Form 944 2009

What is the Form 944

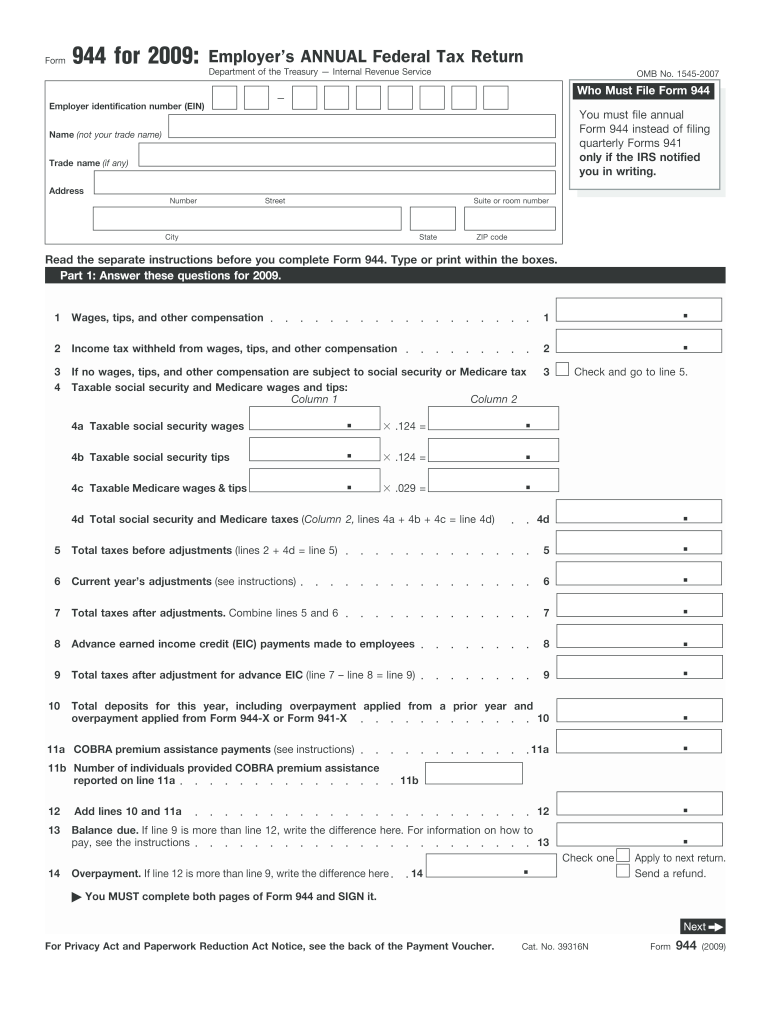

The Form 944 is a U.S. Internal Revenue Service (IRS) tax form used by small businesses to report and pay their annual federal payroll taxes. Unlike the more commonly known Form 941, which is filed quarterly, Form 944 is specifically designed for employers with a lower payroll tax liability. This form simplifies the tax reporting process for eligible businesses by allowing them to submit their payroll tax information once a year instead of four times. It includes details about wages paid, federal income tax withheld, and Social Security and Medicare taxes.

How to use the Form 944

To effectively use the Form 944, employers must first determine their eligibility based on their annual payroll tax liability. If eligible, they can complete the form by providing necessary information such as employee wages, tax withholdings, and any adjustments. The completed form must be submitted to the IRS by the specified deadline, along with any payment due. Employers should keep a copy of the form and all supporting documentation for their records. Using an electronic signature solution can streamline the submission process and ensure compliance with IRS regulations.

Steps to complete the Form 944

Completing the Form 944 involves several key steps:

- Gather all necessary information, including employee wages, tax withholdings, and any adjustments for the year.

- Fill out the form accurately, ensuring that all figures are correct and match your payroll records.

- Review the completed form for any errors or omissions.

- Sign and date the form, either electronically or manually, depending on your submission method.

- Submit the form to the IRS by the deadline, ensuring that any payment due is included.

Legal use of the Form 944

The legal use of the Form 944 is governed by IRS regulations. To ensure that the form is considered valid, it must be completed accurately and submitted on time. Electronic signatures are legally binding under the ESIGN Act, provided that certain requirements are met. This includes using a secure electronic signature solution that complies with federal and state laws. Maintaining proper records and documentation is also essential for legal compliance, especially in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 944 are crucial for compliance. Typically, the form is due by January 31 of the year following the tax year being reported. If the deadline falls on a weekend or holiday, it is extended to the next business day. Employers should also be aware of any specific dates for making tax payments associated with the form. Staying informed about these deadlines helps avoid penalties and ensures timely compliance with IRS requirements.

Penalties for Non-Compliance

Failure to file the Form 944 on time or inaccuracies in the submitted information can result in penalties imposed by the IRS. Common penalties include fines for late filing, late payment, or underpayment of taxes. In some cases, the IRS may also impose interest on unpaid taxes. To mitigate these risks, employers should ensure accurate completion of the form and timely submission, as well as maintain thorough records of payroll and tax information.

Quick guide on how to complete 2009 form 944

Easily Prepare Form 944 on Any Device

Managing documents online has gained traction among companies and individuals. It offers an excellent eco-friendly option to traditional printed and signed files, as it allows you to access the necessary form and securely store it online. airSlate SignNow furnishes you with all the resources required to swiftly create, modify, and electronically sign your documents without delays. Handle Form 944 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to Modify and Electronically Sign Form 944 with Ease

- Locate Form 944 and click Obtain Form to get started.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Signature tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Finish button to save your adjustments.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misfiled documents, endless form searches, or errors requiring new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 944 to guarantee excellent communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 form 944

Create this form in 5 minutes!

How to create an eSignature for the 2009 form 944

The best way to generate an eSignature for your PDF online

The best way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is Form 944 and how does it relate to airSlate SignNow?

Form 944 is an annual tax form that small employers use to report their federal payroll taxes. With airSlate SignNow, you can easily eSign and send Form 944, ensuring that your documents are securely signed and stored, streamlining your payroll tax reporting process.

-

How can airSlate SignNow help me manage Form 944 submissions?

airSlate SignNow simplifies the management of Form 944 submissions by allowing you to create, sign, and store documents electronically. This reduces paperwork, minimizes errors, and enhances compliance, making it easier for your business to stay on top of federal payroll tax requirements.

-

What features does airSlate SignNow offer for handling Form 944?

AirSlate SignNow provides a variety of features for handling Form 944, including customizable templates, electronic signatures, and document tracking. These features ensure that your Form 944 submissions are processed efficiently and securely, allowing you to focus on your core business activities.

-

Is airSlate SignNow affordable for small businesses needing to file Form 944?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. With competitive pricing plans, you can access essential features for filing Form 944 without breaking the bank, making it an ideal choice for budget-conscious companies.

-

Can I integrate airSlate SignNow with other software for Form 944 filing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software, making it easy to manage Form 944 filings. This integration enhances your workflow and ensures that all your financial data is synchronized and up-to-date.

-

What are the benefits of using airSlate SignNow for Form 944?

Using airSlate SignNow for Form 944 offers numerous benefits, including increased efficiency, reduced paper usage, and improved compliance. The platform's user-friendly interface and secure signing process help streamline your payroll tax reporting, saving you time and resources.

-

How secure is airSlate SignNow for storing Form 944?

AirSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Form 944 and other sensitive documents. You can trust that your information is safe, allowing you to focus on running your business without worrying about data bsignNowes.

Get more for Form 944

- Bankers life insurance full surrender form

- Default argument passing method for functions freebasicnet form

- Outgoing medical records request form

- Avmed application form

- Cys health assessment form

- Electronic data interchange edi enrollment 8292 form office ally

- Electronic data interchange edi enrollment 8292 form

- Grievance and appeal bformb simply healthcare plans

Find out other Form 944

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim