Schedule D Form 1041 Capital Gains and Losses 2020

What is the Schedule D Form 1041 Capital Gains And Losses

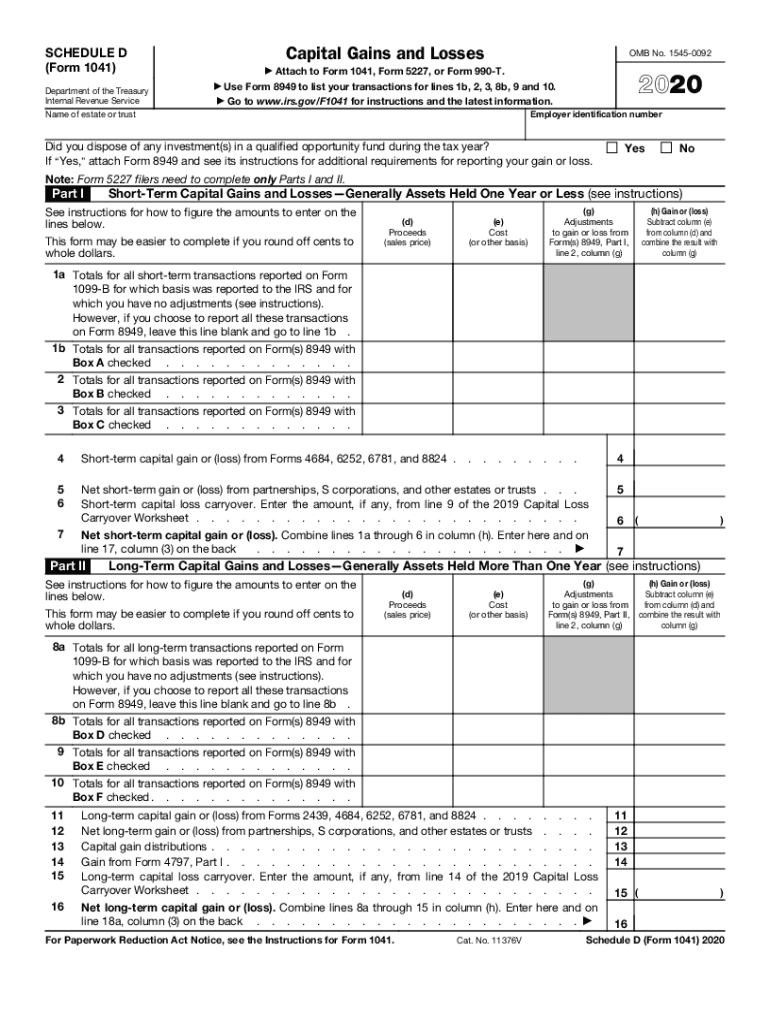

The Schedule D Form 1041 is a tax form used by estates and trusts to report capital gains and losses. It is an essential part of the income tax return for estates and trusts, allowing them to detail the sale of capital assets, such as stocks, bonds, and real estate. This form helps to determine the net capital gain or loss that will be taxed. Understanding the distinctions between short-term and long-term capital gains is crucial, as they are taxed at different rates. Short-term gains arise from assets held for one year or less, while long-term gains come from assets held for more than one year.

How to use the Schedule D Form 1041 Capital Gains And Losses

Using the Schedule D Form 1041 involves several steps. First, gather all relevant financial documents that detail the sales of capital assets throughout the tax year. Next, complete the form by listing each transaction, including the date of acquisition, date of sale, sale price, and purchase price. The form will guide you through calculating total gains and losses, which will then be transferred to the main Form 1041. It is important to ensure accuracy in reporting to avoid potential issues with the IRS.

Steps to complete the Schedule D Form 1041 Capital Gains And Losses

Completing the Schedule D Form 1041 requires careful attention to detail. Follow these steps:

- Gather all necessary documentation related to capital asset transactions.

- Fill out Part I for short-term capital gains and losses, listing each transaction.

- Complete Part II for long-term capital gains and losses, following the same process.

- Calculate the totals for both short-term and long-term sections.

- Transfer the net gain or loss to Form 1041.

Ensure that all calculations are accurate and that you have included all required information to facilitate a smooth filing process.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule D Form 1041. It is essential to refer to the latest IRS instructions for the form, as they outline the requirements for reporting capital gains and losses. These guidelines include how to treat various types of income, the importance of accurate record-keeping, and the implications of different holding periods for assets. Familiarizing yourself with these guidelines can help ensure compliance and reduce the risk of errors in your tax filing.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Form 1041 align with the due date for the Form 1041 itself. Typically, the deadline falls on the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the due date is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is crucial to be aware of these dates to avoid penalties and ensure timely submission.

Penalties for Non-Compliance

Failure to file the Schedule D Form 1041 accurately and on time can result in significant penalties. The IRS may impose fines for late filing, which can accumulate over time. Additionally, inaccuracies in reporting capital gains and losses can lead to further scrutiny and potential audits. It is important to ensure that all information is correct and submitted by the deadline to avoid these consequences.

Quick guide on how to complete 2020 schedule d form 1041 capital gains and losses

Complete Schedule D Form 1041 Capital Gains And Losses effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a superb environmentally friendly substitute for conventional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Schedule D Form 1041 Capital Gains And Losses across any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign Schedule D Form 1041 Capital Gains And Losses seamlessly

- Obtain Schedule D Form 1041 Capital Gains And Losses and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Select important sections of your documents or redact sensitive information with the tools specifically developed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to secure your modifications.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Alter and eSign Schedule D Form 1041 Capital Gains And Losses while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule d form 1041 capital gains and losses

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule d form 1041 capital gains and losses

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is the 2020 Schedule D and why is it important for eSigning?

The 2020 Schedule D is a tax form used by individuals to report capital gains and losses. For businesses using airSlate SignNow, efficiently eSigning this document can enhance compliance and streamline the filing process. Integrating eSignature solutions can simplify the submission of your 2020 Schedule D, ensuring timely and accurate reporting.

-

How can airSlate SignNow help with my 2020 Schedule D filing?

airSlate SignNow offers a straightforward platform for eSigning and sending important documents like the 2020 Schedule D. Our intuitive interface allows users to easily upload, eSign, and send their forms securely, reducing the hassle of manual processes. This efficiency can lead to quicker processing and compliance with tax obligations.

-

What are the pricing options for using airSlate SignNow for my 2020 Schedule D?

airSlate SignNow provides flexible pricing plans to meet various business needs, making it cost-effective for anyone needing to eSign their 2020 Schedule D. Monthly and annual subscription options are available, allowing you to choose a plan that fits your budget while ensuring you can manage your important documents seamlessly.

-

Can I integrate airSlate SignNow with my existing accounting software for handling the 2020 Schedule D?

Yes, airSlate SignNow supports integrations with various accounting software to help manage your 2020 Schedule D efficiently. Integrating eSignature capabilities directly into your existing workflow can save time and reduce errors. This ensures that your tax reporting is smooth and compliant with regulations.

-

Is it secure to eSign my 2020 Schedule D with airSlate SignNow?

Absolutely! airSlate SignNow employs robust security measures to protect your sensitive documents, including the 2020 Schedule D. We use encryption technology and comply with industry standards to ensure that your eSigned documents are safe from unauthorized access or tampering, giving you peace of mind.

-

Can multiple users collaborate on the 2020 Schedule D using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate seamlessly on documents like the 2020 Schedule D. You can invite team members to review and eSign, ensuring that all necessary stakeholders have input and approval. This collaborative feature simplifies the workflow and enhances productivity.

-

How long does it take to eSign a 2020 Schedule D with airSlate SignNow?

eSigning your 2020 Schedule D with airSlate SignNow is quick and straightforward. Typically, the process can be completed in just a few minutes, allowing you to promptly submit your documents. This efficiency helps you stay on schedule with tax deadlines and reduces the stress associated with last-minute filings.

Get more for Schedule D Form 1041 Capital Gains And Losses

- Wfp written test sample pdf form

- Fake templates and documents fake templates and documents form

- Fake blood test results fake blood test results form

- How to make fake cancer report khrw3 how to make fake cancer report khrw3 form

- Api textbook of medicine 12th edition pdf form

- Nmcn jobs form

- Caiib information technology pdf

- School medication taken during hours form

Find out other Schedule D Form 1041 Capital Gains And Losses

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application