Rd 471 1974-2026

What is the Rd 471?

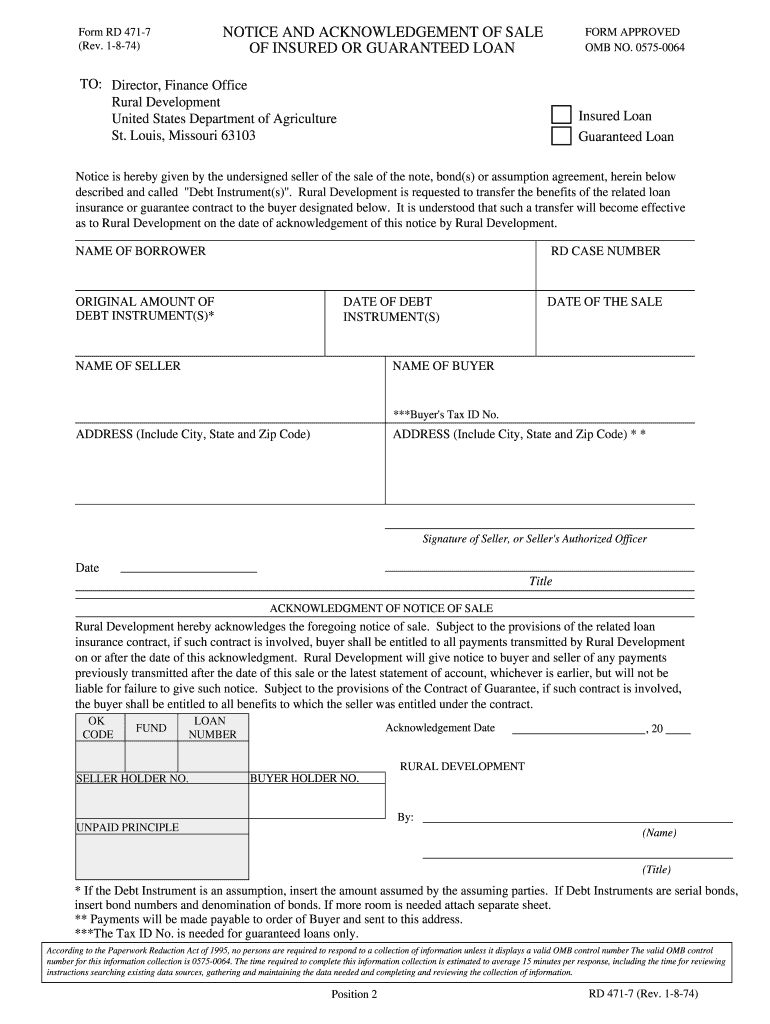

The Rd 471 form, also known as the Rd 471 7 form, is a crucial document used in the context of USDA loans, specifically for acknowledging the sale of properties that are insured by the USDA. This form is essential for ensuring that all parties involved in the transaction are aware of the terms and conditions associated with the sale. It serves as a formal acknowledgment of the sale and is required for processing the loan and securing the necessary funding.

How to Use the Rd 471

To effectively use the Rd 471 form, it is important to first gather all relevant information regarding the property and the transaction. This includes details about the buyer, seller, and the specifics of the sale. Once you have all the necessary information, you can fill out the form accurately. Ensure that all fields are completed, as incomplete forms may lead to delays in processing. After filling out the form, it should be submitted to the appropriate USDA office for review and approval.

Steps to Complete the Rd 471

Completing the Rd 471 form involves several key steps:

- Gather all required information about the property and transaction.

- Fill out the form completely, ensuring that all fields are accurate and up-to-date.

- Review the completed form for any errors or omissions.

- Submit the form to the designated USDA office, either online or by mail.

Following these steps carefully will help ensure that the form is processed smoothly and efficiently.

Legal Use of the Rd 471

The Rd 471 form must be used in compliance with USDA regulations to be considered legally valid. It is important to ensure that the form is current and that all information provided is accurate. Using outdated forms or providing incorrect information can lead to legal complications and may jeopardize the loan approval process. Understanding the legal implications of the Rd 471 is essential for both buyers and sellers involved in USDA-insured transactions.

Required Documents

When completing the Rd 471 form, several documents may be required to accompany the submission. These documents typically include:

- Proof of identity for both the buyer and seller.

- Documentation of the property’s current status and any relevant inspections.

- Financial statements or disclosures related to the sale.

Having these documents ready will facilitate a smoother submission process and help avoid any delays in processing the Rd 471 form.

Form Submission Methods

The Rd 471 form can be submitted through various methods, depending on the guidelines set by the USDA. Common submission methods include:

- Online submission via the USDA's designated portal.

- Mailing the completed form to the appropriate USDA office.

- In-person submission at a local USDA office.

Choosing the appropriate submission method is important to ensure timely processing of the form.

Quick guide on how to complete notice and acknowledgement of sale of insured or forms forms sc egov usda

Explore the most efficient method to complete and endorse your Rd 471

Are you still spending precious time preparing your official documents on paper instead of doing it online? airSlate SignNow offers a superior approach to complete and endorse your Rd 471 and associated forms for public services. Our intelligent electronic signature solution equips you with all the necessary tools to handle documents swiftly and in compliance with official guidelines - advanced PDF editing, managing, securing, signing, and sharing functionalities all accessible within a user-friendly interface.

Only a few steps are needed to finish filling out and endorsing your Rd 471:

- Insert the fillable template into the editor using the Get Form button.

- Verify the information you need to provide in your Rd 471.

- Move through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to enter your details into the blanks.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Conceal fields that are no longer relevant.

- Click on Sign to generate a legally binding electronic signature using any method you prefer.

- Add the Date beside your signature and finalize your work with the Done button.

Store your completed Rd 471 in the Documents folder within your profile, download it, or transfer it to your preferred cloud storage. Our solution also provides versatile form sharing options. There’s no need to print your forms when you can submit them directly to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

FAQs

-

Can I print a notice of intent form to homeschool in Nevada, fill it out, and turn it in?

It's best to ask homeschoolers in your state. Every state has different laws. What works in one may not work in another.This looks like the information you need: Notice of Intent (NOI)

-

I never received any type of payroll forms when I was hired at my job a month ago, was I supposed to or do I find them myself and fill them out?

It is your employer's responsibility to provide you with the I-9 form and to complete it--within your first three days of employment--after you've completed the first section. Technically, they probably shouldn't allow you to work without a completed I-9; they are also putting themselves in the position of being out of compliance with the I-9 retention requirements. If they were audited, they'd be fined for not having the proper forms on file.Neither the W-4 nor the A-4 is required in order to pay you. The IRS wants you to fill it out (and so does Arizona, I'm sure) but if you haven't, that doesn't prevent you from being paid. The employer can default your withholding to Single with 0 exemptions for Federal, and for AZ the default is the 2.7% rate.If it has been more than 10 days since the end of your pay period and you still haven't been paid, your employer is breaking the AZ labor law regarding timely payment (and depending on specific circumstances, they could be in that position only 5 days after the end of the pay period). In that case, you might want to consider filing a complaint with the labor board.Note: Since you commented elsewhere that you're only 16, I'd also add that it's probably in your best interest to obtain and submit the W-4 and A-4 forms. Your tax liability for the year is likely to be quite low (and possibly 0) so you'll probably want to adjust the amount that's being deducted, rather than defaulting to the higher withholding rate and letting the IRS/State of AZ be your no-interest bankers until next year.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

Why is it that on a lot of forms and documents with surveys to be filled out, there is a separate question asking about whether or not you are of Latin or Hispanic descent?

That item occurs more usually in the USA than anywhere else in the world.In the USA, Latin/Hispanic is socioculturally and sociopolitically considered a separate ethnic or racial category — whereas it is mostly not anywhere else in the world.Thanks for the A2A.

Create this form in 5 minutes!

How to create an eSignature for the notice and acknowledgement of sale of insured or forms forms sc egov usda

How to generate an eSignature for your Notice And Acknowledgement Of Sale Of Insured Or Forms Forms Sc Egov Usda online

How to generate an eSignature for the Notice And Acknowledgement Of Sale Of Insured Or Forms Forms Sc Egov Usda in Google Chrome

How to make an electronic signature for signing the Notice And Acknowledgement Of Sale Of Insured Or Forms Forms Sc Egov Usda in Gmail

How to generate an electronic signature for the Notice And Acknowledgement Of Sale Of Insured Or Forms Forms Sc Egov Usda straight from your mobile device

How to make an eSignature for the Notice And Acknowledgement Of Sale Of Insured Or Forms Forms Sc Egov Usda on iOS

How to generate an electronic signature for the Notice And Acknowledgement Of Sale Of Insured Or Forms Forms Sc Egov Usda on Android devices

People also ask

-

What is Rd 471 in relation to airSlate SignNow?

Rd 471 refers to a specific document management feature within the airSlate SignNow platform. This feature enhances the eSigning process, enabling users to efficiently manage and send documents for signature. By utilizing Rd 471, businesses can streamline their workflow and improve document turnaround times.

-

How much does airSlate SignNow cost with Rd 471 features?

The pricing for airSlate SignNow varies based on the plan you choose, which includes access to Rd 471 features. Typically, plans start with a basic tier that offers essential eSigning capabilities, while higher tiers include advanced functionalities associated with Rd 471. It’s best to check the airSlate SignNow pricing page for the most current details.

-

What are the key benefits of using airSlate SignNow with Rd 471?

Using airSlate SignNow with Rd 471 offers numerous benefits, including enhanced efficiency in document signing processes and improved collaboration among team members. The Rd 471 feature supports customizable workflows, making it easier for businesses to manage document approvals. Additionally, it ensures compliance with legal standards, which is crucial for many organizations.

-

Can I integrate other applications with airSlate SignNow's Rd 471?

Yes, airSlate SignNow's Rd 471 supports integration with various applications, allowing for a seamless workflow across different platforms. Whether you use CRM systems, project management tools, or cloud storage services, Rd 471 can connect with them to facilitate easy document handling. This integration capability enhances productivity and reduces manual work.

-

Is airSlate SignNow's Rd 471 suitable for small businesses?

Absolutely! Rd 471 is designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective pricing make it an ideal solution for small enterprises looking to improve their document signing processes. Small businesses can take advantage of Rd 471 to create a professional image and save time.

-

How does Rd 471 ensure the security of my documents?

Rd 471 incorporates robust security measures to protect your documents while using airSlate SignNow. These measures include encryption, secure storage, and compliance with industry standards for data protection. With Rd 471, you can confidently send and store sensitive documents without worrying about unauthorized access.

-

What types of documents can I manage with Rd 471 on airSlate SignNow?

With Rd 471 on airSlate SignNow, you can manage a wide variety of documents, including contracts, agreements, and forms. The platform supports various file formats, making it versatile for different business needs. Whether you need to send a simple form or a complex contract, Rd 471 can handle it efficiently.

Get more for Rd 471

- Form 943 employers annual federal tax return for

- Form 8582 fill out and sign printable pdf templatesignnow

- Form 8833 fillable treaty based return position disclosure

- 2021 form 1095 b health coverage

- 2017 2021 form il dsd cdts 8 fill online printable

- Instructions for form 1040 x rev september 2021 instructions for form 1040 x amended us individual income tax return use with

- 2021 form 1095 c employer provided health insurance offer and coverage

- Tier 6 6310 and special plan members form 624 new york city

Find out other Rd 471

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors