Renunciation and Disclaimer of Property Received by Intestate Succession Rhode Island Form

What is the Renunciation and Disclaimer of Property Received by Intestate Succession in Rhode Island

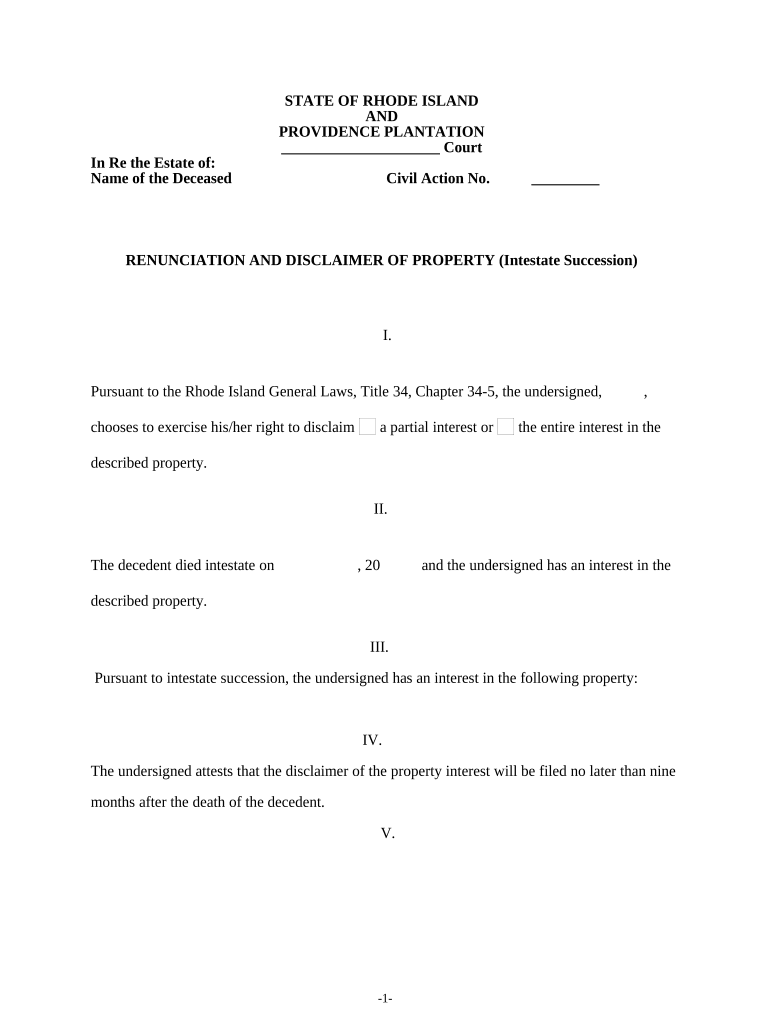

The Renunciation and Disclaimer of Property Received by Intestate Succession in Rhode Island is a legal document that allows an individual to formally refuse any property or assets they may inherit when someone dies without a will. This process is significant as it enables heirs to decline their inheritance, which can have implications for tax liabilities or personal circumstances. By executing this document, individuals can ensure that the property is redistributed according to state laws, potentially benefiting other heirs or beneficiaries.

How to Use the Renunciation and Disclaimer of Property Received by Intestate Succession in Rhode Island

This form is utilized when an heir decides to renounce their right to inherit property. To use the form effectively, the individual must complete it accurately, ensuring that all required information is provided. Once filled out, the document should be signed and dated. It is essential to file the renunciation with the appropriate probate court to make it legally binding. This process helps clarify the heir's intentions and prevents any future disputes regarding the inheritance.

Steps to Complete the Renunciation and Disclaimer of Property Received by Intestate Succession in Rhode Island

Completing the Renunciation and Disclaimer of Property involves several key steps:

- Obtain the official form from the probate court or a legal resource.

- Fill in your personal information, including your name and relationship to the deceased.

- Clearly state your intention to renounce the inheritance.

- Sign and date the document in the presence of a notary public, if required.

- Submit the completed form to the probate court where the estate is being administered.

Legal Use of the Renunciation and Disclaimer of Property Received by Intestate Succession in Rhode Island

The legal use of this form is crucial for ensuring that the renunciation is recognized by the courts. It must comply with Rhode Island laws governing intestate succession and disclaimers. The document should be executed within a specific time frame following the decedent's death, typically within nine months. Adhering to these legal requirements helps protect the rights of the renouncing heir and ensures that the property is handled according to state laws.

State-Specific Rules for the Renunciation and Disclaimer of Property Received by Intestate Succession in Rhode Island

Rhode Island has specific regulations governing the renunciation and disclaimer process. The form must be filed in the probate court that oversees the estate of the deceased. Additionally, the renouncing party cannot have accepted any benefits from the property being disclaimed. Understanding these state-specific rules is vital for ensuring that the renunciation is valid and enforceable.

Required Documents for the Renunciation and Disclaimer of Property Received by Intestate Succession in Rhode Island

To complete the Renunciation and Disclaimer of Property, certain documents may be required, including:

- A copy of the death certificate of the deceased.

- The original will, if available, or proof of intestacy.

- Identification for the renouncing heir, such as a driver's license or state ID.

Having these documents ready can facilitate a smoother process when filing the renunciation with the probate court.

Quick guide on how to complete renunciation and disclaimer of property received by intestate succession rhode island

Effortlessly Prepare Renunciation And Disclaimer Of Property Received By Intestate Succession Rhode Island on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Renunciation And Disclaimer Of Property Received By Intestate Succession Rhode Island on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Renunciation And Disclaimer Of Property Received By Intestate Succession Rhode Island with Ease

- Locate Renunciation And Disclaimer Of Property Received By Intestate Succession Rhode Island and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new copies of documents. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign Renunciation And Disclaimer Of Property Received By Intestate Succession Rhode Island to ensure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for submitting a Renunciation And Disclaimer Of Property Received By Intestate Succession in Rhode Island?

To submit a Renunciation And Disclaimer Of Property Received By Intestate Succession in Rhode Island, you must complete a formal document outlining your decision to decline the inheritance. This document needs to be filed with the probate court handling the estate. airSlate SignNow offers an efficient platform to create and eSign these documents, making the process straightforward.

-

What are the benefits of using airSlate SignNow for my Renunciation And Disclaimer Of Property Received By Intestate Succession in Rhode Island?

Using airSlate SignNow simplifies the execution of a Renunciation And Disclaimer Of Property Received By Intestate Succession in Rhode Island. Our platform allows for easy document creation, collaboration with legal advisors, and secure electronic signatures, ensuring your documents are processed swiftly and efficiently.

-

How much does it cost to use airSlate SignNow for filing my Renunciation And Disclaimer Of Property Received By Intestate Succession in Rhode Island?

AirSlate SignNow offers a variety of pricing plans that cater to different needs and budgets. You can select a plan based on your specific requirements while utilizing our features for processing your Renunciation And Disclaimer Of Property Received By Intestate Succession in Rhode Island. Most plans are cost-effective and provide great value for document management.

-

Can airSlate SignNow assist with other estate planning documents beyond the Renunciation And Disclaimer Of Property Received By Intestate Succession in Rhode Island?

Absolutely! airSlate SignNow can assist with a variety of estate planning documents, in addition to the Renunciation And Disclaimer Of Property Received By Intestate Succession in Rhode Island. Our platform supports creating, managing, and signing wills, power of attorney forms, and more, all in a user-friendly environment.

-

Is it secure to use airSlate SignNow for my legal documents related to Renunciation And Disclaimer Of Property Received By Intestate Succession in Rhode Island?

Yes, airSlate SignNow prioritizes security for all users. We implement strong encryption and comply with legal standards to protect sensitive information related to your Renunciation And Disclaimer Of Property Received By Intestate Succession in Rhode Island. Your data is safe with us as you manage your documents online.

-

How can I integrate airSlate SignNow with my existing systems for managing Renunciation And Disclaimer Of Property Received By Intestate Succession in Rhode Island?

airSlate SignNow provides seamless integration options with various CRM and document management systems. This allows you to incorporate our platform into your existing workflows for managing Renunciation And Disclaimer Of Property Received By Intestate Succession in Rhode Island efficiently, enhancing productivity and organization.

-

What features can I expect when using airSlate SignNow for Renunciation And Disclaimer Of Property Received By Intestate Succession in Rhode Island?

When using airSlate SignNow for your Renunciation And Disclaimer Of Property Received By Intestate Succession in Rhode Island, you can expect features such as electronic signatures, document templates, real-time collaboration, and secure cloud storage. These features will streamline your document management process and ensure compliance with legal requirements.

Get more for Renunciation And Disclaimer Of Property Received By Intestate Succession Rhode Island

- Caps form

- Printable cms 500 medicare form

- Testing and maintenance report town of cary townofcary form

- Fdw002 safety agreement form

- Volleyball line up sheet form

- Notice of intent to operate ottawa county michigan miottawa form

- Electrical load calculation worksheet form

- Ddm service agreement elap services form

Find out other Renunciation And Disclaimer Of Property Received By Intestate Succession Rhode Island

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online