Form U 6, Rev , Public Service Company Tax Return Forms Fillable 2014

What is the Form U-6, Rev, Public Service Company Tax Return Forms Fillable

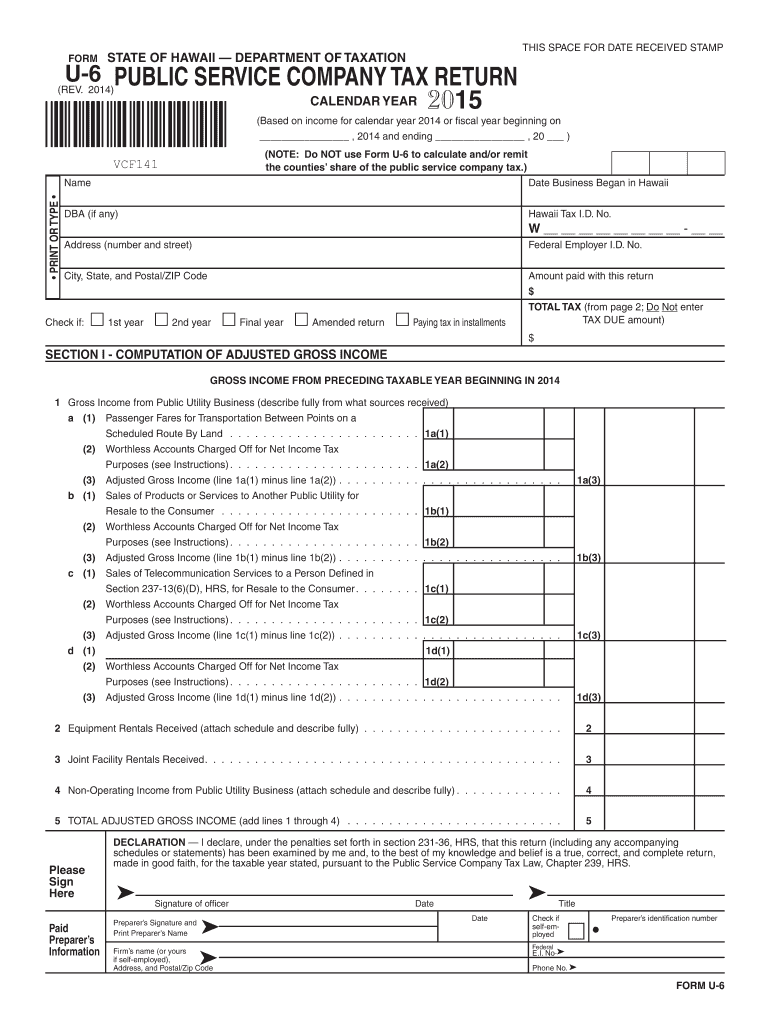

The Form U-6, Rev, Public Service Company Tax Return is a specific tax document required for public service companies in the United States. This form is designed to report income, expenses, and other financial data to the relevant tax authorities. It is fillable online, allowing users to enter their information directly into the form fields, which can streamline the filing process and reduce errors. The digital format also enhances accessibility, ensuring that companies can complete their tax obligations efficiently.

Steps to Complete the Form U-6, Rev, Public Service Company Tax Return Forms Fillable

Completing the Form U-6, Rev, involves several key steps to ensure accuracy and compliance:

- Gather all necessary financial documents, including income statements and expense reports.

- Access the fillable form online, ensuring you have a reliable internet connection.

- Carefully enter the required information in each section, double-checking for accuracy.

- Review the completed form for any errors or omissions.

- Sign the form electronically, ensuring compliance with IRS regulations.

- Submit the form through the designated method, whether online or by mail.

Legal Use of the Form U-6, Rev, Public Service Company Tax Return Forms Fillable

The Form U-6, Rev, serves a legal purpose in the tax reporting process for public service companies. It is essential for compliance with federal and state tax laws. The IRS recognizes electronically signed forms as legally binding, provided they meet specific criteria outlined in the eSignature regulations. This legal framework allows companies to file their taxes without the need for physical signatures, promoting efficiency and reducing the risk of document loss.

How to Obtain the Form U-6, Rev, Public Service Company Tax Return Forms Fillable

Obtaining the Form U-6, Rev, is straightforward. Companies can access the fillable version of the form through the IRS website or authorized tax preparation platforms. It is important to ensure that the form being used is the most current version, as tax regulations may change. Users should verify that they are downloading the official form to avoid issues during submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form U-6, Rev, is crucial for compliance. Typically, public service companies must submit their tax returns by the due date specified by the IRS, which is usually aligned with the end of the fiscal year. Companies should be aware of any extensions or changes to deadlines, especially during tax season, to avoid penalties for late submission.

Key Elements of the Form U-6, Rev, Public Service Company Tax Return Forms Fillable

The Form U-6, Rev, includes several key elements that must be accurately completed:

- Company Information: Name, address, and identification number.

- Income Reporting: Detailed breakdown of revenue sources.

- Expense Reporting: Itemized list of deductible expenses.

- Signature Section: Area for electronic signature to validate the submission.

Quick guide on how to complete form u 6 rev 2014 public service company tax return forms 2014 fillable

Your assistance manual on how to prepare your Form U 6, Rev , Public Service Company Tax Return Forms Fillable

If you’re curious about how to create and submit your Form U 6, Rev , Public Service Company Tax Return Forms Fillable, here are some concise guidelines to make tax submission simpler.

To start, you just need to set up your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is a highly intuitive and powerful document solution that allows you to modify, draft, and finalize your tax paperwork effortlessly. With its editor, you can switch between text, checkboxes, and electronic signatures and return to amend details as necessary. Streamline your tax management with sophisticated PDF editing, eSigning, and easy sharing.

Follow these steps to finalize your Form U 6, Rev , Public Service Company Tax Return Forms Fillable in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Click Get form to access your Form U 6, Rev , Public Service Company Tax Return Forms Fillable in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to affix your legally-recognized eSignature (if required).

- Examine your document and correct any errors.

- Save alterations, print your copy, send it to your recipient, and save it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to return mistakes and postpone reimbursements. Before e-filing your taxes, ensure to check the IRS website for filing regulations applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct form u 6 rev 2014 public service company tax return forms 2014 fillable

FAQs

-

Can I form a UK limited company in March 2015 and start trading after 6 April 2015 without needing to send an annual return for the previous tax year (5 April 2014 to 5 April 2015)?

You dont write 'tax returns' for your business based on the personal income tax dates (April) you write them based on your companies own financial year end dates.Have a look here:https://www.gov.uk/prepare-file-...You must send your return 9 months after the end of your financial year - I.e. 21 months after you start your company. That's for companies house and paying tax -- you actually have another 3 months before you need to report to HMRC. It has nothing to do with the personal 'tax year'.The only things you need to report based on April deadlines is employee payments (PAYE) and your own personal tax return -- which you either won't have to do (because you won't have been paid anything) or will have to do anyway for another reason (already earned over £100k one year in the past etc.)Basically - rather than worrying about the tax and filing for the first year, worry about making some money!

Create this form in 5 minutes!

How to create an eSignature for the form u 6 rev 2014 public service company tax return forms 2014 fillable

How to create an eSignature for the Form U 6 Rev 2014 Public Service Company Tax Return Forms 2014 Fillable online

How to generate an eSignature for your Form U 6 Rev 2014 Public Service Company Tax Return Forms 2014 Fillable in Chrome

How to make an electronic signature for putting it on the Form U 6 Rev 2014 Public Service Company Tax Return Forms 2014 Fillable in Gmail

How to create an eSignature for the Form U 6 Rev 2014 Public Service Company Tax Return Forms 2014 Fillable straight from your smart phone

How to generate an electronic signature for the Form U 6 Rev 2014 Public Service Company Tax Return Forms 2014 Fillable on iOS

How to create an electronic signature for the Form U 6 Rev 2014 Public Service Company Tax Return Forms 2014 Fillable on Android

People also ask

-

What is the Form U 6, Rev, Public Service Company Tax Return Forms Fillable?

The Form U 6, Rev, Public Service Company Tax Return Forms Fillable is a tax return form specifically designed for public service companies. This form ensures that businesses in this sector can efficiently report their financial activities while complying with state regulations. Our platform provides a fillable version that simplifies the completion and submission process.

-

How can airSlate SignNow help me fill out the Form U 6, Rev, Public Service Company Tax Return Forms Fillable?

airSlate SignNow simplifies the process of filling out the Form U 6, Rev, Public Service Company Tax Return Forms Fillable by providing an intuitive interface where you can enter all necessary information. Our platform ensures that your data is securely stored and easily accessible, allowing you to complete the form accurately and efficiently. You can also eSign the document to formalize your submission.

-

What features does airSlate SignNow offer for the Form U 6, Rev, Public Service Company Tax Return Forms Fillable?

Our platform offers a range of features tailored for the Form U 6, Rev, Public Service Company Tax Return Forms Fillable, including customizable templates, collaborative workflows, and automated reminders. These features enhance your productivity and make it easier to manage deadlines associated with tax forms. You can also track the status of your documents in real-time.

-

Is there a cost associated with using airSlate SignNow for the Form U 6, Rev, Public Service Company Tax Return Forms Fillable?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs. We provide a cost-effective solution for filling out the Form U 6, Rev, Public Service Company Tax Return Forms Fillable, giving you access to essential features and unlimited document signing options. You can choose a plan that fits your budget while benefiting from our services.

-

Can I integrate airSlate SignNow with other software when using the Form U 6, Rev, Public Service Company Tax Return Forms Fillable?

Absolutely! airSlate SignNow offers seamless integration with various applications and software platforms that enhance your workflow when dealing with the Form U 6, Rev, Public Service Company Tax Return Forms Fillable. This includes popular CRMs, cloud storage services, and project management tools. Such integrations save time and reduce manual data entry.

-

What are the benefits of using airSlate SignNow for the Form U 6, Rev, Public Service Company Tax Return Forms Fillable?

Using airSlate SignNow for the Form U 6, Rev, Public Service Company Tax Return Forms Fillable provides numerous benefits, including time savings, increased efficiency, and enhanced security. You can fill out and eSign your forms quickly, ensuring timely submissions while keeping your sensitive data protected. Additionally, our user-friendly platform makes document management a breeze.

-

How does airSlate SignNow ensure the security of the Form U 6, Rev, Public Service Company Tax Return Forms Fillable?

airSlate SignNow prioritizes the security of all documents, including the Form U 6, Rev, Public Service Company Tax Return Forms Fillable, by implementing industry-standard encryption protocols. We ensure that your data is safeguarded during transit and storage, providing peace of mind while you manage your tax forms. Regular security audits further enhance our commitment to your protection.

Get more for Form U 6, Rev , Public Service Company Tax Return Forms Fillable

Find out other Form U 6, Rev , Public Service Company Tax Return Forms Fillable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors