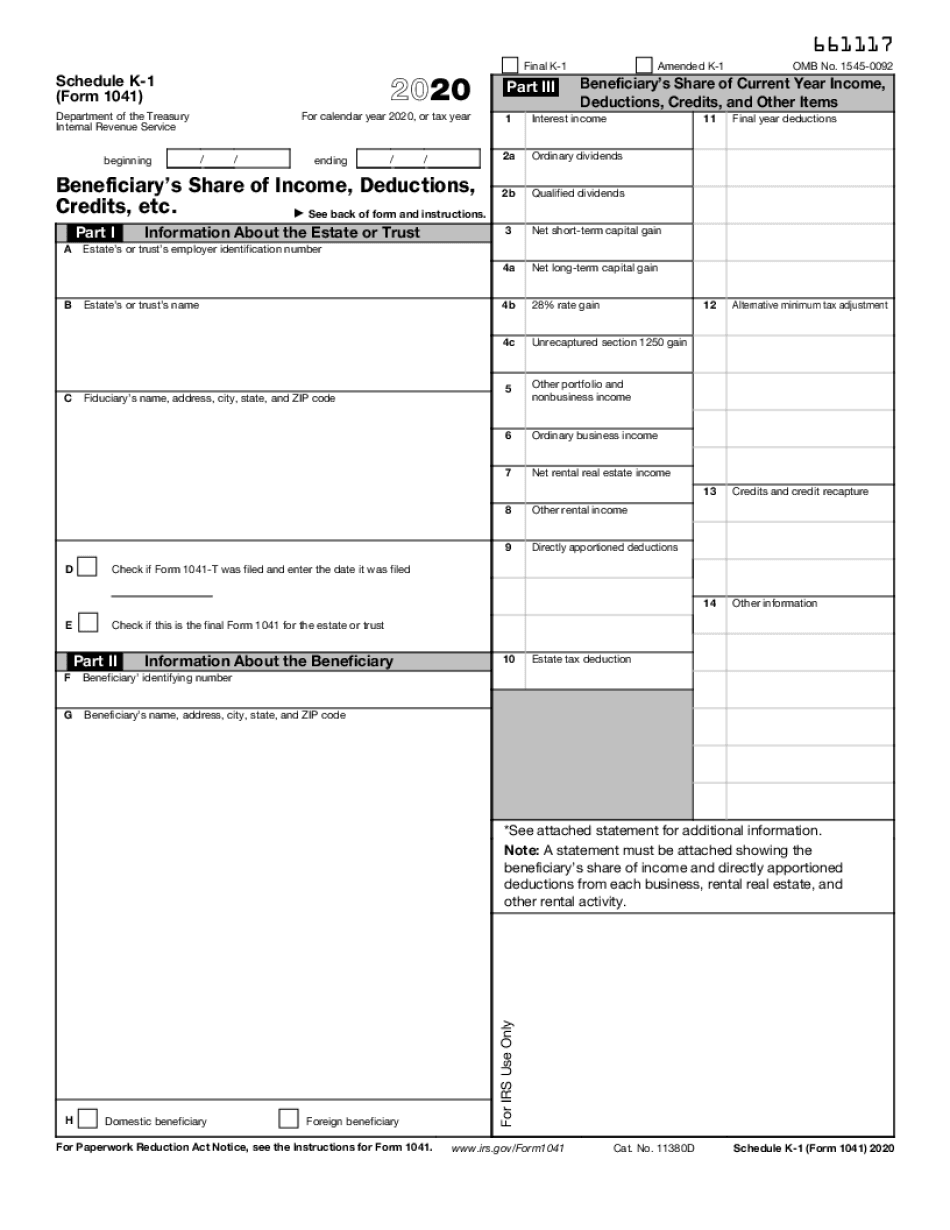

Form 1041 Schedule K 1 2020

What is the Form 1041 Schedule K-1

The Form 1041 Schedule K-1 is a tax document used to report income, deductions, and credits from a partnership, estate, or trust to the Internal Revenue Service (IRS). It is specifically designed for beneficiaries of estates or trusts and partners in partnerships. The information provided on this form is essential for recipients to accurately report their share of income on their individual tax returns. Each beneficiary or partner receives a separate Schedule K-1, which details their portion of the entity's income, losses, and other tax-related items.

How to use the Form 1041 Schedule K-1

To effectively use the Form 1041 Schedule K-1, recipients must first review the information provided to ensure accuracy. This includes checking the amounts reported for income, deductions, and credits. Once verified, the recipient will need to report these amounts on their individual tax return, typically on Form 1040. The specific lines on Form 1040 where these amounts are reported depend on the type of income or deduction. It is crucial to follow IRS guidelines to ensure proper reporting and compliance.

Steps to complete the Form 1041 Schedule K-1

Completing the Form 1041 Schedule K-1 involves several key steps:

- Gather relevant financial information from the partnership, estate, or trust.

- Fill out the form with accurate data, including the beneficiary's name, address, and taxpayer identification number.

- Report the income, deductions, and credits allocated to the beneficiary based on the entity's financial statements.

- Ensure that all calculations are correct and that the form is signed by the authorized individual.

- Distribute copies of the completed Schedule K-1 to each beneficiary or partner and retain a copy for the entity's records.

Legal use of the Form 1041 Schedule K-1

The legal use of the Form 1041 Schedule K-1 is vital for ensuring compliance with federal tax regulations. This form must be accurately completed and filed by the entity responsible for the partnership, estate, or trust. Beneficiaries and partners must use the information provided on the K-1 to report their income correctly, as failure to do so can result in penalties and interest from the IRS. Additionally, the form serves as a record of the beneficiary's share of the entity's taxable income, which is essential for individual tax filings.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Form 1041 Schedule K-1. These guidelines include instructions on how to report various types of income, such as ordinary business income, capital gains, and dividends. It is essential for both the entity and recipients to familiarize themselves with these guidelines to ensure accurate reporting. The IRS also outlines deadlines for filing the form and penalties for late submissions, emphasizing the importance of adhering to these regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 Schedule K-1 are crucial for compliance. Generally, the deadline for filing Form 1041 is the fifteenth day of the fourth month following the end of the tax year. For calendar year filers, this typically falls on April 15. However, if the entity has received an extension, the filing deadline may be extended by six months. Beneficiaries should also be aware of the deadlines for reporting the information on their individual tax returns to avoid penalties.

Quick guide on how to complete form 1041 schedule k 1

Effortlessly Prepare Form 1041 Schedule K 1 on Any Device

Managing documents online has gained traction among companies and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed materials, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Form 1041 Schedule K 1 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign Form 1041 Schedule K 1 with Ease

- Obtain Form 1041 Schedule K 1 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes moments and has the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Form 1041 Schedule K 1 and ensure outstanding communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 schedule k 1

Create this form in 5 minutes!

How to create an eSignature for the form 1041 schedule k 1

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the 2014 form k 1 and why is it important?

The 2014 form k 1 is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It is important for taxpayers to receive their form k 1 to accurately report their share of income on their tax returns and to understand their tax obligations.

-

How can airSlate SignNow help with sending the 2014 form k 1?

airSlate SignNow provides an easy-to-use platform for businesses to securely send and eSign the 2014 form k 1. By streamlining the document signing process, users can save time and ensure compliance with tax regulations.

-

Is there a cost to use airSlate SignNow for the 2014 form k 1?

airSlate SignNow offers a cost-effective solution designed for businesses of all sizes, including features tailored for the 2014 form k 1. Pricing plans are flexible, allowing users to choose based on their document volume and specific needs.

-

What features does airSlate SignNow offer for managing the 2014 form k 1?

Key features of airSlate SignNow for managing the 2014 form k 1 include document templates, secure storage, and real-time tracking of document status. These features simplify the process of handling tax documents efficiently and securely.

-

Can airSlate SignNow be integrated with accounting software for the 2014 form k 1?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions. This makes it easier for users to manage the 2014 form k 1 and ensure all financial documents are aligned with their accounting systems.

-

What benefits does eSigning the 2014 form k 1 provide?

eSigning the 2014 form k 1 offers numerous benefits, including enhanced security, quicker turnaround times, and the ability to access documents from anywhere. This digital approach also reduces the reliance on paper, making it environmentally friendly.

-

How secure is the process of signing the 2014 form k 1 with airSlate SignNow?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Users can trust that their 2014 form k 1 and other sensitive documents are protected throughout the signing process.

Get more for Form 1041 Schedule K 1

- Electricity and energy business unit form

- Inventory form across australia removals

- Broker loan submission coversheet form

- Work at height risk assessment form

- Fillioform 014 mit a plicat on she t 438ea10ffill free fillable form 014 mit a plicat on she t pdf form

- Applying for your credit report as a sole trader or experian form

- Transaction summary sheet form

- Iep minor ucl form

Find out other Form 1041 Schedule K 1

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document