Schedule B Form 990, 990 EZ, or 990 PF Schedule of Contributors 2020

What is the Schedule B Form 990, 990 EZ, Or 990 PF Schedule Of Contributors

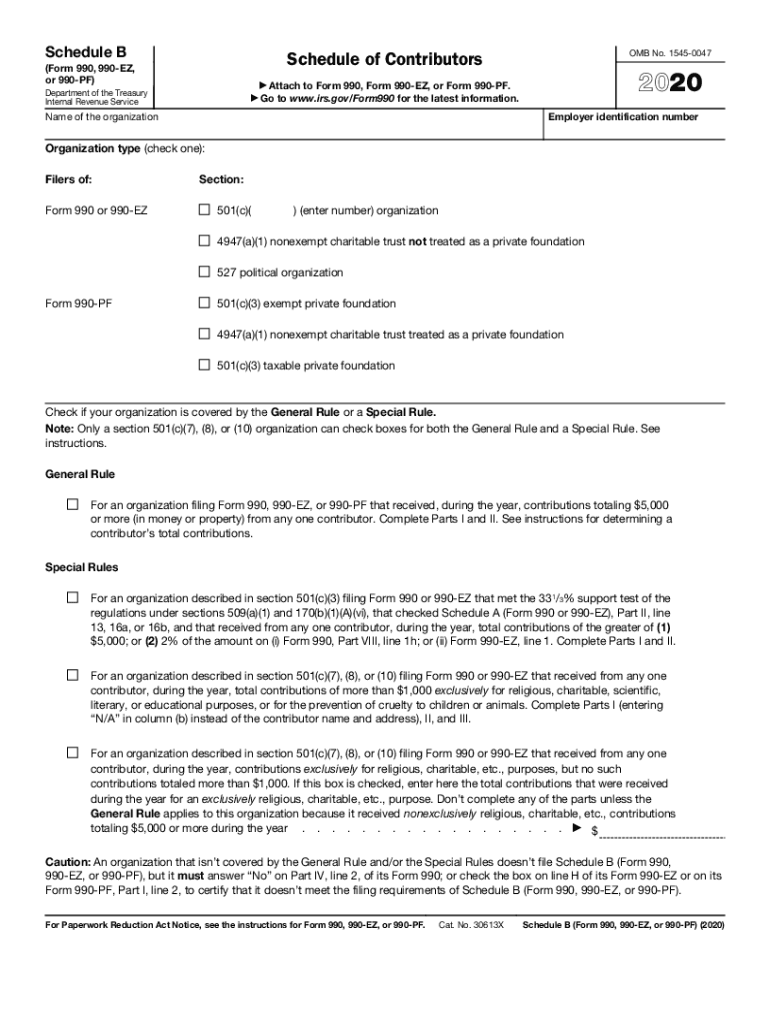

The Schedule B Form 990, 990 EZ, or 990 PF is an essential document required by the IRS for certain tax-exempt organizations. This form provides a detailed account of the contributors who have donated to the organization during the fiscal year. It is crucial for transparency and accountability, as it helps the IRS and the public understand the sources of funding for these organizations. The form includes information about the names, addresses, and amounts contributed by each donor, ensuring that organizations comply with federal regulations regarding charitable contributions.

How to use the Schedule B Form 990, 990 EZ, Or 990 PF Schedule Of Contributors

Using the Schedule B Form involves several steps to ensure accurate reporting of contributions. First, gather all necessary information about your organization’s contributors, including their names, addresses, and the amounts donated. Next, complete the form by entering this information in the designated sections. It is important to ensure that the data aligns with your organization’s financial records. After completing the form, review it for accuracy before submission. This form must be filed along with the main Form 990, 990 EZ, or 990 PF, depending on the organization’s size and type.

Steps to complete the Schedule B Form 990, 990 EZ, Or 990 PF Schedule Of Contributors

Completing the Schedule B Form requires a systematic approach. Follow these steps for a thorough completion:

- Collect all relevant donor information, including names, addresses, and contribution amounts.

- Access the Schedule B Form specific to your organization type (990, 990 EZ, or 990 PF).

- Fill in the required fields accurately, ensuring that all contributions are reported.

- Verify that the total contributions match your organization’s financial statements.

- Consult IRS guidelines for any specific reporting requirements related to your organization.

- Submit the completed form along with your main tax return.

Legal use of the Schedule B Form 990, 990 EZ, Or 990 PF Schedule Of Contributors

The legal use of the Schedule B Form is governed by IRS regulations, which mandate that tax-exempt organizations report their contributors to maintain transparency. This form serves as a legal document that can be audited by the IRS. Organizations must ensure that they are compliant with all reporting requirements to avoid penalties. Accurate completion and timely submission of the Schedule B Form not only fulfill legal obligations but also enhance public trust in the organization.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule B Form coincide with the deadlines for the main Form 990, 990 EZ, or 990 PF. Generally, these forms are due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. If your organization operates on a calendar year basis, the deadline would typically be May 15. It is advisable to file early to avoid any last-minute issues. Organizations can also apply for an extension if needed, but they must ensure that the Schedule B Form is included in the extension request.

Penalties for Non-Compliance

Failure to comply with the requirements for the Schedule B Form can result in significant penalties. The IRS may impose fines for late filings or inaccuracies in reporting. Organizations that neglect to file this form may face loss of tax-exempt status, which can have severe financial implications. It is crucial for organizations to understand these penalties and take proactive steps to ensure compliance, including regular audits of their financial records and contributor information.

Quick guide on how to complete 2020 schedule b form 990 990 ez or 990 pf schedule of contributors

Easily Prepare Schedule B Form 990, 990 EZ, Or 990 PF Schedule Of Contributors on Any Device

The management of documents online has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without interruptions. Manage Schedule B Form 990, 990 EZ, Or 990 PF Schedule Of Contributors from any device using the airSlate SignNow apps for Android or iOS, and simplify your document-related tasks today.

The Easiest Way to Modify and eSign Schedule B Form 990, 990 EZ, Or 990 PF Schedule Of Contributors Effortlessly

- Locate Schedule B Form 990, 990 EZ, Or 990 PF Schedule Of Contributors and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for that function.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to share your form: via email, SMS, invite link, or download it to your computer.

Eliminate worries about misplaced or lost files, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Schedule B Form 990, 990 EZ, Or 990 PF Schedule Of Contributors and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule b form 990 990 ez or 990 pf schedule of contributors

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule b form 990 990 ez or 990 pf schedule of contributors

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is the purpose of the IRS Form 990-PF?

The IRS Form 990-PF is filed by private foundations to provide information about their financial activities and grants. Conducting an IRS Form 990 PF search can help you understand the philanthropic activities and financial status of a specific foundation, which is crucial for various compliance and research purposes.

-

How can airSlate SignNow assist in completing IRS Form 990-PF?

airSlate SignNow offers an intuitive platform for creating, signing, and managing electronic documents, including IRS Form 990-PF. By utilizing eSignatures and document workflows, you can streamline the completion and submission process, ensuring compliance and accuracy in your filings.

-

Is there a cost associated with using airSlate SignNow for IRS Form 990-PF submissions?

Yes, airSlate SignNow provides various pricing plans to suit different business needs. With affordable, cost-effective options, you can select a plan that allows easy management of IRS Form 990-PF submissions without breaking the bank.

-

What features does airSlate SignNow include for managing IRS Form 990-PF?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and document tracking to facilitate IRS Form 990 PF searches and submissions. This user-friendly interface streamlines your workflow, helping you manage documentation efficiently.

-

Can I integrate other tools with airSlate SignNow for IRS Form 990-PF management?

Absolutely! airSlate SignNow offers integrations with various applications like CRMs and cloud storage services, enabling you to create a seamless workflow for managing IRS Form 990 PF searches. This flexibility ensures your existing tools can work harmoniously with our platform.

-

What are the benefits of using airSlate SignNow for IRS Form 990-PF documentation?

Using airSlate SignNow for IRS Form 990-PF documentation provides several benefits, including enhanced efficiency, reduced turnaround times, and improved data accuracy. Our solution allows you to focus on your foundation’s impact rather than the complexities of paperwork.

-

How secure is the information processed through airSlate SignNow?

Security is a top priority at airSlate SignNow. All documents processed, including those related to IRS Form 990-PF searches, are encrypted and stored securely, ensuring your sensitive information remains protected throughout the entire process.

Get more for Schedule B Form 990, 990 EZ, Or 990 PF Schedule Of Contributors

- Ie irish stock transfer form

- School meals projects scheme form

- Communityadobecomt5acrobat readerthe document you are trying to load requires adobe reader 8 form

- Georgia state board of cosmetology and barbers apprentice application form

- Michigan assigned claims application form

- This application may be used form

- Credentialing mn form

- Revenuedelawaregovbusiness tax formsbusiness tax forms 2021 2022 division of revenue delaware

Find out other Schedule B Form 990, 990 EZ, Or 990 PF Schedule Of Contributors

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form