Form 8938 Statement of Specified Foreign Financial Assets 2020

What is the Form 8938 Statement Of Specified Foreign Financial Assets

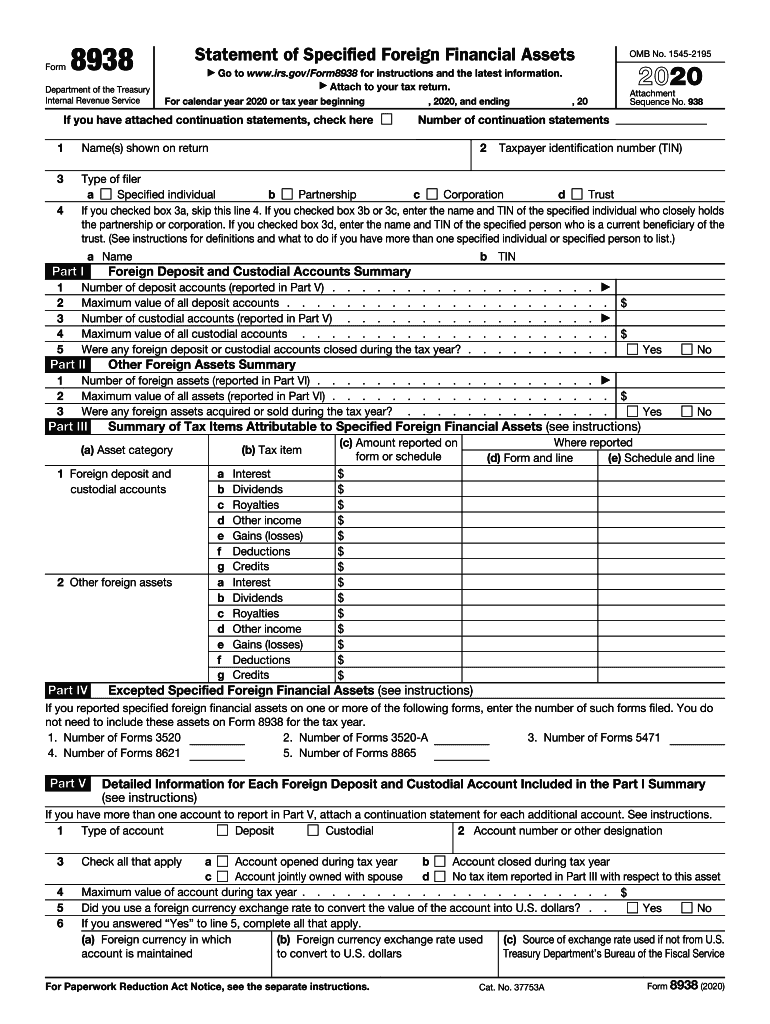

The Form 8938, officially known as the Statement of Specified Foreign Financial Assets, is a tax form required by the Internal Revenue Service (IRS) for certain U.S. taxpayers. This form is designed to report specified foreign financial assets, which may include foreign bank accounts, stocks, and other financial instruments. Taxpayers must file this form if their total value of specified foreign financial assets exceeds certain thresholds, which vary based on filing status and residency.

How to use the Form 8938 Statement Of Specified Foreign Financial Assets

Using Form 8938 involves accurately reporting your specified foreign financial assets to the IRS. Begin by gathering information about your foreign financial accounts and assets. You will need to provide details such as account numbers, the maximum value of each asset during the year, and the name and address of the financial institution. Ensure that you meet the reporting thresholds before filing. The form can be filed electronically if you are e-filing your tax return, or it can be submitted as a paper form along with your annual tax return.

Steps to complete the Form 8938 Statement Of Specified Foreign Financial Assets

Completing Form 8938 involves several steps:

- Determine if you are required to file based on your asset thresholds.

- Gather necessary information about your foreign financial assets, including account details and maximum values.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

- File the form electronically or by mail as part of your tax return.

Filing Deadlines / Important Dates

Form 8938 must be filed along with your annual tax return. The typical deadline for individual tax returns is April 15, with extensions available until October 15. If you are required to file Form 8938, it is essential to adhere to these deadlines to avoid penalties. Keep in mind that if you are living abroad, different deadlines may apply, so it is important to check the IRS guidelines for your specific situation.

Penalties for Non-Compliance

Failing to file Form 8938 when required can result in significant penalties. The IRS imposes a penalty of $10,000 for failure to file, and additional penalties may apply for continued non-compliance after receiving a notice from the IRS. In some cases, taxpayers may also face criminal charges for willful failure to report foreign financial assets. Therefore, it is crucial to ensure compliance with all reporting requirements to avoid these consequences.

Eligibility Criteria

To determine your eligibility for filing Form 8938, consider the following criteria:

- You must be a specified individual, which includes U.S. citizens, resident aliens, and certain non-resident aliens.

- Your total value of specified foreign financial assets must exceed the reporting thresholds set by the IRS.

- You must have an interest in specified foreign financial assets, which can include bank accounts, stocks, and other financial instruments.

Quick guide on how to complete 2020 form 8938 statement of specified foreign financial assets

Effortlessly prepare Form 8938 Statement Of Specified Foreign Financial Assets on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle Form 8938 Statement Of Specified Foreign Financial Assets on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Form 8938 Statement Of Specified Foreign Financial Assets effortlessly

- Locate Form 8938 Statement Of Specified Foreign Financial Assets and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8938 Statement Of Specified Foreign Financial Assets and maintain outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 8938 statement of specified foreign financial assets

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8938 statement of specified foreign financial assets

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

Can I efile Form 8938 using airSlate SignNow?

Yes, you can efile Form 8938 using airSlate SignNow. Our platform provides an easy and secure way to prepare, sign, and submit tax documents electronically. With our intuitive interface, you can quickly navigate through the efiling process while ensuring compliance with IRS requirements.

-

What features does airSlate SignNow offer for efiling documents?

airSlate SignNow offers features such as cloud storage, document templates, and advanced eSignature capabilities. When asking, 'Can I efile Form 8938?' keep in mind that our solution streamlines the entire process from preparation to submission, making it accessible for users at all experience levels.

-

Is there a cost associated with efiling Form 8938 through airSlate SignNow?

While airSlate SignNow provides a cost-effective solution, the efiling of Form 8938 may incur additional fees depending on your specific needs. We offer several pricing plans tailored to different types of users, ensuring you get the best value while successfully efiling relevant tax documents.

-

Can I integrate airSlate SignNow with other accounting software for efiling?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software programs. This integration is particularly beneficial for users asking, 'Can I efile Form 8938?', as it helps streamline your workflow and enhances the efficiency of managing tax documents electronically.

-

How secure is the efiling process with airSlate SignNow?

The efiling process with airSlate SignNow is designed with security in mind. We use advanced encryption technologies to protect your sensitive information, providing peace of mind while you manage your tax documents, including when you're ready to efile Form 8938.

-

Can I track my efiled Form 8938 with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your efiled documents, including Form 8938. This tracking feature ensures you stay informed about the submission process, offering updates and notifications as your documents progress through the efiling system.

-

Does airSlate SignNow offer customer support for efiling questions?

Yes, airSlate SignNow provides robust customer support to assist you with any questions regarding efiling, including inquiries such as 'Can I efile Form 8938?'. Our dedicated support team is available to help you navigate the platform and ensure a smooth efiling experience.

Get more for Form 8938 Statement Of Specified Foreign Financial Assets

- Roblox robux generator no human verification form

- Airport jobs for form four leavers

- Rent report alberta works form

- Old permanent record form 137 editable

- Harvard resume template google docs form

- Vahana udambadi karar malayalam form

- Interventional radiology scheduling form renown health renown

- Fillable online 2 6 2 6 f ax fax email print pdffiller form

Find out other Form 8938 Statement Of Specified Foreign Financial Assets

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure