Form U 6, Rev , Public Service Company Tax Return Forms Fillable 2024

Understanding the U 6 Hawaii Form

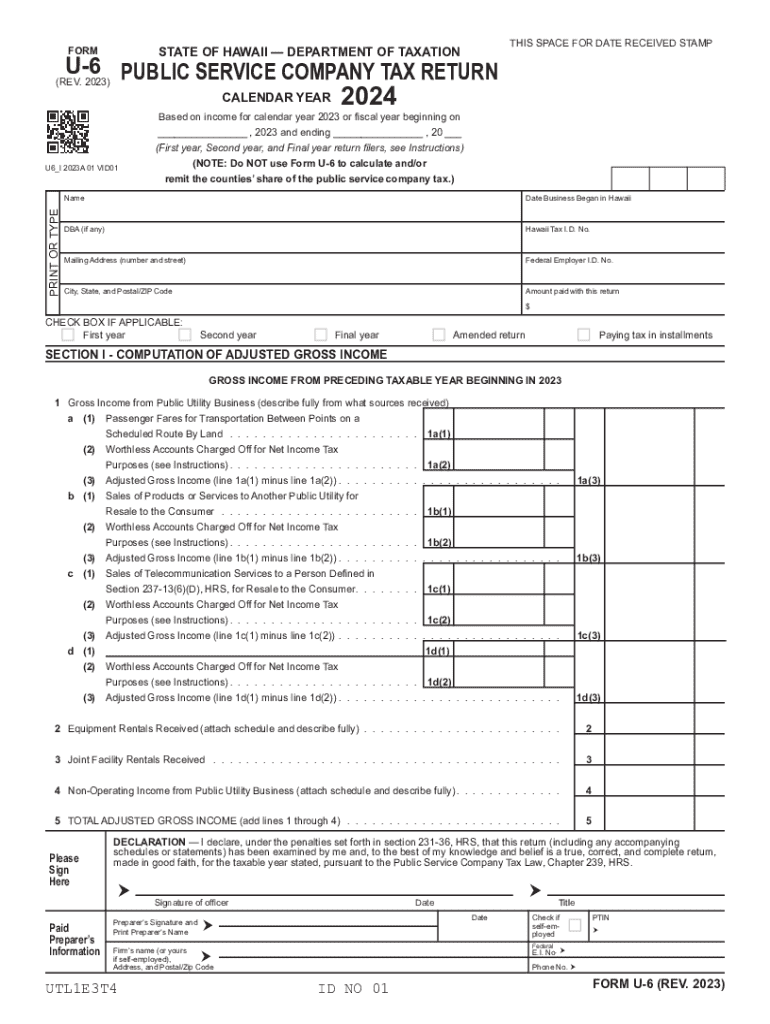

The U 6 Hawaii form, also known as the Hawaii U 6 return, is a public service company tax return form used by businesses operating within the state of Hawaii. This form is essential for reporting income and expenses related to public service companies, which include utilities and other service-oriented businesses. The U 6 form is crucial for ensuring compliance with state tax regulations and for accurately assessing the tax obligations of these entities.

Steps to Complete the U 6 Hawaii Form

Completing the U 6 Hawaii form involves several key steps. First, gather all necessary financial documents, including income statements, expense reports, and any relevant tax documents. Next, accurately fill out each section of the form, ensuring that all figures are correct and reflect the company's financial activities. Pay special attention to sections that require detailed breakdowns of revenue sources and expenses. Once the form is completed, review it carefully for any errors before submitting it.

Obtaining the U 6 Hawaii Form

The U 6 Hawaii form can be obtained through the official Hawaii Department of Taxation website. It is available in both printable and fillable formats to accommodate different filing preferences. Businesses can download the form directly from the website, ensuring they have the most current version. Additionally, physical copies may be available at local tax offices for those who prefer to fill out the form by hand.

Legal Use of the U 6 Hawaii Form

The U 6 Hawaii form is legally required for public service companies operating in Hawaii. Filing this form accurately and on time is essential to comply with state tax laws. Failure to file or inaccuracies in the form can result in penalties, including fines or additional tax assessments. It is important for businesses to understand the legal implications of this form and to ensure that all information reported is truthful and complete.

Key Elements of the U 6 Hawaii Form

Key elements of the U 6 Hawaii form include sections for reporting total revenue, allowable deductions, and tax calculations. The form also requires businesses to provide information about their operations, such as the type of services offered and the geographical areas served. Understanding these elements is crucial for accurately completing the form and ensuring compliance with state tax regulations.

Filing Deadlines for the U 6 Hawaii Form

Filing deadlines for the U 6 Hawaii form are typically aligned with the state’s tax calendar. Businesses are generally required to submit their returns annually. It is important to check the specific deadlines each year, as they may vary based on the business's fiscal year and any changes in state tax laws. Timely filing is essential to avoid penalties and ensure that the business remains in good standing with the state.

Examples of Using the U 6 Hawaii Form

Examples of using the U 6 Hawaii form include utility companies reporting their annual income from services provided to customers. Additionally, service companies that operate in multiple jurisdictions may use the U 6 form to report income generated specifically within Hawaii. These examples illustrate the form's application in various business contexts and highlight its importance in maintaining compliance with state tax obligations.

Create this form in 5 minutes or less

Find and fill out the correct form u 6 rev public service company tax return forms fillable 770083811

Create this form in 5 minutes!

How to create an eSignature for the form u 6 rev public service company tax return forms fillable 770083811

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the u 6 hawaii form and why is it important?

The u 6 hawaii form is a crucial document used for various administrative purposes in Hawaii. It helps streamline processes by ensuring that all necessary information is collected efficiently. Understanding this form is essential for businesses operating in Hawaii to maintain compliance and avoid potential issues.

-

How can airSlate SignNow help with the u 6 hawaii form?

airSlate SignNow simplifies the process of completing and signing the u 6 hawaii form. With our platform, you can easily fill out the form, add signatures, and send it securely to the relevant parties. This saves time and reduces the risk of errors, ensuring your documents are processed smoothly.

-

Is there a cost associated with using airSlate SignNow for the u 6 hawaii form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing you to manage the u 6 hawaii form and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the u 6 hawaii form?

airSlate SignNow provides a range of features for managing the u 6 hawaii form, including customizable templates, secure eSigning, and real-time tracking. These features enhance the efficiency of document management and ensure that you can handle the form with ease. Additionally, our user-friendly interface makes it accessible for everyone.

-

Can I integrate airSlate SignNow with other tools for the u 6 hawaii form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to connect your workflow for the u 6 hawaii form with tools you already use. This integration capability enhances productivity and ensures that all your documents are managed in one place.

-

What are the benefits of using airSlate SignNow for the u 6 hawaii form?

Using airSlate SignNow for the u 6 hawaii form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored safely and can be accessed anytime, anywhere. This flexibility allows businesses to operate more effectively.

-

Is airSlate SignNow secure for handling the u 6 hawaii form?

Yes, airSlate SignNow prioritizes security and compliance when handling the u 6 hawaii form. We utilize advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are safe and secure while using our platform.

Get more for Form U 6, Rev , Public Service Company Tax Return Forms Fillable

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497429680 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement washington form

- Notice rent increase 497429682 form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants washington form

- Shut off notice 497429684 form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat washington form

- Waiver release lien form

- 30 day notice to terminate month to month lease for residential from tenant to landlord washington form

Find out other Form U 6, Rev , Public Service Company Tax Return Forms Fillable

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF