Form 8863 Instructions Fill Out and Sign Printable PDF 2020

IRS Guidelines for Schedule EIC Form 2019

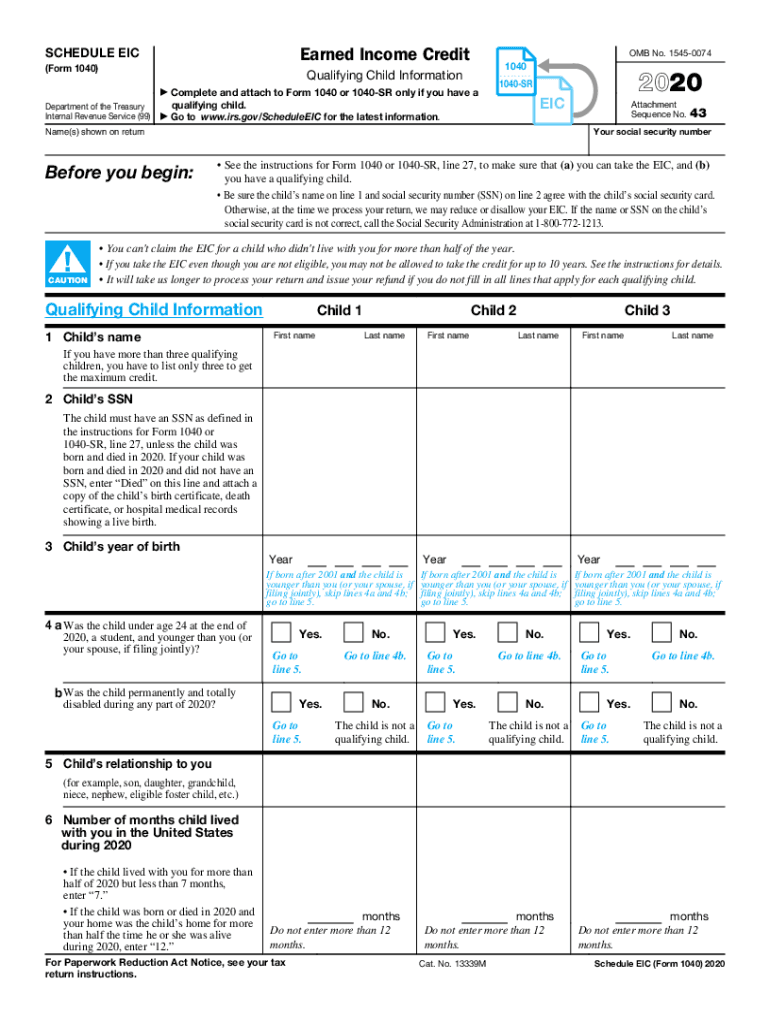

The Schedule EIC form 2019 is essential for taxpayers claiming the Earned Income Tax Credit (EITC). The IRS provides specific guidelines to ensure accurate completion and eligibility. The form must be filled out correctly to qualify for the credit, which can significantly reduce tax liability. Taxpayers should review the IRS guidelines, which detail eligibility criteria, income limits, and filing requirements. Understanding these guidelines is crucial for maximizing potential refunds and avoiding delays in processing.

Steps to Complete the Schedule EIC Form 2019

Completing the Schedule EIC form 2019 involves several key steps. First, gather all necessary documentation, including income statements and Social Security numbers for qualifying children. Next, fill out the form by providing personal information and calculating your earned income. Pay close attention to the eligibility criteria for the EITC, as this will determine the amount of credit you can claim. After completing the form, review it for accuracy before submitting it with your tax return.

Filing Deadlines for Schedule EIC Form 2019

Timely filing of the Schedule EIC form 2019 is crucial for taxpayers seeking the Earned Income Tax Credit. The standard deadline for filing federal tax returns is April 15, unless extended. If you are unable to file by this date, consider applying for an extension, which can provide additional time to complete your return. However, an extension does not extend the time to pay any taxes owed, so ensure you estimate and pay any due taxes by the original deadline to avoid penalties.

Eligibility Criteria for Schedule EIC Form 2019

To qualify for the Earned Income Tax Credit using the Schedule EIC form 2019, taxpayers must meet specific eligibility criteria. These include having earned income from employment or self-employment, meeting income limits based on filing status, and having a valid Social Security number. Additionally, qualifying children must meet age, relationship, and residency requirements. Understanding these criteria is vital for ensuring compliance and maximizing the potential credit.

Required Documents for Schedule EIC Form 2019

When completing the Schedule EIC form 2019, certain documents are essential for accurate filing. Taxpayers should have their W-2 forms, 1099 forms, and any other income statements readily available. Additionally, documentation proving the relationship and residency of qualifying children, such as birth certificates or school records, may be necessary. Having these documents organized will streamline the process and help ensure that all required information is provided.

Penalties for Non-Compliance with Schedule EIC Form 2019

Failure to comply with the requirements of the Schedule EIC form 2019 can result in penalties. If the IRS determines that a taxpayer has incorrectly claimed the EITC, they may be subject to repayment of the credit, along with interest and penalties. Additionally, repeated errors or fraudulent claims can lead to disqualification from claiming the EITC in future years. It is essential to ensure that all information provided is accurate and that eligibility criteria are met to avoid these consequences.

Quick guide on how to complete form 8863 instructions fill out and sign printable pdf

Effortlessly prepare Form 8863 Instructions Fill Out And Sign Printable PDF on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 8863 Instructions Fill Out And Sign Printable PDF on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Form 8863 Instructions Fill Out And Sign Printable PDF with ease

- Locate Form 8863 Instructions Fill Out And Sign Printable PDF and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to finalize your changes.

- Select your preferred method to share your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Modify and eSign Form 8863 Instructions Fill Out And Sign Printable PDF and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8863 instructions fill out and sign printable pdf

Create this form in 5 minutes!

How to create an eSignature for the form 8863 instructions fill out and sign printable pdf

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the schedule eic form 2019, and why is it important?

The schedule eic form 2019 is a vital document used to claim the Earned Income Credit (EIC) for eligible taxpayers. Completing this form accurately can help you benefit from signNow tax credits, especially if you have children or dependents. Ensuring you fill out the schedule eic form 2019 correctly can maximize your tax refund and reduce your tax liability.

-

How can airSlate SignNow help me manage the schedule eic form 2019?

With airSlate SignNow, you can efficiently fill out, sign, and store your schedule eic form 2019 securely. Our user-friendly platform allows you to collaborate with accountants or family members, ensuring that all necessary signatures are obtained. This streamlined process can save you valuable time during tax season.

-

Are there any costs associated with using airSlate SignNow to process the schedule eic form 2019?

AirSlate SignNow offers competitive pricing plans designed to accommodate different business needs. You can choose from various subscription packages that include features specifically aimed at managing documents like the schedule eic form 2019. Whether you are an individual taxpayer or a business, we have a cost-effective solution for you.

-

What features does airSlate SignNow offer for handling tax documents like the schedule eic form 2019?

AirSlate SignNow provides features such as electronic signatures, customizable templates, and document tracking to enhance your experience with the schedule eic form 2019. These features ensure that all parties involved can efficiently complete necessary steps, maintaining accurate records at the same time. You can also store your tax documents securely in the cloud.

-

Is airSlate SignNow compliant with tax regulations when managing the schedule eic form 2019?

Yes, airSlate SignNow is designed to comply with industry standards and regulations for handling sensitive documents like the schedule eic form 2019. Your data security and compliance are our top priorities, ensuring that your tax information remains protected at all times. We utilize encryption and secure storage solutions to safeguard your data.

-

Can I integrate airSlate SignNow with other software for completing the schedule eic form 2019?

Absolutely! AirSlate SignNow allows seamless integrations with various accounting and tax software, making it easier to manage the schedule eic form 2019. Whether you use popular tools like QuickBooks, Zapier, or others, you can automate your workflows and enhance productivity while handling your tax documentation.

-

What benefits can I expect when using airSlate SignNow for the schedule eic form 2019?

Using airSlate SignNow for the schedule eic form 2019 introduces efficiency, security, and ease of access to your important documents. Our platform ensures that you can quickly prepare and send your form, receive notifications, and track its status all in one location. This means less stress during tax season and the ability to focus on what truly matters.

Get more for Form 8863 Instructions Fill Out And Sign Printable PDF

- Defy waiver form

- Tada bill for practical examination for all classes form

- Kisii university application form pdf

- Room rental agreement template word doc singapore form

- Sections 144g 45 or 144g 81 waiver request assisted living licensure form

- New patient gynecological questionnaire oakdale obgyn form

- Clients request to arbitrate a fee dispute form

- Sacramento spca form

Find out other Form 8863 Instructions Fill Out And Sign Printable PDF

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors