Gift Deed Form

What is the Gift Deed

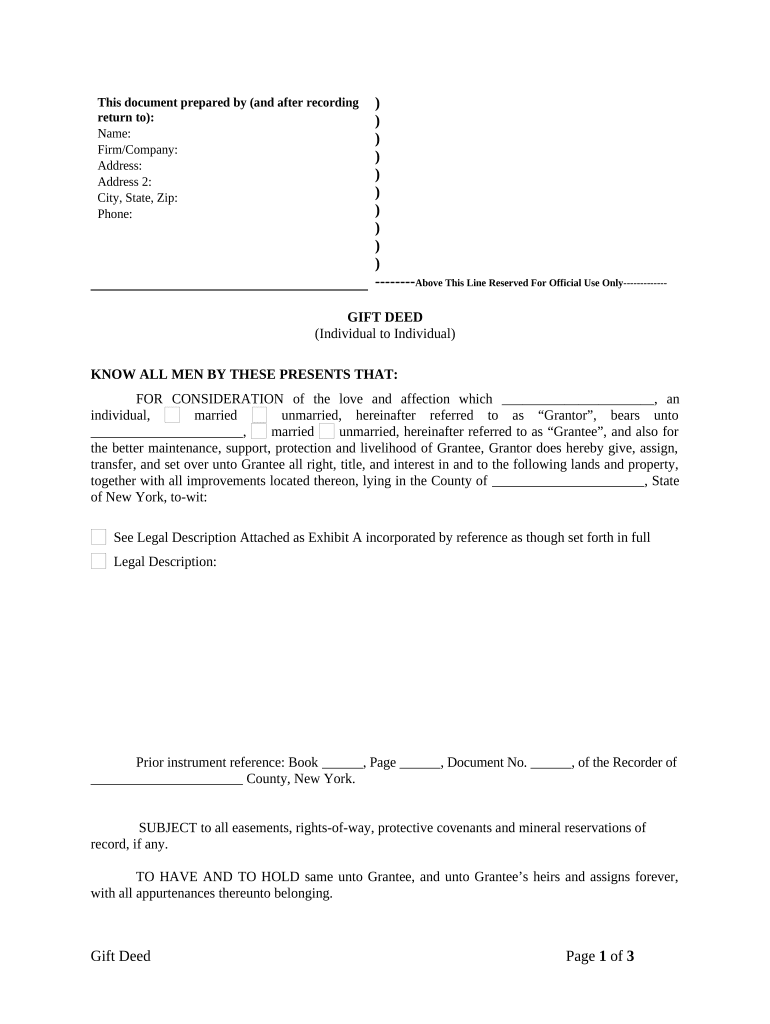

A gift deed is a legal document that facilitates the transfer of ownership of property or assets from one individual to another without any exchange of money. This document serves as a formal record of the intent to make a gift, ensuring that both the giver and receiver understand the terms of the transfer. In the United States, a gift deed must comply with specific state laws to be considered valid. It typically includes details such as the names of the parties involved, a description of the property being gifted, and any conditions attached to the gift.

Key Elements of the Gift Deed

To ensure that a gift deed is legally binding, it must contain several key elements:

- Parties Involved: Clearly identify the donor (giver) and the donee (receiver).

- Description of the Gift: Provide a detailed description of the property or assets being transferred.

- Intent to Gift: Include a statement expressing the donor's intention to make a gift.

- Acceptance of the Gift: The donee must accept the gift, which can be stated explicitly in the deed.

- Signatures: Both parties should sign the document, and it may need to be notarized depending on state requirements.

Steps to Complete the Gift Deed

Completing a gift deed involves several important steps:

- Gather Information: Collect all necessary details about the property and the parties involved.

- Draft the Document: Use a gift deed template to create the document, ensuring all key elements are included.

- Review and Revise: Both parties should review the draft for accuracy and clarity.

- Sign the Document: Have both parties sign the gift deed, and consider having it notarized for added legal protection.

- File the Deed: Depending on state laws, you may need to file the gift deed with the appropriate local government office.

Legal Use of the Gift Deed

The legal use of a gift deed is crucial for ensuring that the transfer of property is recognized by law. In the United States, the gift deed must comply with state-specific regulations, which may dictate how the deed is executed and filed. It is important to understand that a gift deed is irrevocable; once the property is transferred, the donor cannot reclaim it. Additionally, certain tax implications may arise from gifting property, so consulting with a legal professional is advisable to navigate these complexities.

How to Obtain the Gift Deed

Obtaining a gift deed can be done through various means:

- Online Templates: Many legal websites offer downloadable gift deed templates that can be customized.

- Legal Professionals: Consulting with an attorney can ensure that the deed complies with all legal requirements.

- Local Government Offices: Some jurisdictions provide forms and guidance for creating a gift deed.

IRS Guidelines

The Internal Revenue Service (IRS) has specific guidelines regarding gift taxes that may apply when transferring property. Gifts above a certain value may be subject to taxation, and it is essential to be aware of the annual exclusion limit. For 2023, the annual exclusion is set at a specific amount, which can change yearly. Donors should keep accurate records of the gift deed and any relevant transactions to ensure compliance with IRS regulations.

Quick guide on how to complete gift deed 497321174

Finish Gift Deed effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Gift Deed on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Gift Deed effortlessly

- Find Gift Deed and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark relevant parts of your documents or obscure sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Gift Deed and ensure excellent communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a gift deed PDF and why do I need one?

A gift deed PDF is a legal document used to transfer ownership of property or assets from one person to another as a gift. It's essential to have a properly executed gift deed to ensure that the transfer is recognized under law. Using airSlate SignNow, you can easily create, customize, and eSign your gift deed PDF securely and efficiently.

-

How do I create a gift deed PDF using airSlate SignNow?

Creating a gift deed PDF with airSlate SignNow is straightforward. Simply choose a template, fill in the required information, and customize it to suit your needs. Once you're ready, you can eSign the document and share it directly with other parties, making the process seamless and quick.

-

Is there a cost associated with generating a gift deed PDF?

Yes, there is a cost associated with using airSlate SignNow for creating a gift deed PDF. The pricing plans are competitive and designed to provide value for businesses of all sizes. Depending on the features you need, there are flexible subscription options to choose from that can help save on costs while accessing premium services.

-

What features does airSlate SignNow offer for gift deed PDFs?

airSlate SignNow provides several features specifically for managing gift deed PDFs, including customizable templates, electronic signature capabilities, and secure document storage. You can also track document status and send reminders to ensure timely signing. These features simplify the process and enhance collaboration.

-

Can I integrate airSlate SignNow with other applications for gift deed PDFs?

Yes, airSlate SignNow offers integration capabilities with various applications such as CRM systems, cloud storage services, and project management tools. This allows you to streamline your workflow even further when creating and managing gift deed PDFs, making it easier to incorporate this essential document into your existing business processes.

-

What are the benefits of using airSlate SignNow for my gift deed PDF?

Using airSlate SignNow for your gift deed PDF offers numerous benefits, including time savings, enhanced security, and convenience. The platform allows for quick and easy creation and signing of documents, reducing the need for physical paperwork. Additionally, electronic signatures are legally binding and increase the efficiency of the entire process.

-

Is my information secure when using airSlate SignNow to create gift deed PDFs?

Absolutely. airSlate SignNow prioritizes the security of your information while creating gift deed PDFs. All documents are encrypted and stored securely, ensuring that your sensitive data remains confidential and protected from unauthorized access throughout the signing and storage process.

Get more for Gift Deed

- Repayments where to send claim forms gov uk

- Ohio tax forms

- Employers annual reconciliation of income tax withheld form

- 5199 financially distressed cities villages and townships fdcvt reimbursement request form

- City of lapeer l 1120 438987551 form

- Claim for refund due a deceased taxpayer mi 1310 claim for refund due a deceased taxpayer mi 1310 form

- Mvr4 online rev 0518north carolina division of form

- Sales and use tax construction contract exemption certificate form

Find out other Gift Deed

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors