it 370 2018

What is the IT-370?

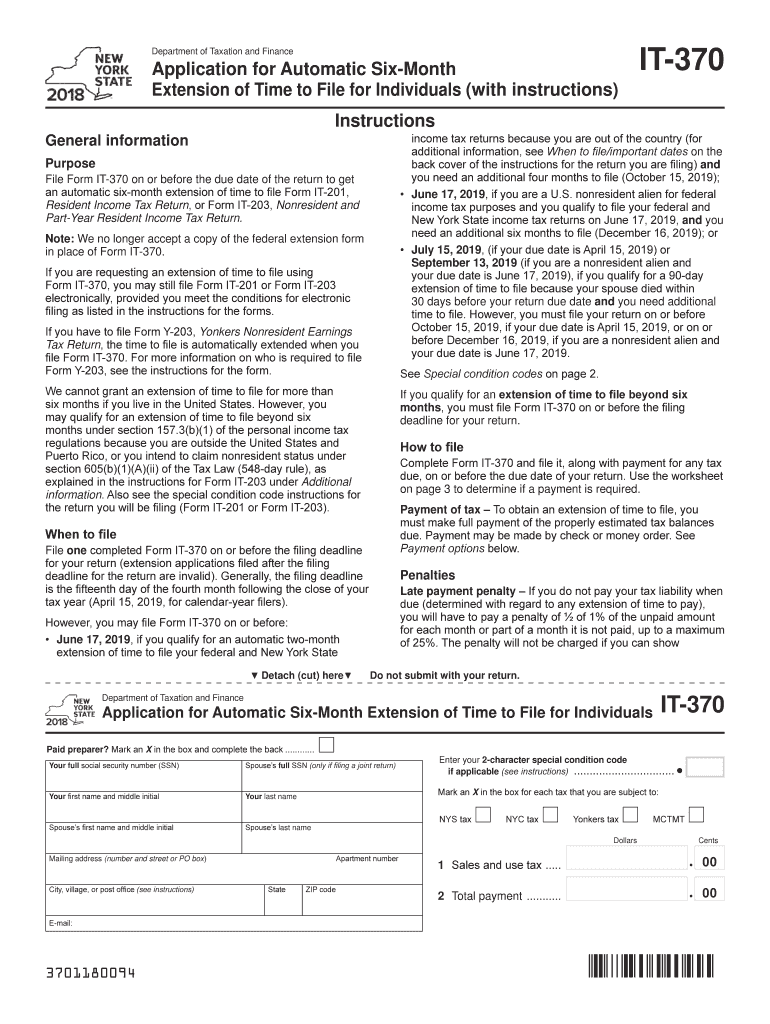

The IT-370 is a New York State tax form used to request an extension for filing personal income tax returns. This form allows taxpayers to extend their filing deadline by six months, providing additional time to gather necessary documentation and complete their tax returns accurately. It is essential to note that while the IT-370 extends the filing deadline, it does not extend the time to pay any taxes owed. Taxpayers must estimate their tax liability and submit any payment due by the original filing deadline to avoid penalties and interest.

How to Use the IT-370

Using the IT-370 involves a straightforward process. Taxpayers must fill out the form with their personal information, including name, address, and Social Security number. Additionally, they need to estimate their tax liability for the year and indicate any payments made. After completing the form, it can be submitted either online or via mail. It is crucial to ensure that the form is submitted before the original due date of the tax return to avoid any penalties.

Steps to Complete the IT-370

Completing the IT-370 requires attention to detail. Follow these steps:

- Gather necessary documents, including previous tax returns and income statements.

- Fill out personal information accurately on the form.

- Estimate your total tax liability for the year.

- Indicate any payments already made toward your tax obligation.

- Review the completed form for accuracy.

- Submit the form by the original tax return due date, either online or by mail.

Legal Use of the IT-370

The IT-370 is legally recognized by the New York State Department of Taxation and Finance as a valid request for an extension to file personal income tax returns. To ensure compliance, taxpayers must adhere to the guidelines set forth by the state, including submitting the form on time and paying any estimated taxes owed. Failure to comply with these regulations may result in penalties or interest on unpaid taxes.

Filing Deadlines / Important Dates

The deadline for filing the IT-370 coincides with the original due date for personal income tax returns, typically April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for taxpayers to mark their calendars and ensure that the IT-370 is submitted on or before this deadline to avoid penalties.

Required Documents

When completing the IT-370, taxpayers should have the following documents ready:

- Previous year’s tax return for reference.

- W-2 forms from employers.

- 1099 forms for other income sources.

- Any documentation of estimated tax payments made.

Having these documents on hand will facilitate a smoother completion of the form and ensure accurate estimations of tax liability.

Form Submission Methods

The IT-370 can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can help ensure timely processing of the extension request.

Quick guide on how to complete it 370 2018 2019 form

Your assistance manual on how to prepare your It 370

If you're curious about how to generate and dispatch your It 370, here are some quick pointers on making tax submission less challenging.

To start, you simply need to sign up for your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax paperwork effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures and return to amend details wherever necessary. Streamline your tax administration with sophisticated PDF editing, electronic signing, and easy sharing.

Follow the instructions below to finalize your It 370 in just a few minutes:

- Set up your account and start working on PDFs within minutes.

- Utilize our directory to obtain any IRS tax form; browse through variants and schedules.

- Press Get form to access your It 370 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-recognized electronic signature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Be aware that submitting on paper can lead to more errors and delay refunds. Of course, before e-filing your taxes, verify the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct it 370 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out the BHU's form of B.Com in 2018 and crack it?

you can fill from to go through bhu portal and read all those instruction and download previous year question paper . that u will get at the portal and solve more and more question paper and read some basics from your study level .focus on study save ur time and energy .do best to achieve your goal .for more detail discus with gajendra ta mtech in iit bhu .AND PKN .good luck .

-

Is it advantageous to fill out the JEE Mains 2018 form as soon as possible?

Yes. It is advantageous to fill out the JEE Mains 2018 form as soon as possible? Click here to know more about what are the advantage of filling JEE Main Application Form Earlier.

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the it 370 2018 2019 form

How to create an electronic signature for your It 370 2018 2019 Form online

How to make an eSignature for your It 370 2018 2019 Form in Google Chrome

How to generate an electronic signature for putting it on the It 370 2018 2019 Form in Gmail

How to make an electronic signature for the It 370 2018 2019 Form right from your smartphone

How to create an electronic signature for the It 370 2018 2019 Form on iOS

How to create an eSignature for the It 370 2018 2019 Form on Android

People also ask

-

What is the It 370 feature in airSlate SignNow?

The It 370 feature in airSlate SignNow allows users to seamlessly manage document workflows while ensuring that all electronic signatures are legally binding. This functionality enhances the efficiency of document handling and streamlines the signing process for businesses.

-

How much does the It 370 functionality cost in airSlate SignNow?

The It 370 feature is included in the various pricing tiers of airSlate SignNow, making it a cost-effective solution for businesses of all sizes. Users can choose from several subscription plans that best fit their needs, ensuring that they only pay for the features they utilize.

-

What are the main benefits of using the It 370 feature?

Using the It 370 feature in airSlate SignNow provides numerous benefits, including time savings, improved accuracy, and enhanced compliance. Businesses can quickly send and eSign documents, which speeds up the overall process and reduces the risk of errors.

-

Can I integrate the It 370 feature with other applications?

Yes, the It 370 feature in airSlate SignNow can be easily integrated with a variety of applications. This allows users to connect their existing systems, such as CRM and project management tools, enhancing productivity and ensuring a smoother workflow.

-

Is the It 370 functionality secure?

Absolutely! The It 370 feature in airSlate SignNow prioritizes security by providing advanced encryption and compliance with industry standards. This ensures that all documents and signatures are protected, giving users peace of mind when handling sensitive information.

-

How user-friendly is the It 370 feature for new users?

The It 370 feature is designed to be user-friendly, allowing new users to quickly adapt without extensive training. With an intuitive interface and straightforward navigation, businesses can start sending and eSigning documents within minutes.

-

What types of documents can I manage with the It 370 feature?

The It 370 feature in airSlate SignNow supports a wide variety of document types, including contracts, agreements, and forms. This versatility makes it an ideal solution for businesses looking to digitize their signing processes and improve overall efficiency.

Get more for It 370

Find out other It 370

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document