Re Corporate Tax Return Form

What is the Re Corporate Tax Return

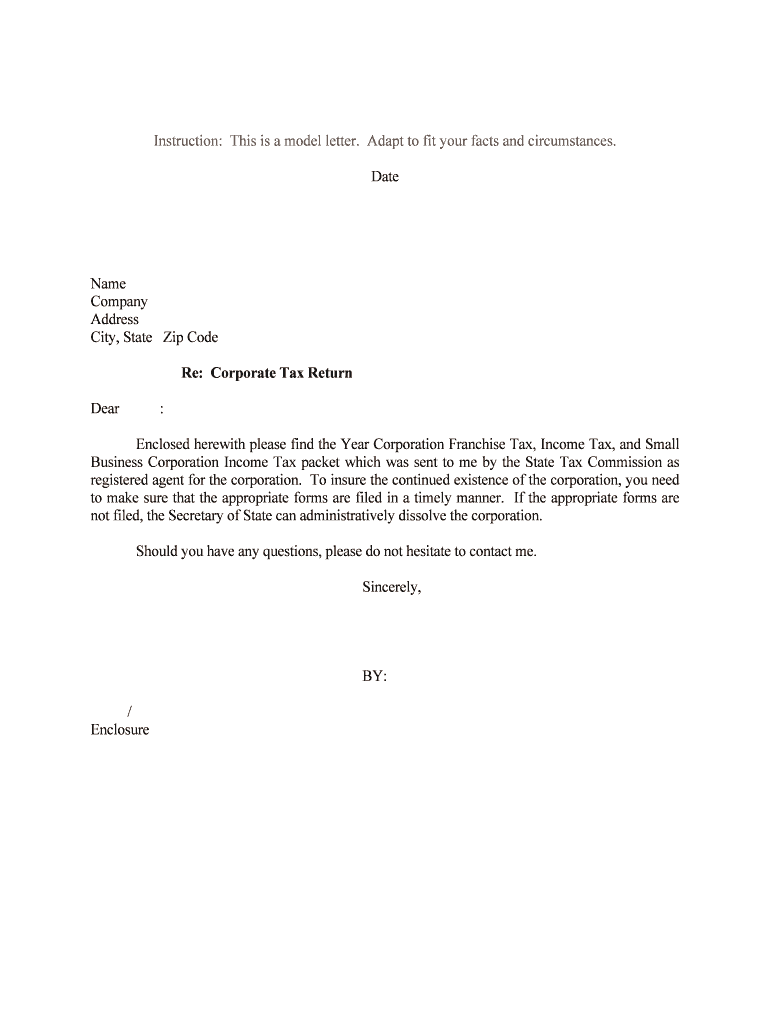

The Re Corporate Tax Return is a specific form used by corporations in the United States to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and provides a comprehensive overview of a corporation's financial activities over the tax year. It is crucial for corporations to accurately complete this form to avoid penalties and ensure proper tax obligations are met.

Steps to complete the Re Corporate Tax Return

Completing the Re Corporate Tax Return involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and receipts for deductions.

- Determine the appropriate tax year for which the return is being filed.

- Fill out the form accurately, ensuring all income and expenses are reported correctly.

- Review the completed form for any errors or omissions.

- Sign and date the form, ensuring it is submitted by the deadline.

Each step is vital to ensure the return is accurate and compliant with IRS regulations.

Legal use of the Re Corporate Tax Return

The Re Corporate Tax Return must be completed in accordance with IRS regulations to be considered legally valid. This includes using the correct form for the specific tax year and ensuring all information is truthful and complete. Any discrepancies or false information can lead to severe penalties, including fines or legal action. Corporations should also retain copies of their submitted returns and supporting documentation for at least three years in case of an audit.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Re Corporate Tax Return. Generally, the deadline for filing is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this date is April fifteenth. If the deadline falls on a weekend or holiday, it is typically extended to the next business day. Additionally, corporations may apply for an extension, allowing an additional six months to file, but any taxes owed must still be paid by the original deadline.

Required Documents

To accurately complete the Re Corporate Tax Return, several documents are necessary:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Receipts and documentation for deductions claimed.

- Previous year’s tax return for reference.

- Any additional schedules or forms required by the IRS.

Having these documents organized and readily available can streamline the preparation process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The Re Corporate Tax Return can be submitted in several ways, allowing corporations to choose the method that best suits their needs. Options include:

- Online submission through the IRS e-file system, which is often the fastest and most efficient method.

- Mailing a paper copy of the completed form to the appropriate IRS address, which varies based on the corporation's location.

- In-person submission at designated IRS offices, although this method may require an appointment.

Each submission method has its own advantages, and corporations should consider factors such as speed, convenience, and record-keeping when choosing how to file.

Quick guide on how to complete re corporate tax return

Complete Re Corporate Tax Return effortlessly on any device

Web-based document administration has become increasingly popular with companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Re Corporate Tax Return on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to edit and eSign Re Corporate Tax Return seamlessly

- Find Re Corporate Tax Return and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Re Corporate Tax Return and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the significance of Re Corporate Tax Return?

The Re Corporate Tax Return is crucial for businesses as it ensures compliance with tax regulations. Filing accurately can help avoid penalties and enhance the overall financial health of your company. Using airSlate SignNow, you can streamline the document-signing process related to your Re Corporate Tax Return, ensuring a swift and hassle-free experience.

-

How does airSlate SignNow simplify the Re Corporate Tax Return process?

airSlate SignNow simplifies the Re Corporate Tax Return process by allowing you to send documents securely for eSignature. You can track the status of your documents in real-time, minimizing delays. This efficiency leads to quicker submission of your Re Corporate Tax Return, giving you peace of mind.

-

What are the costs associated with using airSlate SignNow for Re Corporate Tax Return?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. You can choose a plan that fits your needs, ensuring cost-effectiveness while managing your Re Corporate Tax Return. Investing in our solution can ultimately save you time and money in the long run.

-

Are there specific features in airSlate SignNow that assist with Re Corporate Tax Return?

Yes, airSlate SignNow includes features like custom workflows and template management, specifically designed to assist with your Re Corporate Tax Return. These features allow you to create, send, and manage necessary documents seamlessly and securely. This enhances the overall experience of handling corporate tax documentation.

-

Can I integrate airSlate SignNow with other accounting software for Re Corporate Tax Return?

Absolutely! airSlate SignNow integrates effortlessly with various accounting and tax software, which is beneficial for managing your Re Corporate Tax Return. This integration allows for smooth data transfer and document management, streamlining your workflow and reducing the chances of error.

-

Is airSlate SignNow secure for handling sensitive Re Corporate Tax Return documents?

Yes, airSlate SignNow employs advanced security measures to ensure that your Re Corporate Tax Return documents are protected. With features like encryption and secure storage, you can trust that your sensitive information remains confidential and secure. This allows you to focus on your business while we handle your document security.

-

What benefits can I expect when using airSlate SignNow for my Re Corporate Tax Return?

Using airSlate SignNow for your Re Corporate Tax Return offers multiple benefits, including enhanced efficiency, reduced processing times, and simplified workflows. Additionally, our user-friendly interface makes it easy to navigate and manage all your tax documents. You can focus on your business while we take care of the paperwork.

Get more for Re Corporate Tax Return

Find out other Re Corporate Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors