Notice Demand Bond Form

What is the Notice Demand Bond

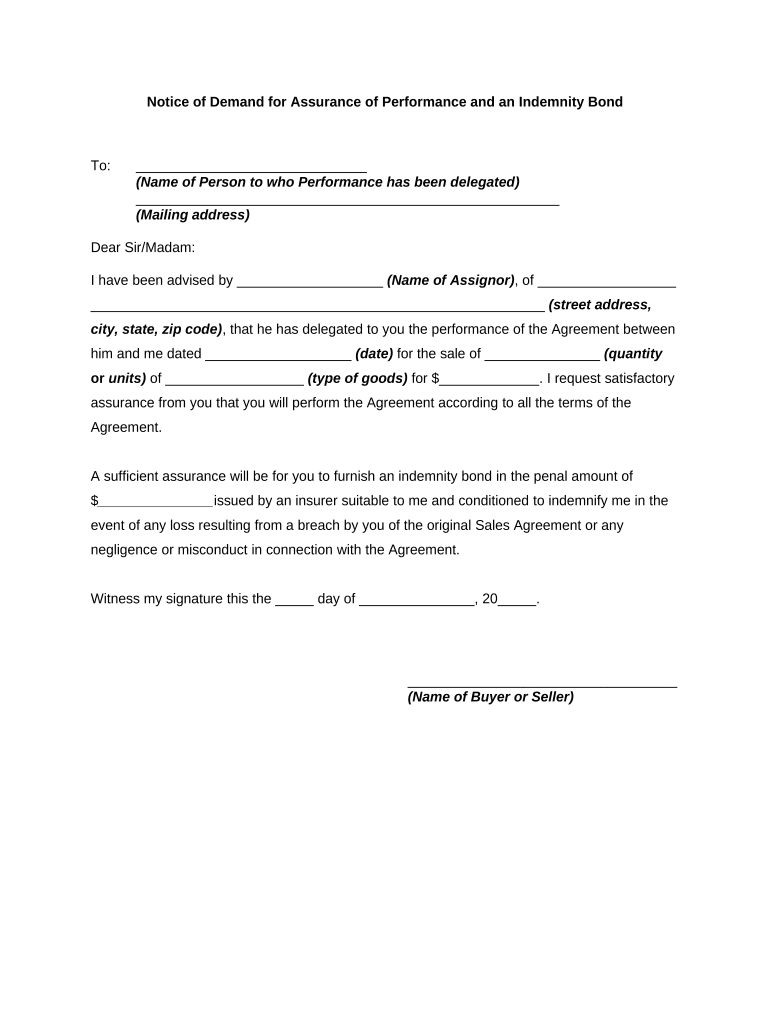

The Notice Demand Bond is a legal document that serves as a guarantee for the performance of certain obligations. It is often required in various business and legal contexts, ensuring that one party will fulfill their responsibilities to another. This bond protects the interests of the obligee, who is the party receiving the guarantee, by providing financial compensation in case the principal fails to meet their obligations. The bond typically includes specific terms and conditions that outline the responsibilities of the parties involved.

How to use the Notice Demand Bond

Using the Notice Demand Bond involves understanding its purpose and the obligations it covers. Typically, the bond is executed when one party requires assurance from another that they will perform a specific task or service. To use the bond effectively, the principal must complete the necessary documentation, ensuring all parties involved understand their roles and responsibilities. Once signed, the bond acts as a legally binding contract, providing security to the obligee. It is important to keep a copy of the bond for reference and compliance purposes.

Steps to complete the Notice Demand Bond

Completing the Notice Demand Bond involves several key steps to ensure its validity:

- Identify the parties involved: Clearly state the names and addresses of the principal, obligee, and surety.

- Define the obligations: Specify the duties or services that the principal is required to perform.

- Set the bond amount: Determine the financial value of the bond based on the obligations outlined.

- Include terms and conditions: Clearly articulate any specific terms that govern the bond's execution.

- Sign and date the bond: Ensure all parties sign the document, including witnesses if required.

Key elements of the Notice Demand Bond

The key elements of the Notice Demand Bond include:

- Principal: The individual or entity responsible for fulfilling the obligations.

- Obligee: The party that requires the bond as a form of security.

- Surety: The entity that guarantees the principal’s performance, often an insurance company.

- Bond amount: The monetary value that the surety will pay if the principal defaults.

- Terms and conditions: Specific clauses that outline the obligations and rights of all parties involved.

Legal use of the Notice Demand Bond

The legal use of the Notice Demand Bond is governed by state and federal laws. It is crucial for the bond to comply with relevant legal frameworks to be enforceable in court. This includes ensuring that the bond is properly executed, contains all necessary information, and is filed with the appropriate authorities if required. Failure to adhere to legal requirements can result in the bond being deemed invalid, which may expose the principal to liability.

Examples of using the Notice Demand Bond

Examples of situations where the Notice Demand Bond may be used include:

- Construction projects, where contractors must guarantee the completion of work.

- Real estate transactions, ensuring that buyers fulfill their purchase agreements.

- Licensing requirements, where businesses must provide a bond to operate legally.

In each case, the bond serves to protect the interests of the obligee by providing a financial safety net in case of non-compliance by the principal.

Quick guide on how to complete notice demand bond

Accomplish Notice Demand Bond seamlessly on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any holdups. Manage Notice Demand Bond on any platform with the airSlate SignNow mobile applications for Android or iOS, and streamline any document-oriented workflow today.

The simplest way to modify and eSign Notice Demand Bond effortlessly

- Find Notice Demand Bond and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key portions of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document versions. airSlate SignNow meets your document management requirements with just a few clicks from any device you prefer. Amend and eSign Notice Demand Bond while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an indemnity bond sample?

An indemnity bond sample is a template that outlines the terms and conditions under which one party agrees to compensate another for any losses or damages incurred. This document is crucial in various business transactions and legal agreements, providing clarity and protection. By using an indemnity bond sample, you can ensure compliance and safeguard your business interests.

-

How can I obtain an indemnity bond sample?

You can easily obtain an indemnity bond sample from airSlate SignNow's resource library. Our platform offers several templates tailored to various industries and specific needs. Simply sign up, access our templates, and customize an indemnity bond sample that suits your requirements.

-

What features does the indemnity bond sample offer on airSlate SignNow?

The indemnity bond sample on airSlate SignNow comes with features like customizable fields, eSign capabilities, and easy sharing options. You can personalize the document to meet your specific needs and ensure that all parties involved understand their obligations. This flexibility makes the indemnity bond sample a vital tool for any business.

-

What are the benefits of using the indemnity bond sample?

Using an indemnity bond sample can signNowly reduce the risk of misunderstandings and disputes in business transactions. Additionally, it streamlines the process of securing agreements and enhances the professional image of your business. By having a reliable indemnity bond sample, you safeguard your financial interests effectively.

-

Is the indemnity bond sample legally binding?

Yes, an indemnity bond sample is legally binding when properly executed by all parties involved. To ensure its enforceability, make sure to follow the setup guidelines, including necessary signatures and witness requirements. Contacting a legal professional for advice can also enhance the validity of your indemnity bond sample.

-

Can I integrate the indemnity bond sample with other tools?

Absolutely! airSlate SignNow offers integration with various platforms and tools, making it easy to incorporate your indemnity bond sample into your existing workflows. You can connect with CRM systems, project management tools, and more to streamline the document management process.

-

What is the pricing for using the indemnity bond sample on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that provide access to the indemnity bond sample and other essential document management features. Depending on your business needs, you can choose from various subscription options that fit your budget. Visit our pricing page for more details on the available plans.

Get more for Notice Demand Bond

Find out other Notice Demand Bond

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now