it 370 Form 2015

What is the It 370 Form

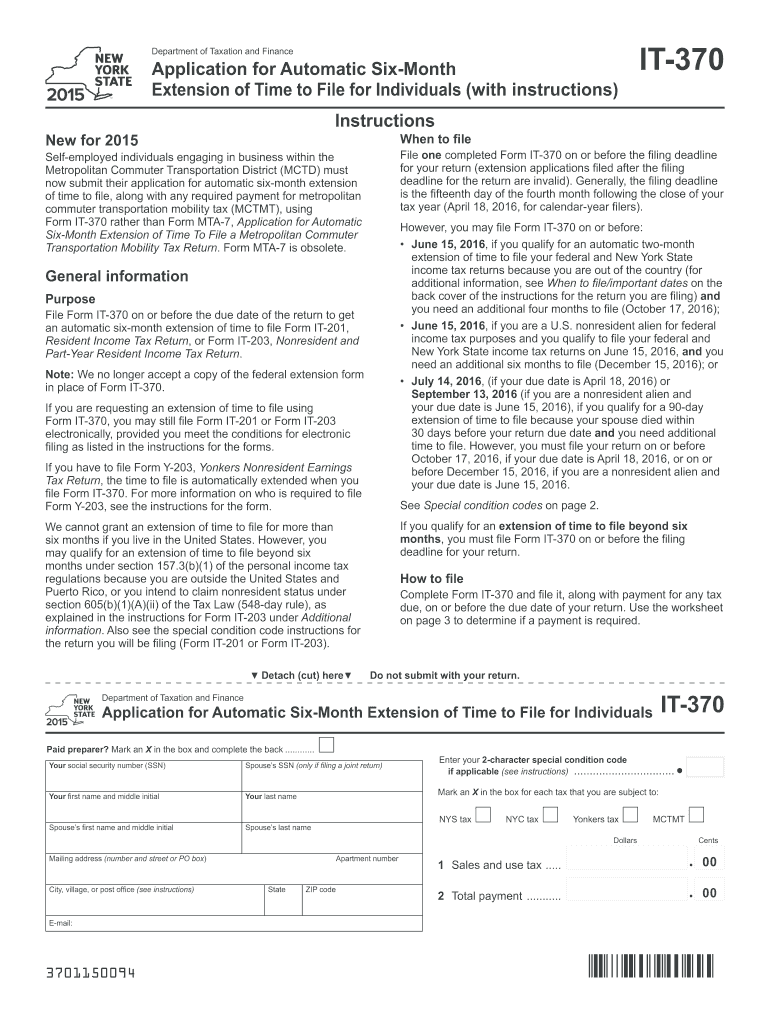

The It 370 Form is a tax form used by residents of the state of New York to apply for a refund of overpaid taxes or to claim a credit. This form is essential for individuals who have had excess tax withheld from their income or who qualify for specific tax credits. It helps streamline the process of receiving refunds, ensuring that taxpayers can efficiently manage their financial obligations.

How to use the It 370 Form

Using the It 370 Form involves several straightforward steps. First, gather all necessary documentation, including your W-2 forms and any other relevant tax documents. Next, accurately fill out the form, ensuring all information is correct and complete. After completing the form, review it for any errors before submitting it to the appropriate tax authority. This process can be done digitally, making it easier to manage your tax filings.

Steps to complete the It 370 Form

Completing the It 370 Form requires careful attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, provide details about your income and any taxes withheld. Be sure to calculate your refund or credit accurately. Once you have filled out all sections, sign and date the form. Finally, submit the form electronically or via mail, adhering to any submission deadlines.

Legal use of the It 370 Form

The It 370 Form is legally recognized by the state of New York as a valid document for claiming tax refunds. It must be completed in accordance with state tax laws and regulations. Using this form correctly ensures compliance with legal requirements, helping to avoid potential penalties or issues with tax authorities. It is important to keep a copy of the submitted form for your records.

Filing Deadlines / Important Dates

Filing deadlines for the It 370 Form typically align with the annual tax filing season. Taxpayers should be aware of specific dates, such as the deadline for submitting the form to ensure timely processing of refunds. Generally, the deadline for filing your state tax return, including the It 370 Form, falls on April fifteenth, unless this date falls on a weekend or holiday, in which case it may be extended. Staying informed about these dates is crucial for avoiding late fees.

Required Documents

To complete the It 370 Form, several documents are necessary. These typically include your W-2 forms, which report your income and tax withholdings, as well as any 1099 forms if you have additional income sources. It is also helpful to have previous tax returns on hand, as they can provide context for your current filing. Collecting these documents in advance can simplify the process of filling out the form.

Form Submission Methods (Online / Mail / In-Person)

The It 370 Form can be submitted through various methods, providing flexibility for taxpayers. Online submission is often the quickest and most efficient option, allowing for immediate processing. Alternatively, taxpayers may choose to mail their completed forms to the appropriate tax office. In-person submissions are also an option, although they may require an appointment. Each method has its own advantages, depending on individual preferences and circumstances.

Quick guide on how to complete it 370 2015 form

Your assistance manual on how to prepare your It 370 Form

If you’re curious about how to construct and dispatch your It 370 Form, here are a few concise instructions to simplify tax submission considerably.

To begin, you just need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, generate, and finalize your tax documents with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and return to adjust responses as necessary. Enhance your tax oversight with sophisticated PDF editing, eSigning, and seamless sharing.

Adhere to the following steps to complete your It 370 Form in no time:

- Create your account and start working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Click Obtain form to access your It 370 Form in our editor.

- Populate the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Signature Tool to append your legally-valid eSignature (if required).

- Examine your document and correct any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that submitting on paper can increase errors and delay refunds. Naturally, before e-filing your taxes, review the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct it 370 2015 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

Create this form in 5 minutes!

How to create an eSignature for the it 370 2015 form

How to create an electronic signature for your It 370 2015 Form in the online mode

How to create an eSignature for the It 370 2015 Form in Chrome

How to make an electronic signature for putting it on the It 370 2015 Form in Gmail

How to create an eSignature for the It 370 2015 Form right from your smart phone

How to generate an electronic signature for the It 370 2015 Form on iOS devices

How to create an eSignature for the It 370 2015 Form on Android OS

People also ask

-

What is the IT 370 Form and how can airSlate SignNow help?

The IT 370 Form is a tax form used for New York State personal income tax. With airSlate SignNow, you can easily fill out and eSign the IT 370 Form, streamlining the process and ensuring accuracy. Our platform simplifies document management, making it easier for you to stay compliant with tax regulations.

-

How much does it cost to use airSlate SignNow for the IT 370 Form?

airSlate SignNow offers flexible pricing plans tailored to meet various needs. You can choose a subscription that best fits your business size and requirements for managing the IT 370 Form and other documents. Our cost-effective solution ensures you get the best value while efficiently managing your eSigning needs.

-

What features does airSlate SignNow offer for managing the IT 370 Form?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and real-time tracking, specifically designed to enhance your experience with the IT 370 Form. You can easily create, edit, and share documents, while our eSignature capabilities ensure your forms are legally binding and compliant.

-

Is airSlate SignNow secure for eSigning the IT 370 Form?

Yes, airSlate SignNow prioritizes security, offering encryption and multi-factor authentication to protect your sensitive information while eSigning the IT 370 Form. Our platform adheres to strict compliance standards, ensuring that your documents are safe and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other applications while using the IT 370 Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, such as Google Drive, Salesforce, and Microsoft Office, making it easy to manage the IT 370 Form along with your other business documents. This integration helps streamline workflows and improves overall efficiency.

-

How does airSlate SignNow improve the efficiency of processing the IT 370 Form?

By using airSlate SignNow, you can signNowly reduce the time spent on processing the IT 370 Form. Our platform allows for quick document preparation, easy collaboration, and instant eSigning, which means you can complete your tax forms faster and with fewer errors, enhancing overall productivity.

-

Can I access the IT 370 Form from any device using airSlate SignNow?

Yes, airSlate SignNow is designed to be accessible from any device, whether it's a desktop, tablet, or smartphone. This flexibility allows you to manage and eSign the IT 370 Form on-the-go, ensuring you can handle your documents anytime, anywhere.

Get more for It 370 Form

- State of south carlina county of in the magistrates form

- Scca732 form

- Application for homestead classification ramsey county co ramsey mn form

- You must own and occupy the property on either january 2 or december 1 and the application must be returned to your assessors form

- Form lic9151 ampquotproperty ownerlandlord notification family

- Lic 9151 form

- Lic 700 form

- Accident and illness report form ct

Find out other It 370 Form

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself