Tax Forms and PublicationsDepartment of Taxation Hawaii Gov 2021

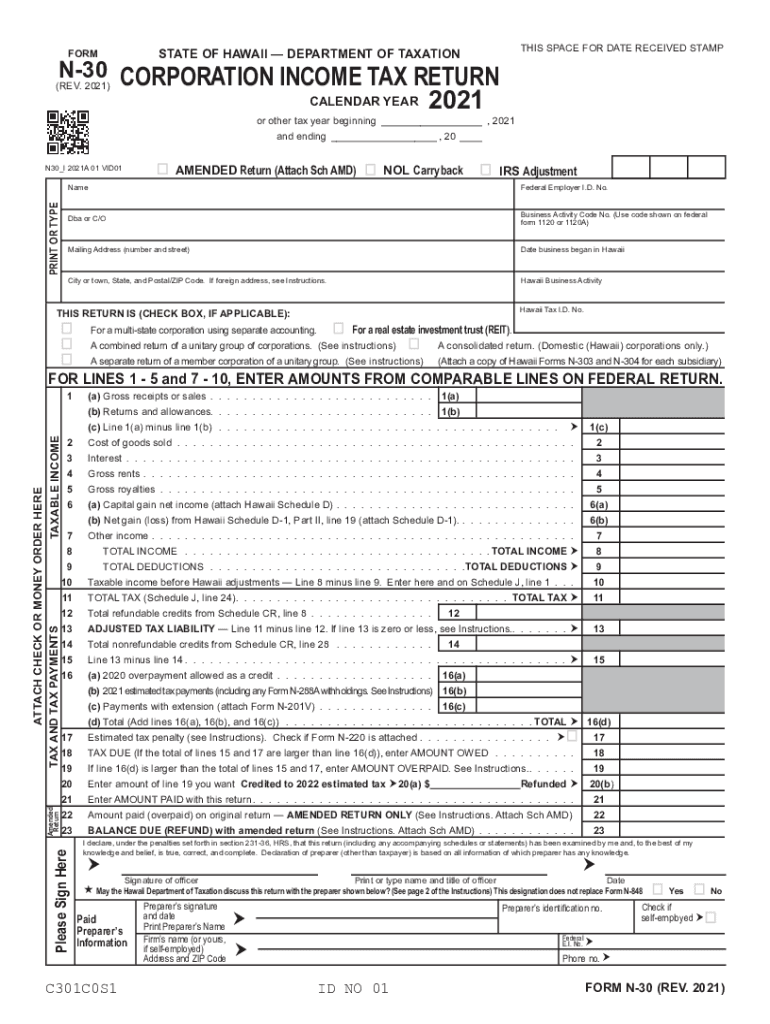

What is the Hawaii Form N-301?

The Hawaii Form N-301 is a tax form used by corporations to report income and calculate taxes owed to the state of Hawaii. It is specifically designed for corporations that are subject to the Hawaii corporation tax. This form helps ensure compliance with state tax regulations and is essential for accurate tax reporting. Understanding the purpose and requirements of Form N-301 is crucial for any business operating in Hawaii.

Steps to Complete the Hawaii Form N-301

Completing the Hawaii Form N-301 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form by providing details such as the corporation's name, address, and federal employer identification number (EIN). Be sure to calculate the taxable income and apply the appropriate tax rates as specified by the Hawaii Department of Taxation. Finally, review the form for completeness and accuracy before submission.

Filing Deadlines for Hawaii Form N-301

It is important to be aware of the filing deadlines for the Hawaii Form N-301 to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the close of the corporation's taxable year. For corporations operating on a calendar year, this typically means the form is due by April 15. Extensions may be available, but it is essential to file for an extension before the original deadline to ensure compliance.

Form Submission Methods for Hawaii Form N-301

The Hawaii Form N-301 can be submitted through various methods, providing flexibility for businesses. Corporations may choose to file the form online through the Hawaii Department of Taxation's e-filing system, which offers a secure and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own requirements, so it is important to follow the guidelines provided by the Department of Taxation.

Penalties for Non-Compliance with Hawaii Form N-301

Failure to file the Hawaii Form N-301 on time or inaccuracies in the form can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal consequences. It is crucial for corporations to understand the importance of timely and accurate submissions to avoid these penalties and maintain good standing with the state tax authorities.

Legal Use of the Hawaii Form N-301

The legal use of the Hawaii Form N-301 is governed by state tax laws and regulations. Corporations must ensure that the information provided is truthful and complete, as any misrepresentation can lead to legal repercussions. Additionally, the form must be filed in accordance with the deadlines and procedures set by the Hawaii Department of Taxation to ensure its validity and compliance with state laws.

Quick guide on how to complete tax forms and publicationsdepartment of taxation hawaiigov

Submit Tax Forms And PublicationsDepartment Of Taxation Hawaii gov effortlessly on any device

Digital document management has grown increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Tax Forms And PublicationsDepartment Of Taxation Hawaii gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Tax Forms And PublicationsDepartment Of Taxation Hawaii gov without hassle

- Obtain Tax Forms And PublicationsDepartment Of Taxation Hawaii gov and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your edits.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Tax Forms And PublicationsDepartment Of Taxation Hawaii gov to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax forms and publicationsdepartment of taxation hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the tax forms and publicationsdepartment of taxation hawaiigov

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is the Hawaii Form N 301 2021?

The Hawaii Form N 301 2021 is a tax form used by businesses and individuals in Hawaii to report certain tax-related information. This form is often required for those claiming specific tax credits or deductions. Understanding the requirements for filling out the Hawaii Form N 301 2021 is essential for compliance.

-

How can airSlate SignNow help with the Hawaii Form N 301 2021?

AirSlate SignNow streamlines the process of preparing and submitting the Hawaii Form N 301 2021 by providing an easy-to-use platform for electronic signatures and document management. You can fill out the form, collect signatures, and submit it directly within the platform, ensuring accuracy and efficiency.

-

What are the pricing options for using airSlate SignNow to manage the Hawaii Form N 301 2021?

AirSlate SignNow offers various pricing plans to accommodate different business needs. Plans are designed to be cost-effective while providing all necessary features to handle documents like the Hawaii Form N 301 2021 efficiently. You can choose from monthly or annual subscriptions to find the best fit.

-

Is airSlate SignNow secure for handling sensitive documents like the Hawaii Form N 301 2021?

Yes, airSlate SignNow prioritizes security, using advanced encryption and compliance measures to protect sensitive information, including documents like the Hawaii Form N 301 2021. This ensures that your data remains confidential and secure during the entire signing and submission process.

-

Can I integrate airSlate SignNow with other software for Hawaii Form N 301 2021 management?

Absolutely! AirSlate SignNow supports integrations with various applications and software programs that can enhance your workflow while dealing with the Hawaii Form N 301 2021. This includes popular CRMs, cloud storage solutions, and more to ensure a seamless experience.

-

What features does airSlate SignNow offer for managing the Hawaii Form N 301 2021?

AirSlate SignNow provides a variety of features to help you manage the Hawaii Form N 301 2021 effectively. These features include easy document editing, customizable templates, electronic signatures, and tracking capabilities, making the filing process smoother and more organized.

-

How can I ensure I am filling out the Hawaii Form N 301 2021 correctly?

To ensure you are filling out the Hawaii Form N 301 2021 correctly, you can utilize airSlate SignNow's guidance features and document templates that meet state requirements. Additionally, consulting a tax professional or using resources offered by the Hawaii Department of Taxation can provide clarity and assistance.

Get more for Tax Forms And PublicationsDepartment Of Taxation Hawaii gov

- Legal last will and testament form for married person with adult children maryland

- Mutual wills package with last wills and testaments for married couple with adult children maryland form

- Maryland legal will form

- Mutual wills package with last wills and testaments for married couple with no children maryland form

- Maryland minor form

- Mutual wills package with last wills and testaments for married couple with minor children maryland form

- Md codicil form

- Legal last will and testament form for married person with adult and minor children from prior marriage maryland

Find out other Tax Forms And PublicationsDepartment Of Taxation Hawaii gov

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online