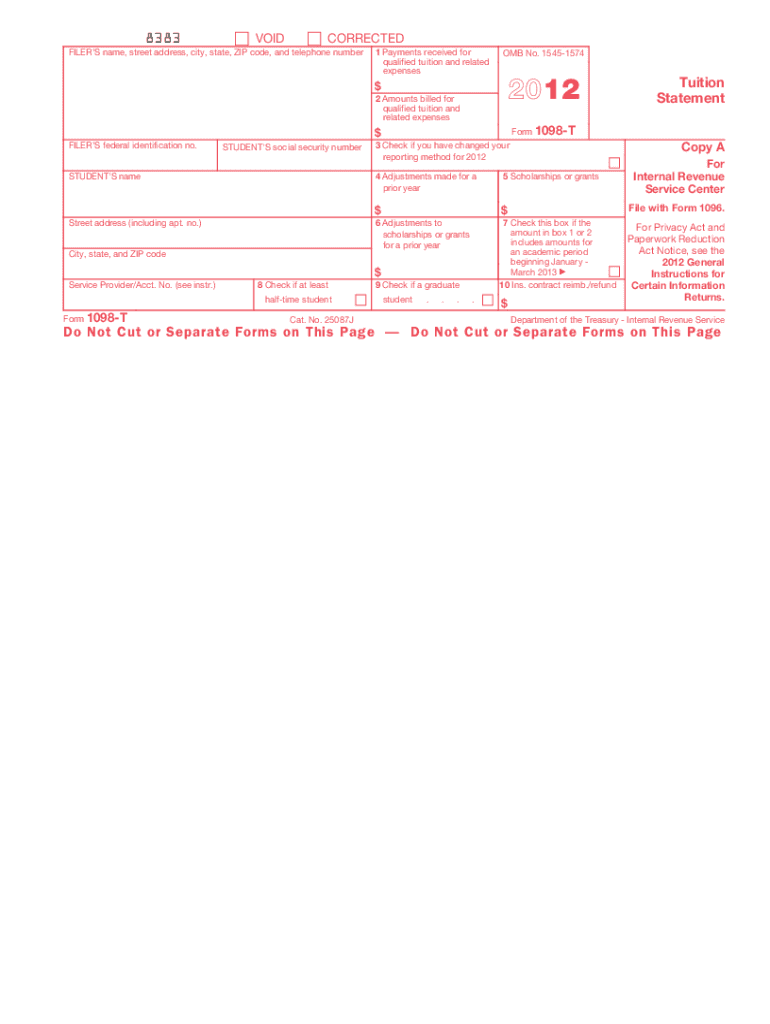

1098 T Form 2012

What is the 1098 T Form

The 1098 T Form is an essential tax document used in the United States, primarily for reporting tuition payments made by students to eligible educational institutions. This form helps students and their families claim education-related tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit. Educational institutions are required to issue this form to students who have made qualifying payments during the tax year, providing crucial information about the amounts paid for qualified tuition and related expenses.

How to use the 1098 T Form

Using the 1098 T Form involves several steps to ensure accurate reporting and claiming of tax credits. First, students should receive the form from their educational institution, which details the payments made. Next, taxpayers should review the information provided, ensuring that the amounts match their records. This form is then used when filling out tax returns, specifically to claim eligible education credits. It is important to keep a copy of the form for personal records and to ensure compliance with IRS regulations.

Steps to complete the 1098 T Form

Completing the 1098 T Form requires careful attention to detail. Follow these steps:

- Gather all necessary documentation, including tuition payment receipts and any relevant financial aid information.

- Review the form for accuracy, ensuring that your name, Social Security number, and the institution's information are correct.

- Fill in the appropriate boxes, including the amounts paid for qualified tuition and related expenses, as well as any scholarships or grants received.

- Sign and date the form, if required, before submitting it to the IRS along with your tax return.

Legal use of the 1098 T Form

The legal use of the 1098 T Form is governed by IRS regulations, which stipulate that it must be used to report tuition payments accurately. This form is crucial for students seeking to claim education tax credits, and it must be completed truthfully to avoid penalties. Institutions that fail to issue the form or provide incorrect information may face legal repercussions. It is important for both students and educational institutions to understand their obligations regarding this form to ensure compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1098 T Form are critical for taxpayers. Educational institutions must provide the form to students by January 31 of the following tax year. Students should ensure they receive their forms on time to avoid delays in filing their tax returns. Additionally, the deadline for submitting tax returns, including the 1098 T Form, is typically April 15, unless an extension is filed. Being aware of these dates helps ensure timely compliance and the ability to claim any eligible tax credits.

Who Issues the Form

The 1098 T Form is issued by eligible educational institutions, including colleges, universities, and vocational schools, that participate in federal student aid programs. These institutions are responsible for collecting and reporting the necessary financial information regarding tuition payments made by students. It is essential for students to ensure that their institution correctly issues the form, as discrepancies can affect their ability to claim education-related tax credits.

Quick guide on how to complete 2012 1098 t form

Complete 1098 T Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without interruptions. Handle 1098 T Form on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign 1098 T Form without any hassle

- Find 1098 T Form and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Select important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign 1098 T Form to ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 1098 t form

Create this form in 5 minutes!

How to create an eSignature for the 2012 1098 t form

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is a 1098 T Form and why is it important?

The 1098 T Form is a tax document used by eligible educational institutions to report information about students and their tuition payments. It is important because it helps students and their families claim education-related tax credits, thus reducing their tax liability. Understanding the 1098 T Form can ensure you maximize your educational tax benefits.

-

How can airSlate SignNow help with the 1098 T Form process?

airSlate SignNow simplifies the process of sending and eSigning the 1098 T Form by providing an easy-to-use platform for businesses and educational institutions. With our solution, you can quickly prepare, send, and securely sign the 1098 T Form, ensuring compliance while saving time and reducing paperwork.

-

Is airSlate SignNow cost-effective for managing 1098 T Forms?

Yes, airSlate SignNow offers a cost-effective solution for managing the 1098 T Form process. Our pricing plans are designed to cater to businesses of all sizes, allowing you to choose the best option that fits your budget while providing robust features to streamline your document management.

-

What features does airSlate SignNow offer for the 1098 T Form?

airSlate SignNow offers features such as customizable templates, secure eSignature options, and automated workflows specifically designed for handling the 1098 T Form. These features enhance efficiency and ensure that all documents are processed smoothly and securely.

-

Can I integrate airSlate SignNow with other software to manage the 1098 T Form?

Absolutely! airSlate SignNow easily integrates with various software solutions such as CRM systems, accounting software, and cloud storage services. This integration allows for seamless management of the 1098 T Form alongside your existing tools, enhancing productivity.

-

What are the benefits of using airSlate SignNow for the 1098 T Form?

Using airSlate SignNow for the 1098 T Form provides several benefits, including increased efficiency, reduced turnaround times, and improved document security. Our platform ensures that your forms are processed quickly while maintaining compliance and protecting sensitive information.

-

How secure is the information on the 1098 T Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect all information related to the 1098 T Form. This ensures that your data remains confidential and compliant with industry regulations.

Get more for 1098 T Form

- Recertification form snf

- If form is not completely filled out bills will be sent diret

- 2018 usrds annual form

- Fax cover sheet greenwood physical therapy form

- The new postacute care payment systems 5 tips to help form

- Send copy of form to the person who fill out the form jotform

- To a third year student cu anschutz form

- Fleet service request form

Find out other 1098 T Form

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document