Form U 6 Rev Public Service Company Tax Return Hawaii Gov 2009

What is the Form U 6 Rev Public Service Company Tax Return Hawaii gov

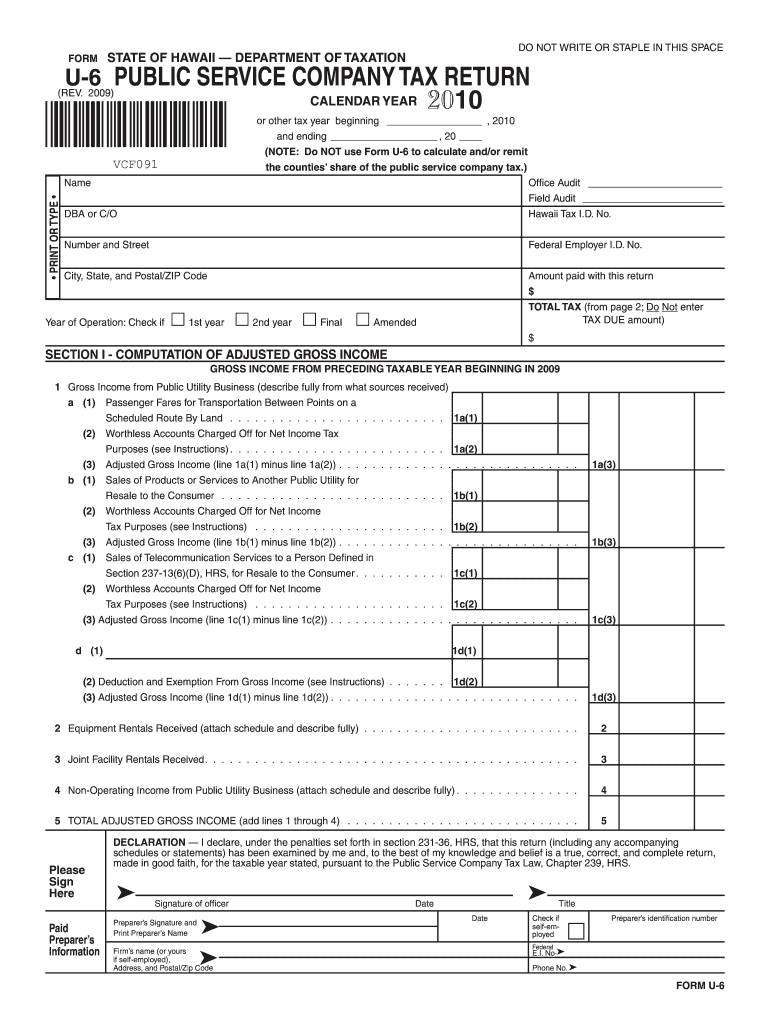

The Form U 6 Rev Public Service Company Tax Return is a tax document required by the state of Hawaii for public service companies. This form is specifically designed for entities engaged in providing public utility services, such as electricity, water, and telecommunications. The primary purpose of the form is to report income, expenses, and other financial information relevant to the operations of these companies, ensuring compliance with state tax regulations.

Steps to complete the Form U 6 Rev Public Service Company Tax Return Hawaii gov

Completing the Form U 6 Rev involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, accurately fill out the form, providing detailed information about revenues, deductions, and any applicable tax credits. It is crucial to double-check all entries for accuracy before submission. Once completed, the form can be signed electronically, ensuring a streamlined filing process.

How to obtain the Form U 6 Rev Public Service Company Tax Return Hawaii gov

The Form U 6 Rev can be obtained directly from the official Hawaii government website. It is typically available in a downloadable format, allowing users to fill it out digitally. Additionally, physical copies may be available at local government offices or tax assistance centers. Ensuring you have the latest version of the form is essential, as updates may occur based on changes in tax laws or regulations.

Key elements of the Form U 6 Rev Public Service Company Tax Return Hawaii gov

Key elements of the Form U 6 Rev include sections for reporting gross income, allowable deductions, and tax credits. It also requires information about the company’s operational status, including details on any subsidiaries or affiliated entities. Accurate reporting of these elements is vital for determining the correct tax liability and ensuring compliance with state regulations.

State-specific rules for the Form U 6 Rev Public Service Company Tax Return Hawaii gov

Hawaii has specific rules governing the completion and submission of the Form U 6 Rev. These include deadlines for filing, specific documentation required to support claims, and guidelines for electronic submission. Familiarizing oneself with these state-specific regulations is crucial for public service companies to avoid penalties and ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form U 6 Rev can be submitted through various methods, including online filing, mailing a physical copy, or delivering it in person to designated state offices. Online submission is often the most efficient method, allowing for quicker processing and confirmation. However, companies should ensure they follow the correct procedures for each submission method to avoid delays or issues with their filings.

Quick guide on how to complete form u 6 rev 2009 public service company tax return hawaiigov

Your assistance manual on how to get ready for your Form U 6 Rev Public Service Company Tax Return Hawaii gov

If you’re curious about how to fill out and send your Form U 6 Rev Public Service Company Tax Return Hawaii gov, here are some brief instructions on how to simplify tax submission.

Initially, you simply need to create your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, generate, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to amend any details as necessary. Enhance your tax administration with sophisticated PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Form U 6 Rev Public Service Company Tax Return Hawaii gov in just a few minutes:

- Set up your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through various versions and schedules.

- Click Obtain form to access your Form U 6 Rev Public Service Company Tax Return Hawaii gov in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Use the Signature Tool to add your legally-recognized eSignature (if required).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Be aware that submitting on paper may increase return errors and delay refunds. Of course, before e-filing your taxes, review the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form u 6 rev 2009 public service company tax return hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the form u 6 rev 2009 public service company tax return hawaiigov

How to make an electronic signature for your Form U 6 Rev 2009 Public Service Company Tax Return Hawaiigov in the online mode

How to generate an eSignature for your Form U 6 Rev 2009 Public Service Company Tax Return Hawaiigov in Chrome

How to generate an eSignature for putting it on the Form U 6 Rev 2009 Public Service Company Tax Return Hawaiigov in Gmail

How to create an electronic signature for the Form U 6 Rev 2009 Public Service Company Tax Return Hawaiigov straight from your mobile device

How to create an electronic signature for the Form U 6 Rev 2009 Public Service Company Tax Return Hawaiigov on iOS

How to create an electronic signature for the Form U 6 Rev 2009 Public Service Company Tax Return Hawaiigov on Android

People also ask

-

What is the Form U 6 Rev Public Service Company Tax Return Hawaii gov. used for?

The Form U 6 Rev Public Service Company Tax Return Hawaii gov. is primarily used by public service companies in Hawaii to report their income and expenses. This form ensures compliance with state regulations and helps streamline the tax filing process. Properly completing this form is essential for transparent financial reporting.

-

How can airSlate SignNow assist in filing the Form U 6 Rev Public Service Company Tax Return Hawaii gov.?

With airSlate SignNow, you can easily prepare, send, and eSign your Form U 6 Rev Public Service Company Tax Return Hawaii gov. The platform simplifies document management and ensures that all necessary signatures are obtained promptly, reducing delays in your tax filings. This streamlined process is designed to enhance your efficiency.

-

Is there a cost associated with filing the Form U 6 Rev Public Service Company Tax Return Hawaii gov. through airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to your business needs, which include the ability to file forms like the Form U 6 Rev Public Service Company Tax Return Hawaii gov. at an affordable rate. By using our services, you'll benefit from a cost-effective solution for managing your important tax documents. The initial investment can save you time and potential penalties in the long run.

-

What features does airSlate SignNow provide for managing the Form U 6 Rev Public Service Company Tax Return Hawaii gov.?

airSlate SignNow provides several key features to assist with the Form U 6 Rev Public Service Company Tax Return Hawaii gov., including customizable templates, secure cloud storage, and the ability to track document status in real-time. These features ensure that every step of your tax return process is smooth and well-organized. Additionally, our platform is user-friendly, making it easy for anyone to navigate.

-

Can I collaborate with my team on the Form U 6 Rev Public Service Company Tax Return Hawaii gov. using airSlate SignNow?

Yes, airSlate SignNow allows for collaboration on the Form U 6 Rev Public Service Company Tax Return Hawaii gov. You can invite team members to review, edit, and sign the document, ensuring that everyone is on the same page. This collaborative approach helps maintain accuracy and compliance with tax regulations.

-

Are there integrations available for airSlate SignNow to manage the Form U 6 Rev Public Service Company Tax Return Hawaii gov.?

airSlate SignNow offers integrations with various business applications that can help manage the Form U 6 Rev Public Service Company Tax Return Hawaii gov. This includes accounting software and workflow automation tools, thereby enhancing productivity and ensuring that all relevant information is easily accessible. These integrations help streamline your overall tax processes.

-

What benefits can I expect from using airSlate SignNow for my Form U 6 Rev Public Service Company Tax Return Hawaii gov.?

Using airSlate SignNow for your Form U 6 Rev Public Service Company Tax Return Hawaii gov. brings numerous benefits, including reduced turnaround times and enhanced security for your documents. Additionally, our platform ensures that you remain compliant with all state regulations, reducing the risk of errors. Overall, it empowers you to focus more on your business while we handle your document needs.

Get more for Form U 6 Rev Public Service Company Tax Return Hawaii gov

- Md letter landlord form

- Maryland law enforcement form

- Maryland violation form

- Md rent increase form

- Md tenant landlord 497310255 form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase maryland form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant maryland form

- Letter tenant landlord notice sample form

Find out other Form U 6 Rev Public Service Company Tax Return Hawaii gov

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure