Pop Up Form, Doesn't Scroll to Bottom General 2023-2026

Understanding New York State Tax Forms

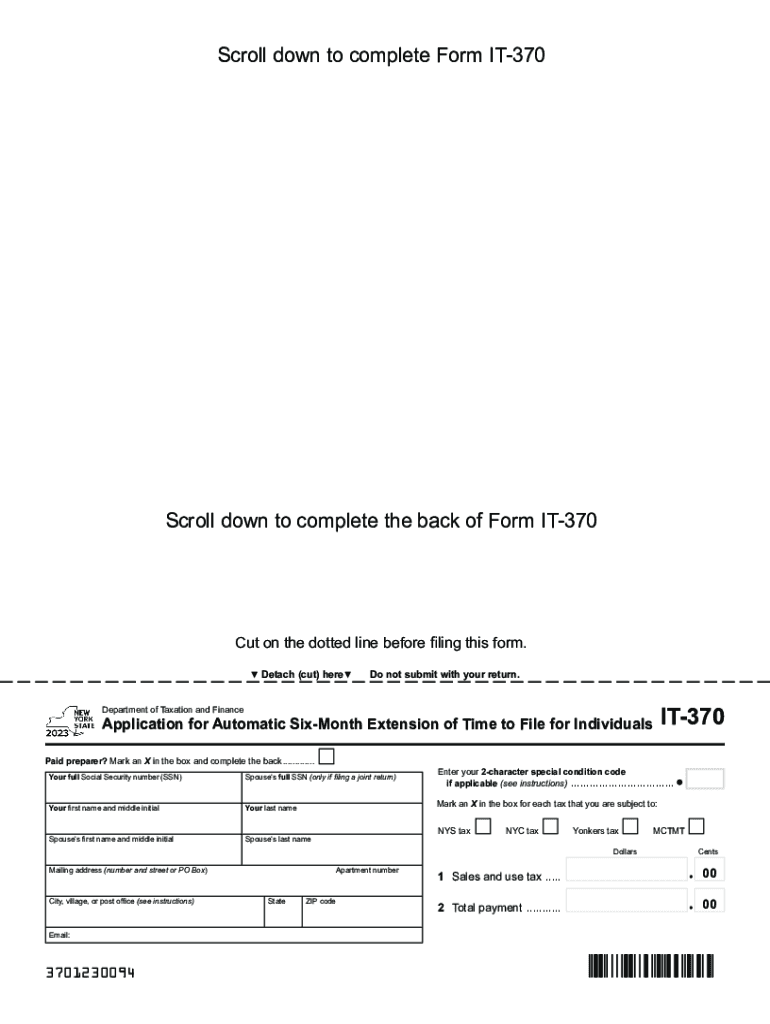

New York State tax forms are essential for individuals and businesses to report income, calculate taxes owed, and claim deductions or credits. Among these forms, the IT-370 is particularly important for taxpayers seeking an extension on their filing deadline. This form allows individuals to request additional time to file their state tax returns without incurring penalties, provided they pay any taxes owed by the original due date.

Steps to Complete the New York State IT-370 Form

Completing the IT-370 form involves several key steps:

- Gather necessary information, including your Social Security number, income details, and any tax payments made.

- Fill out the form accurately, ensuring all sections are completed, including your name, address, and the reason for the extension.

- Calculate any taxes owed to avoid penalties, as the extension only applies to the filing date, not the payment deadline.

- Review the form for accuracy and completeness before submission.

Once completed, you can submit the form online or by mail, depending on your preference.

Filing Deadlines for New York State Tax Forms

It is crucial to be aware of the filing deadlines associated with New York State tax forms. The standard deadline for filing personal income tax returns is typically April fifteenth. However, if you submit the IT-370 form, you may receive an extension until October fifteenth. Remember that this extension is only for filing your return, not for paying any taxes owed.

Where to Mail the New York IT-370 Form

When mailing the IT-370 form, it is important to send it to the correct address to ensure timely processing. The mailing address may vary based on whether you are enclosing a payment or not. If you are sending a payment, mail the form to:

New York State Department of Taxation and Finance

P.O. Box 555

Albany, NY 12

If you are not enclosing a payment, send it to:

New York State Department of Taxation and Finance

P.O. Box 6100

Albany, NY 12

Required Documents for Filing

To complete the IT-370 form, you will need several documents:

- Your previous year’s tax return for reference.

- W-2 forms from your employer.

- 1099 forms for any additional income.

- Records of any tax payments made for the current year.

Having these documents ready will streamline the process and help ensure accuracy when filling out your form.

Penalties for Non-Compliance

Failing to file your New York State tax return on time can result in penalties. If you do not submit your return or an extension request by the deadline, you may incur a late filing penalty. Additionally, if you owe taxes and do not pay them by the due date, interest will accrue on the unpaid balance. It is advisable to file the IT-370 form even if you cannot pay your taxes in full to avoid further penalties.

Quick guide on how to complete pop up form doesnt scroll to bottom general

Complete Pop Up Form, Doesn't Scroll To Bottom General seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can find the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Pop Up Form, Doesn't Scroll To Bottom General on any device using airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to modify and eSign Pop Up Form, Doesn't Scroll To Bottom General effortlessly

- Find Pop Up Form, Doesn't Scroll To Bottom General and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal significance as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Pop Up Form, Doesn't Scroll To Bottom General and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pop up form doesnt scroll to bottom general

Create this form in 5 minutes!

How to create an eSignature for the pop up form doesnt scroll to bottom general

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are New York State tax forms printable with airSlate SignNow?

New York State tax forms printable through airSlate SignNow allow users to easily access, fill out, and eSign their tax documents online. This ensures that you can manage your tax forms effectively without the hassle of printing and mailing paper forms. Our platform simplifies the process, helping you stay compliant and organized.

-

How can I access New York State tax forms printable?

To access New York State tax forms printable, simply visit the airSlate SignNow website and navigate to our forms section. You can easily find and select the specific tax forms you need. Users can fill out these forms electronically, making it easier to submit your taxes on time.

-

Are New York State tax forms printable free of charge?

While airSlate SignNow offers several free resources, access to New York State tax forms printable may require a subscription. Our cost-effective plans provide a range of features to ensure you have everything you need for your tax filing. Check our pricing page for more details on subscriptions and available features.

-

What features do the New York State tax forms printable offer?

The New York State tax forms printable provided by airSlate SignNow come with features such as eSigning, automated reminders, and customizable templates. These features simplify the completion and submission of your tax forms, ensuring a seamless user experience. Our user-friendly interface makes it easy for anyone to manage their documentation.

-

Can I integrate New York State tax forms printable with other applications?

Yes, airSlate SignNow allows for seamless integration with various third-party applications, enabling you to work efficiently with your New York State tax forms printable. Whether you use cloud storage services or accounting software, our integrations help streamline your workflow. This flexibility ensures that you can manage documents in one cohesive environment.

-

What are the benefits of using airSlate SignNow for New York State tax forms printable?

Using airSlate SignNow for your New York State tax forms printable provides numerous benefits including time savings, enhanced security, and improved accuracy. By allowing electronic signatures and digital storage, you can eliminate paper clutter and ensure your forms are securely submitted. This efficiency helps reduce stress during tax season.

-

Is it easy to fill out New York State tax forms printable on airSlate SignNow?

Absolutely! Filling out New York State tax forms printable on airSlate SignNow is designed to be intuitive and straightforward. Users can quickly navigate the document interface and easily input their information, ensuring a smooth experience from start to finish. Our platform supports users with prompts and guidance along the way.

Get more for Pop Up Form, Doesn't Scroll To Bottom General

Find out other Pop Up Form, Doesn't Scroll To Bottom General

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement