This Form is Not yet Available for the 202 Tax YearApply for an Extension of Time to File an Income Tax ReturnApply for an Exten 2021

Understanding New York State Tax Forms

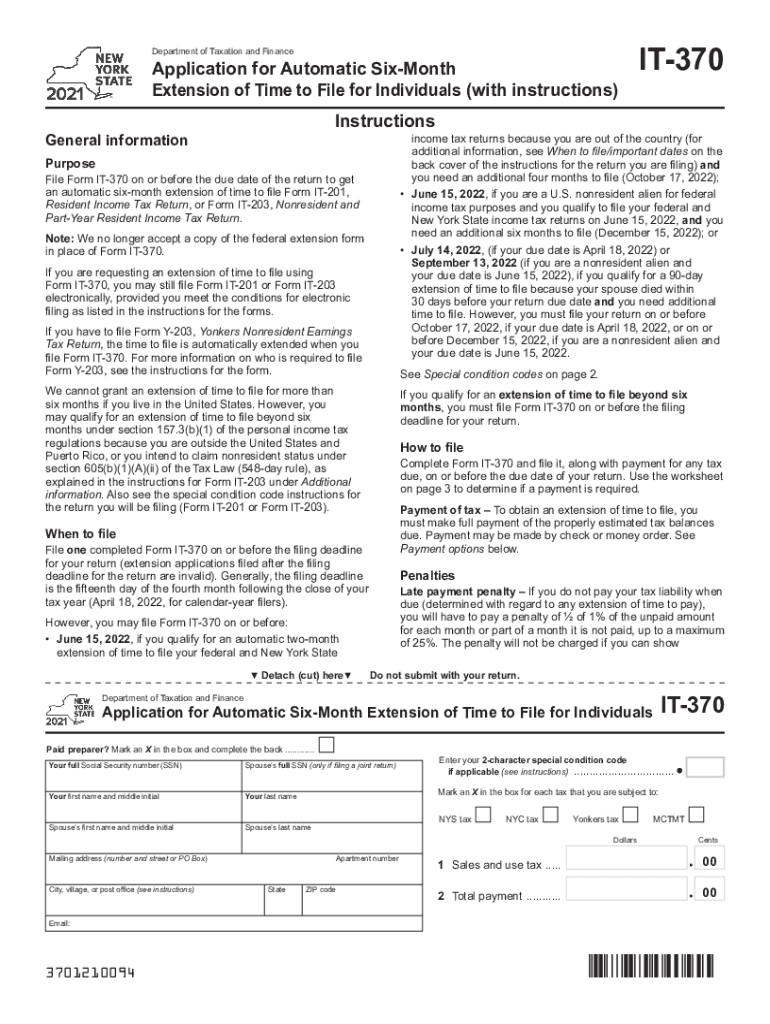

New York State tax forms are essential documents used by residents and businesses to report income, claim deductions, and pay taxes. These forms vary based on the taxpayer's situation, including individual income tax, corporate tax, and sales tax. Each form has specific instructions that guide users through the filing process, ensuring compliance with state tax laws.

Key Elements of the New York State Tax Forms

When filling out New York State tax forms, it is crucial to understand their key elements, which typically include:

- Personal Information: This includes your name, address, and Social Security number.

- Income Reporting: You must accurately report all sources of income, including wages, interest, and dividends.

- Deductions and Credits: Identify any deductions or credits you may qualify for, which can reduce your overall tax liability.

- Signature: A signature certifies that the information provided is accurate and complete.

Filing Deadlines and Important Dates

Filing deadlines for New York State tax forms are critical to avoid penalties. Typically, individual income tax returns are due on April fifteenth. If you need more time, you can apply for an extension, which usually allows an additional six months for filing. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods

New York State tax forms can be submitted through various methods:

- Online: Many forms can be filed electronically through the New York State Department of Taxation and Finance website.

- Mail: Completed forms can be printed and mailed to the appropriate address specified in the form instructions.

- In-Person: Some taxpayers may choose to file in person at designated tax offices.

Eligibility Criteria for New York State Tax Forms

Eligibility for specific New York State tax forms depends on various factors, including:

- Residency Status: Determine whether you are a resident, non-resident, or part-year resident.

- Income Level: Certain forms may only apply to individuals or businesses with income above or below specific thresholds.

- Business Type: Different forms are required for different business entities, such as sole proprietorships, LLCs, and corporations.

Penalties for Non-Compliance

Failing to file New York State tax forms on time can result in penalties. Common penalties include:

- Late Filing Penalty: A percentage of the tax due for each month the return is late.

- Late Payment Penalty: Interest accrues on any unpaid tax from the due date until payment is made.

- Additional Fees: Failure to comply with specific filing requirements may result in further charges.

Quick guide on how to complete this form is not yet available for the 202 tax yearapply for an extension of time to file an income tax returnapply for an

Complete This Form Is Not Yet Available For The 202 Tax YearApply For An Extension Of Time To File An Income Tax ReturnApply For An Exten seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an outstanding eco-friendly substitute to traditional printed and signed papers, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle This Form Is Not Yet Available For The 202 Tax YearApply For An Extension Of Time To File An Income Tax ReturnApply For An Exten on any device with the airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The most efficient way to edit and eSign This Form Is Not Yet Available For The 202 Tax YearApply For An Extension Of Time To File An Income Tax ReturnApply For An Exten effortlessly

- Obtain This Form Is Not Yet Available For The 202 Tax YearApply For An Extension Of Time To File An Income Tax ReturnApply For An Exten and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign This Form Is Not Yet Available For The 202 Tax YearApply For An Extension Of Time To File An Income Tax ReturnApply For An Exten and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct this form is not yet available for the 202 tax yearapply for an extension of time to file an income tax returnapply for an

Create this form in 5 minutes!

People also ask

-

What are new york state tax forms, and why are they important?

New York state tax forms are official documents required by the state for filing income tax returns. They are crucial for ensuring compliance with state tax laws and can affect your tax refund or liability. Accurate completion of these forms is essential for both individuals and businesses.

-

How can airSlate SignNow help me with new york state tax forms?

airSlate SignNow provides an easy-to-use platform for signing and managing new york state tax forms electronically. You can simplify the signing process, reduce paper clutter, and securely store your tax documents. Our solution ensures that you can complete and submit forms efficiently and effectively.

-

What features does airSlate SignNow offer for managing new york state tax forms?

airSlate SignNow offers various features tailored for handling new york state tax forms, such as electronic signatures, document templates, and customizable workflows. These features enable quick turnaround times and help maintain compliance with state regulations. Our user-friendly interface makes it easy to modify and manage tax documents.

-

Is there a cost associated with using airSlate SignNow for new york state tax forms?

Yes, airSlate SignNow offers various pricing plans depending on your needs. Each plan provides access to essential features for managing new york state tax forms, ensuring you only pay for what you need. We also offer a free trial so you can explore our services before committing.

-

Can I integrate airSlate SignNow with other software for new york state tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easier to manage new york state tax forms. You can connect our platform to your existing accounting or tax software to streamline your workflow. This integration ensures you can efficiently transfer data and maintain accurate records.

-

What benefits does electronic signing provide for new york state tax forms?

Electronic signing through airSlate SignNow offers numerous benefits for new york state tax forms, including faster processing times and enhanced security. You eliminate the delays associated with physical signatures and can promptly submit your forms to the state. Additionally, our system provides audit trails for accountability.

-

Are new york state tax forms secure when using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow, especially when handling new york state tax forms. Our platform utilizes industry-standard encryption and compliance measures to ensure that your documents are secure and confidential. You can trust that your sensitive tax information is safeguarded.

Get more for This Form Is Not Yet Available For The 202 Tax YearApply For An Extension Of Time To File An Income Tax ReturnApply For An Exten

Find out other This Form Is Not Yet Available For The 202 Tax YearApply For An Extension Of Time To File An Income Tax ReturnApply For An Exten

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word