Form U 6, Rev , Public Service Company Tax Return Forms Fillable 2020

What is the Form U-6, Rev, Public Service Company Tax Return?

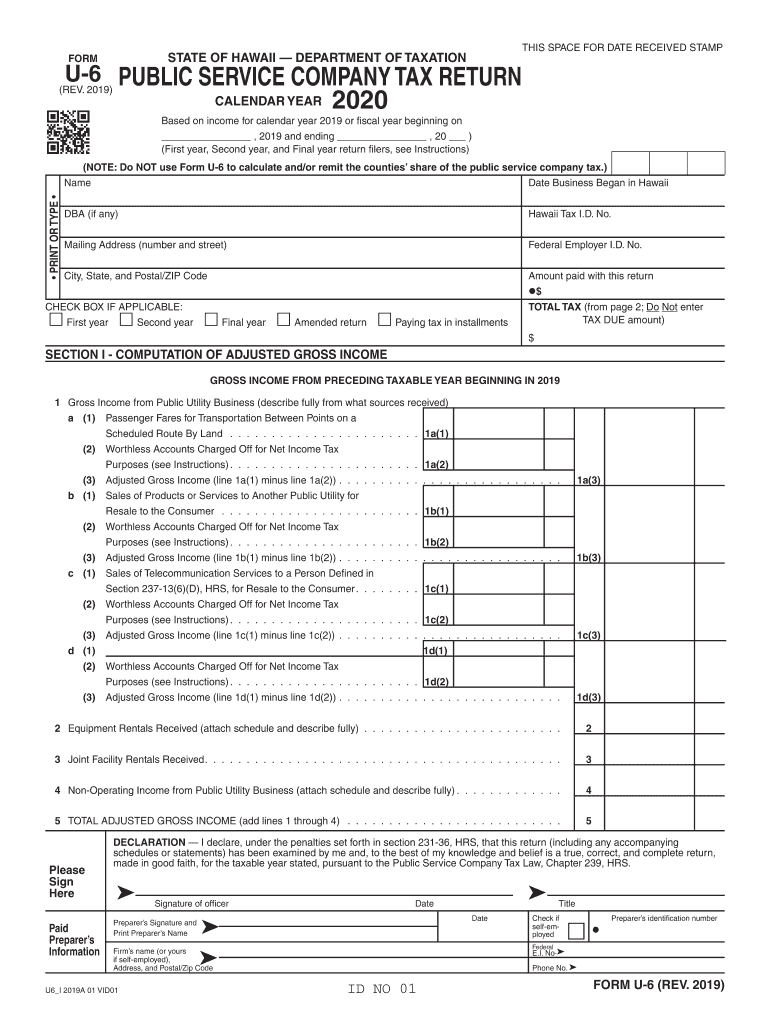

The Form U-6, Rev, is a tax return specifically designed for public service companies operating in Hawaii. This form is essential for reporting income, expenses, and other financial information relevant to the public service sector. It ensures compliance with state tax regulations and helps maintain transparency in financial reporting. The form is used by various entities, including utility companies, to calculate their tax liability accurately.

Steps to Complete the Form U-6, Rev

Completing the Form U-6, Rev requires careful attention to detail. Here are the general steps to follow:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill out the identification section with the company’s name, address, and tax identification number.

- Report total income from public service operations in the designated section.

- Detail allowable deductions and expenses to calculate the taxable income.

- Complete any additional schedules required for specific deductions or credits.

- Review the completed form for accuracy before submission.

Legal Use of the Form U-6, Rev

The Form U-6, Rev serves a vital legal function in the tax compliance landscape for public service companies. It is recognized by the state of Hawaii as the official document for reporting public service company taxes. Properly completing and submitting this form ensures that businesses meet their legal obligations and avoid potential penalties. The form must be signed by an authorized representative to validate its contents legally.

Filing Deadlines / Important Dates

Timely filing of the Form U-6, Rev is crucial to avoid penalties. The specific deadlines can vary based on the tax year and the type of entity filing. Generally, the form must be submitted annually, with the due date typically falling on the last day of the fourth month following the end of the tax year. It is advisable to check the Hawaii Department of Taxation's website for any updates or changes to filing deadlines to ensure compliance.

Required Documents for Form U-6, Rev

When preparing to complete the Form U-6, Rev, several documents are typically required:

- Financial statements, including balance sheets and income statements.

- Records of all income generated from public service operations.

- Documentation of allowable deductions and expenses.

- Previous tax returns, if applicable, for reference and consistency.

Form Submission Methods

The Form U-6, Rev can be submitted through various methods to accommodate different preferences. Businesses may choose to file the form online through the Hawaii Department of Taxation's e-filing system, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own requirements and processing times, so it is essential to select the one that best suits the business's needs.

Quick guide on how to complete form u 6 rev 2019 public service company tax return forms 2019 fillable

Easily Prepare Form U 6, Rev , Public Service Company Tax Return Forms Fillable on Any Device

The management of online documents has gained popularity among companies and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Handle Form U 6, Rev , Public Service Company Tax Return Forms Fillable on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and eSign Form U 6, Rev , Public Service Company Tax Return Forms Fillable with Minimal Effort

- Find Form U 6, Rev , Public Service Company Tax Return Forms Fillable and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors requiring new printed copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Form U 6, Rev , Public Service Company Tax Return Forms Fillable and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form u 6 rev 2019 public service company tax return forms 2019 fillable

Create this form in 5 minutes!

How to create an eSignature for the form u 6 rev 2019 public service company tax return forms 2019 fillable

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is the hawaii u6 tax and how does it affect businesses?

The hawaii u6 tax is a specific tax requirement in Hawaii that affects how businesses report their gross receipts. It is essential for businesses to understand this tax to ensure compliance and avoid penalties. By properly managing the hawaii u6 tax, businesses can streamline their operations and focus on growth.

-

How can airSlate SignNow help with hawaii u6 tax documentation?

airSlate SignNow allows businesses to efficiently manage and eSign important documents related to the hawaii u6 tax. Our platform provides an easy-to-use solution for sending and receiving contracts, tax forms, and compliance documents. By using airSlate SignNow, you ensure that your hawaii u6 tax paperwork is organized and accessible.

-

Are there any specific features in airSlate SignNow that support hawaii u6 tax filing?

Yes, airSlate SignNow includes features that facilitate the management of documents crucial for hawaii u6 tax filing. With template creation, reusable forms, and automated reminders, businesses can ensure that they stay on top of their tax obligations. These features allow for a smoother and more accurate hawaii u6 tax filing process.

-

What are the pricing options for airSlate SignNow when dealing with hawaii u6 tax?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes managing hawaii u6 tax documentation. Our plans are designed to provide cost-effective solutions without sacrificing functionality. You can choose the plan that best fits your needs in relation to hawaii u6 tax compliance and document management.

-

Can airSlate SignNow integrate with other platforms for hawaii u6 tax purposes?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and financial software that support hawaii u6 tax management. This integration allows for a smooth workflow where your tax documents and business records are easily accessible. With this capability, businesses can enhance their overall efficiency in handling the hawaii u6 tax.

-

How secure is airSlate SignNow for managing hawaii u6 tax documents?

Security is paramount at airSlate SignNow. All documents related to hawaii u6 tax are stored with advanced encryption and access controls. This ensures that your sensitive tax information remains safe and compliant with regulations.

-

What benefits does airSlate SignNow provide for businesses handling hawaii u6 tax?

Using airSlate SignNow for hawaii u6 tax management offers several benefits, including enhanced document organization, reduced turnaround time for signatures, and improved compliance tracking. These features help businesses operate more efficiently while ensuring they meet hawaii u6 tax obligations without hassle.

Get more for Form U 6, Rev , Public Service Company Tax Return Forms Fillable

- Quitclaim deed from corporation to individual virginia form

- Va general corporation form

- Quitclaim deed from corporation to llc virginia form

- Quitclaim deed from corporation to corporation virginia form

- Warranty deed from corporation to corporation virginia form

- Quitclaim deed from corporation to two individuals virginia form

- Warranty deed from corporation to two individuals virginia form

- Virginia warranty form

Find out other Form U 6, Rev , Public Service Company Tax Return Forms Fillable

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe