SD DO 3A Form

What is the SD DO 3A

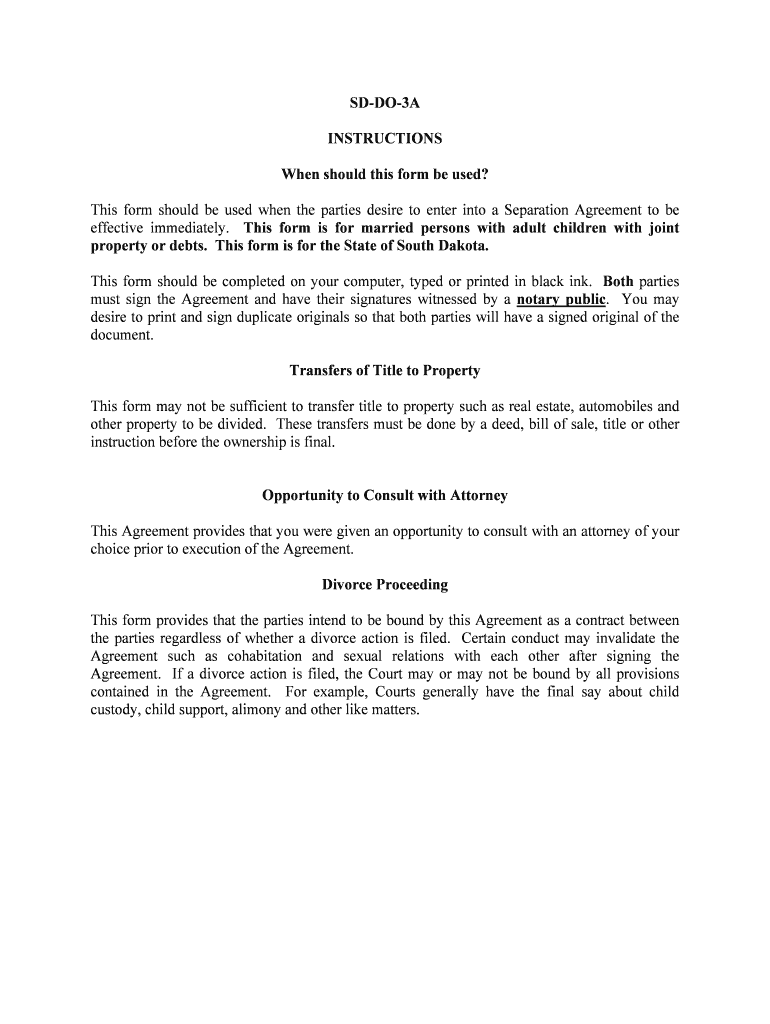

The SD DO 3A form is a specific document used primarily in the context of tax filings and compliance within the United States. This form is essential for certain tax-related processes and is often utilized by individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the SD DO 3A is crucial for ensuring accurate and timely submissions, thereby avoiding potential penalties or compliance issues.

How to use the SD DO 3A

Using the SD DO 3A form involves several key steps to ensure proper completion and submission. First, gather all necessary financial documents and information required for the form. This may include income statements, previous tax returns, and any relevant deductions or credits. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is advisable to review the form multiple times to catch any errors before submission. Finally, submit the completed form according to the guidelines provided by the IRS, which may include online submission or mailing the form to a designated address.

Steps to complete the SD DO 3A

Completing the SD DO 3A form requires a systematic approach to ensure accuracy. Follow these steps:

- Gather all necessary documents, including income records and previous tax returns.

- Read the instructions carefully to understand the requirements for each section of the form.

- Fill out the form, ensuring that all information is entered correctly.

- Double-check calculations and ensure that all figures are accurate.

- Sign and date the form where required.

- Submit the form via the appropriate method, whether online, by mail, or in person.

Legal use of the SD DO 3A

The legal use of the SD DO 3A form is governed by federal tax laws and regulations. To be considered legally binding, the form must be completed accurately and submitted within the designated timeframes set by the IRS. Compliance with eSignature laws can also enhance the legal standing of the document when submitted electronically. Ensuring that all required signatures and certifications are included will help validate the form's legitimacy and protect against potential legal challenges.

Key elements of the SD DO 3A

Several key elements are essential to the SD DO 3A form, including:

- Personal Information: This includes the taxpayer's name, address, and Social Security number.

- Financial Information: Detailed reporting of income, deductions, and credits.

- Signature: Required to validate the form, indicating that the information provided is accurate and complete.

- Date of Submission: Important for tracking compliance with filing deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the SD DO 3A form are critical to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, extensions may be available under certain circumstances. Staying informed about any changes to filing dates is essential for compliance and can help prevent unnecessary complications.

Quick guide on how to complete sd do 3a

Easily Prepare SD DO 3A on Any Device

Managing documents online has gained popularity among both businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools needed to create, modify, and electronically sign your documents quickly without delays. Handle SD DO 3A on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign SD DO 3A with Ease

- Locate SD DO 3A and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select relevant sections of the documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose how you'd like to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

No more worrying about lost files, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and electronically sign SD DO 3A while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is SD DO 3A and how does it relate to airSlate SignNow?

SD DO 3A is a powerful feature within the airSlate SignNow platform that allows businesses to streamline their document signing processes. By utilizing this feature, users can enhance their efficiency and ensure compliance, making it a vital component of our eSigning solution.

-

How much does it cost to use SD DO 3A with airSlate SignNow?

Pricing for airSlate SignNow and the SD DO 3A feature varies based on the subscription plan you choose. We offer different tiers that cater to various business needs and budgets, so you can find a cost-effective solution that includes SD DO 3A functionalities.

-

What are the key features of SD DO 3A in airSlate SignNow?

SD DO 3A includes features such as customizable templates, audit trails, and real-time notifications for document status. These features help users manage their signing processes more efficiently and securely, giving them complete control over their document workflows.

-

What benefits does SD DO 3A provide for businesses?

By using SD DO 3A, businesses can signNowly speed up their document signing processes while maintaining high levels of security and compliance. The streamlined workflow not only saves time but also enhances customer satisfaction through faster service delivery.

-

Can SD DO 3A integrate with other software solutions?

Yes, SD DO 3A is designed to integrate seamlessly with various software solutions, enhancing your overall workflow. Whether you're using CRM systems or project management tools, airSlate SignNow allows for smooth integration, making SD DO 3A even more valuable.

-

Is it easy to use SD DO 3A for beginners?

Absolutely! SD DO 3A is built with user-friendliness in mind, ensuring that even beginners can navigate the airSlate SignNow platform with ease. With intuitive design and accessible features, new users can quickly become proficient in using our eSigning solutions.

-

What industries benefit most from SD DO 3A?

SD DO 3A is beneficial across a wide range of industries, including real estate, education, and healthcare. Any business that requires efficient document signing can leverage airSlate SignNow's capabilities to improve productivity and reduce overhead costs.

Get more for SD DO 3A

Find out other SD DO 3A

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF