrates seamlessly with many popular applications such as Google Drive, Dropbox, and Zoho. These integrations enhance your tax management capabilities, allowing you to store, share, and manage documents related to Hawaii Schedule O instructions for 2021 directly from your preferred platforms.

-

What are the benefits of using airSlate SignNow for eSigning Hawaii Schedule O?

Using airSlate SignNow for eSigning Hawaii Schedule O provides numerous benefits, including time savings, enhanced security, and improved compliance. Our platform allows you to sign documents electronically, reducing the need for physical paperwork. This not only expedites the process but also ensures your documents are securely stored and easily retrievable.

-

Is airSlate SignNow suitable for small businesses looking to manage Hawaii Schedule O?

Yes, airSlate SignNow is particularly beneficial for small businesses managing the Hawaii Schedule O instructions for 2021. Our user-friendly interface and affordable pricing models make it accessible and effective for businesses of all sizes. By simplifying the eSigning process, small businesses can save time and reduce errors on important tax documents.

Get more for Form N 30, Rev , Corporation Income Tax Return Forms Fillable

- Construction project experience template form

- San joaquin county cottage food permit form

- Nrca 05 mch form

- Rules and regulations for tailoring apprentice form

- Construction waste management cwm city of atwater atwater form

- Installment plan agreement de 999d form

- Abc 257 form

- 497 24 hour contribution california report instructions form

Find out other Form N 30, Rev , Corporation Income Tax Return Forms Fillable

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word