Trust Agreement Form

What is the Trust Agreement Form

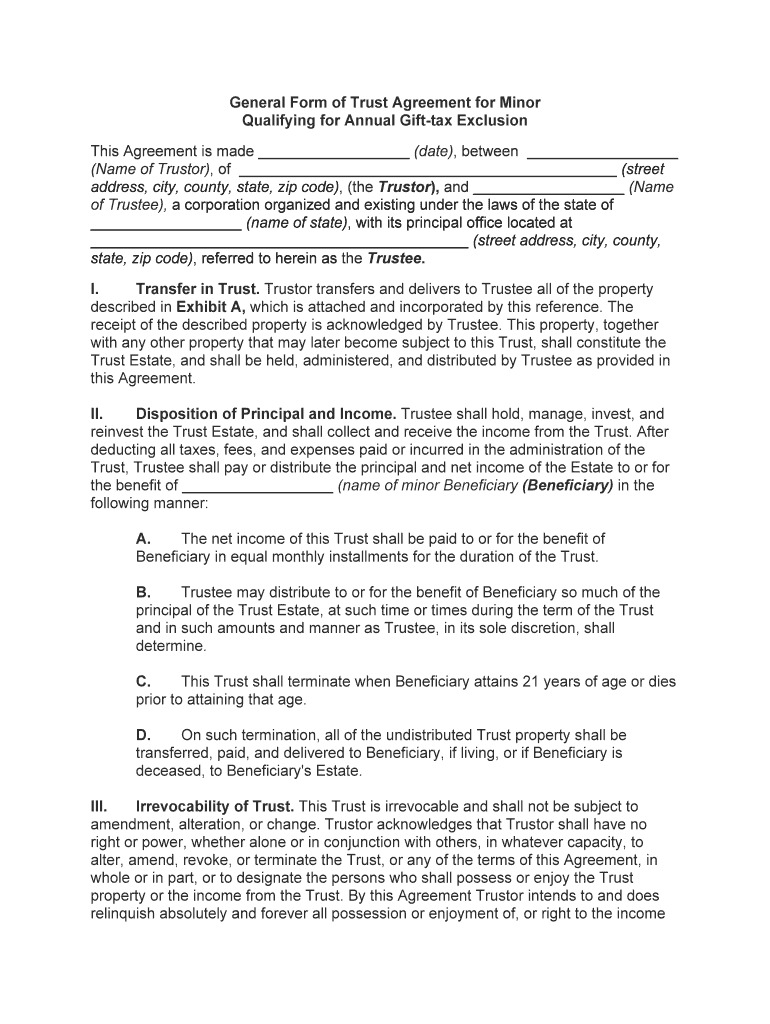

The Trust Agreement Form is a legal document that outlines the terms and conditions under which a trust is created and managed. This form specifies the roles of the trustee and beneficiaries, detailing how assets will be managed and distributed. Trusts can be utilized for various purposes, including estate planning, asset protection, and tax management. Understanding the specific provisions within this form is crucial for ensuring compliance with legal standards and for achieving the intended financial outcomes.

How to Use the Trust Agreement Form

Using the Trust Agreement Form involves several key steps. First, identify the type of trust you wish to establish, such as a revocable or irrevocable trust. Next, gather all necessary information, including the names and addresses of the trustee and beneficiaries, as well as a detailed description of the trust assets. Once the form is filled out, it should be reviewed for accuracy and completeness. Finally, the form must be signed by the trustee and, in some cases, notarized to ensure its legal validity.

Steps to Complete the Trust Agreement Form

Completing the Trust Agreement Form requires careful attention to detail. Begin by entering the trust name and the date of creation. Follow this by providing the trustee's information, including their legal name and contact details. Next, outline the beneficiaries, specifying their share of the trust assets. Include any specific instructions regarding asset management and distribution. After filling in all required sections, review the document for any errors before signing. It is advisable to consult with a legal professional to ensure all provisions meet state laws.

Legal Use of the Trust Agreement Form

The legal use of the Trust Agreement Form is governed by state laws, which dictate how trusts must be established and managed. To ensure compliance, it is important to understand the specific legal requirements in your state, including any necessary witnessing or notarization. The form must be executed properly to be enforceable in court. Additionally, adhering to the guidelines set forth by the IRS regarding tax implications of trusts is essential for maintaining the legal integrity of the trust.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for the taxation of trusts. Trusts may be subject to different tax rates depending on their classification as grantor or non-grantor trusts. It is important to understand how income generated by the trust will be taxed and whether any tax returns need to be filed on behalf of the trust. Consulting IRS publications related to trusts can provide clarity on tax obligations and help ensure compliance with federal tax laws.

Required Documents

When preparing to complete the Trust Agreement Form, several documents may be required. These can include identification for the trustee and beneficiaries, a list of trust assets, and any existing estate planning documents. Additionally, if the trust involves real estate, property deeds may need to be included. Having all necessary documentation ready will facilitate a smoother process in creating the trust and ensure that all legal requirements are met.

Form Submission Methods

The Trust Agreement Form can typically be submitted through various methods, including online, by mail, or in person. If submitting online, ensure that you are using a secure and compliant platform. For mail submissions, it is advisable to send the form via certified mail to confirm receipt. In-person submissions may be required in certain jurisdictions, especially if notarization is necessary. Always check with local authorities for specific submission guidelines to ensure compliance.

Quick guide on how to complete trust agreement form

Effortlessly Prepare Trust Agreement Form on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and eSign your documents without unnecessary holdups. Manage Trust Agreement Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Method to Modify and eSign Trust Agreement Form Effortlessly

- Find Trust Agreement Form and click on Get Form to initiate the process.

- Utilize the tools available to fill out your document.

- Emphasize key sections of the documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Alter and eSign Trust Agreement Form to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a general tax trial and how does it relate to airSlate SignNow?

A general tax trial is a legal procedure that may involve disputes over tax obligations. Utilizing airSlate SignNow in your general tax trial can streamline the process by allowing you to send and eSign essential documents quickly, ensuring that you maintain compliance and save time.

-

How does airSlate SignNow help with document management during a general tax trial?

airSlate SignNow offers robust document management features that are key for general tax trials. You can efficiently organize, track, and manage all documentation, making it easier to handle signNow volumes of tax-related paperwork and ensuring that everything is compliant and accessible.

-

What are the pricing options for airSlate SignNow when preparing for a general tax trial?

airSlate SignNow provides flexible pricing plans tailored for businesses of all sizes, making it an affordable choice for those preparing for a general tax trial. Depending on your needs, you can choose from monthly or annual subscription models, which include various features designed to support document signing and management.

-

What features does airSlate SignNow offer that benefit general tax trial processes?

Key features of airSlate SignNow that benefit general tax trial processes include secure eSigning, document templates, and in-app document sharing. These features enhance efficiency and ensure that you have everything you need for a smooth workflow during your tax-related legal proceedings.

-

Can I integrate airSlate SignNow with other tools I use during a general tax trial?

Yes, airSlate SignNow offers seamless integration with various applications, making it simple to connect your existing tools. Whether you use project management software, CRMs, or cloud storage services, these integrations can help streamline the management of documents related to your general tax trial.

-

Is airSlate SignNow secure for sensitive documents involved in a general tax trial?

Absolutely! airSlate SignNow prioritizes document security, implementing advanced encryption and other security measures to protect sensitive information. When handling documents for a general tax trial, you can trust that your data is kept safe and confidential.

-

How can airSlate SignNow improve collaboration during a general tax trial?

With airSlate SignNow, collaboration during a general tax trial is enhanced through the ability to share documents and get real-time feedback from involved parties. This eliminates delays and helps ensure that everyone is on the same page, crucial for the success of your trial.

Get more for Trust Agreement Form

- Mississippi workerscompensation commission mwcc no form

- Workers compensation worksheet form

- The enterprise tocsin from indianola mississippi on form

- Medical records affidavit in wc case form

- Doctors affidavit of med records form

- Rule 31 filing and service of briefs miss r app p 31 form

- Mississippi workers compensation claim clm wiki form

- Know all men by these presents that i for and in consideration form

Find out other Trust Agreement Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors