STATE of HAWAII STATE TAX COLLECTIONS and DISTRIBUTION DEPARTMENT of 2022

Understanding the Hawaii State Tax Collections and Distribution Department

The Hawaii State Tax Collections and Distribution Department is responsible for the administration and enforcement of tax laws in Hawaii. This department oversees the collection of various taxes, including income, sales, and service company tax. The department ensures that tax revenues are appropriately allocated to support state services and programs. Understanding the role of this department is crucial for businesses operating in Hawaii, as compliance with state tax regulations is essential for maintaining good standing.

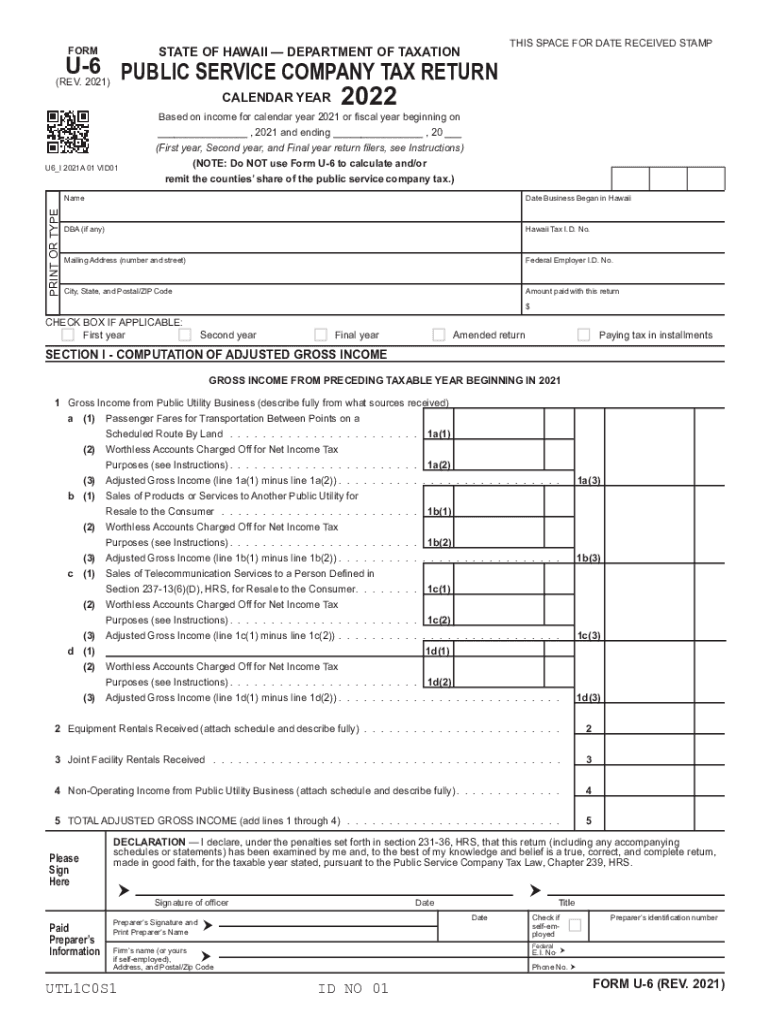

Steps to Complete the Service Company Tax Form

Completing the service company tax form in Hawaii involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, accurately fill out the form, ensuring that all information reflects your company's financial activities for the tax year. After completing the form, review it for any errors or omissions. Finally, submit the form by the designated deadline, either electronically or via mail, to avoid penalties.

Required Documents for Filing

When filing the service company tax in Hawaii, certain documents are essential to support your submission. These typically include:

- Income statements detailing revenue generated by your services.

- Expense reports that outline costs incurred during the tax year.

- Previous tax returns, if applicable, to provide context for your current filing.

- Any relevant contracts or agreements that may affect your tax obligations.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state regulations.

Filing Deadlines and Important Dates

Staying aware of filing deadlines is crucial for avoiding penalties associated with late submissions. The service company tax form typically has a due date of April 20 for most businesses. However, if your business operates on a fiscal year, the deadline may differ. It is important to check the Hawaii State Tax Collections and Distribution Department's official calendar for any updates or changes to these deadlines to ensure timely compliance.

Penalties for Non-Compliance

Failing to comply with the service company tax regulations can result in significant penalties. Common consequences include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, increasing the overall amount owed.

- Potential legal action for severe non-compliance, which could affect your business operations.

Understanding these penalties emphasizes the importance of timely and accurate tax filings for service companies in Hawaii.

Digital vs. Paper Version of the Form

When completing the service company tax form, businesses have the option to file digitally or submit a paper version. The digital version offers several advantages, including faster processing times and reduced chances of errors. Additionally, electronic submissions often provide immediate confirmation of receipt. However, some businesses may prefer the traditional paper method for record-keeping purposes. It is essential to choose the method that best suits your operational needs while ensuring compliance with state requirements.

Quick guide on how to complete state of hawaii state tax collections and distribution department of

Easily Prepare STATE OF HAWAII STATE TAX COLLECTIONS AND DISTRIBUTION DEPARTMENT OF on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle STATE OF HAWAII STATE TAX COLLECTIONS AND DISTRIBUTION DEPARTMENT OF on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and eSign STATE OF HAWAII STATE TAX COLLECTIONS AND DISTRIBUTION DEPARTMENT OF Effortlessly

- Locate STATE OF HAWAII STATE TAX COLLECTIONS AND DISTRIBUTION DEPARTMENT OF and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

No more concerns about lost or misplaced documents, repetitive form searches, or errors requiring new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign STATE OF HAWAII STATE TAX COLLECTIONS AND DISTRIBUTION DEPARTMENT OF to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of hawaii state tax collections and distribution department of

Create this form in 5 minutes!

People also ask

-

What is a service company tax and how does it affect my business?

A service company tax typically refers to the taxation applied to businesses that offer services rather than tangible products. Understanding the specifics of service company tax is crucial for compliance and planning. Proper management and understanding of these taxes can signNowly influence your business profitability.

-

How can airSlate SignNow help with service company tax documentation?

airSlate SignNow streamlines the process of managing important documents related to service company tax by allowing you to eSign and send documents easily. This ensures all your tax paperwork is organized and easily accessible. Utilizing our platform can save you time and reduce the chances of errors in your documentation.

-

What are the pricing options for using airSlate SignNow for service company tax services?

airSlate SignNow offers various pricing plans suitable for different business needs, including tiered options based on the number of users and features required. This flexibility allows service companies to choose a plan that best aligns with their budget and requirements for handling service company tax operations effectively.

-

Can I integrate airSlate SignNow with my accounting software for service company tax?

Yes, airSlate SignNow can be seamlessly integrated with several popular accounting software programs. This integration enhances efficiency by allowing you to manage service company tax documents alongside your financial records. By syncing these platforms, you can ensure that your tax documentation remains accurate and up-to-date.

-

What features does airSlate SignNow offer to support service company tax compliance?

Our platform includes features like customizable templates, document tracking, and secure eSigning that cater specifically to service company tax compliance needs. These tools help ensure that all necessary forms are completed correctly and submitted on time. Additionally, our user-friendly interface simplifies the entire process.

-

How does airSlate SignNow improve efficiency for handling service company tax?

airSlate SignNow automates many processes related to service company tax, allowing you to focus on your core business activities. By eliminating the need for manual document handling, you can signNowly reduce time spent on administrative tasks. This improved efficiency leads to faster turnaround times for your tax submissions.

-

Is airSlate SignNow suitable for small businesses regarding service company tax?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, including small service companies that need to navigate service company tax requirements. Our cost-effective solutions provide essential tools that make managing tax-related documents simpler and more efficient for small business owners.

Get more for STATE OF HAWAII STATE TAX COLLECTIONS AND DISTRIBUTION DEPARTMENT OF

- Amendment of lease package north dakota form

- Annual financial checkup package north dakota form

- Nd bill sale form

- Living wills and health care package north dakota form

- Last will and testament package north dakota form

- Subcontractors package north dakota form

- North dakota protecting form

- North dakota identity form

Find out other STATE OF HAWAII STATE TAX COLLECTIONS AND DISTRIBUTION DEPARTMENT OF

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile