Installment Promissory Note Document Form

What is the installment promissory note document?

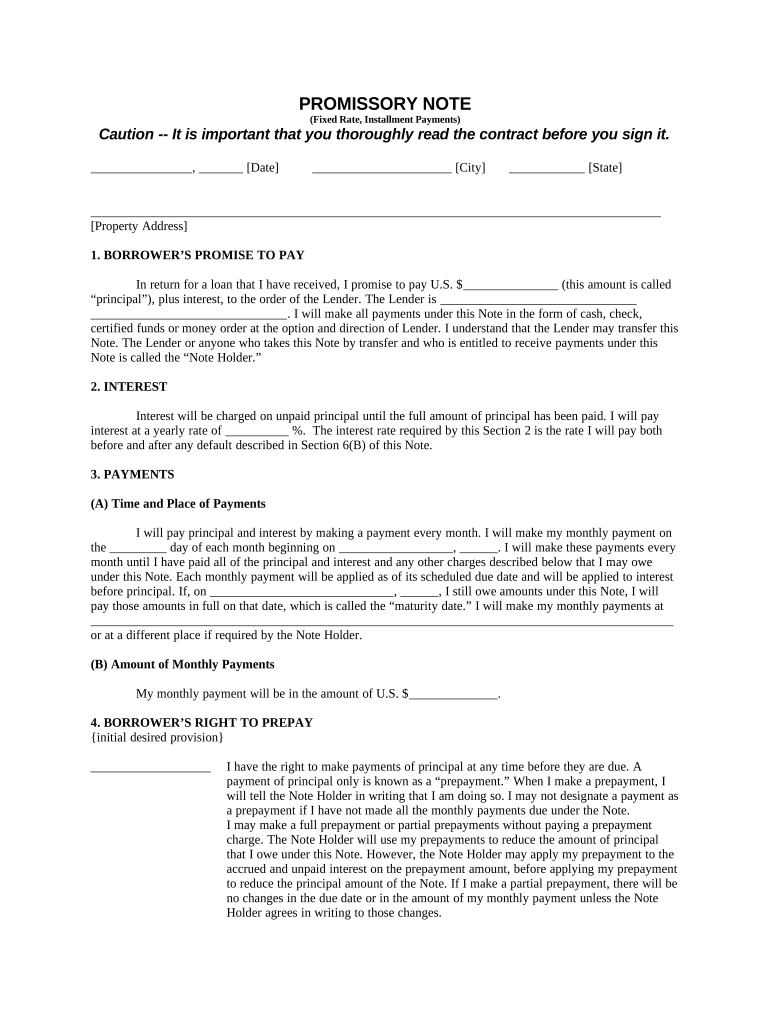

An installment promissory note document is a legal agreement in which one party (the borrower) promises to pay back a specified amount of money to another party (the lender) in a series of scheduled payments. This type of note outlines the terms of the loan, including the interest rate, payment schedule, and any penalties for late payments. It serves as a formal record of the debt and is essential for both parties to understand their rights and obligations.

How to use the installment promissory note document

To effectively use the installment promissory note document, both parties should first agree on the loan terms. This includes the total loan amount, interest rate, and repayment schedule. Once these details are finalized, the borrower should fill out the document accurately, ensuring that all relevant information is included. After both parties review and sign the document, it becomes legally binding. It is advisable to keep a copy for personal records and provide one to the lender as well.

Key elements of the installment promissory note document

The key elements of an installment promissory note document include:

- Principal Amount: The total amount borrowed.

- Interest Rate: The percentage charged on the principal amount.

- Payment Schedule: Specific dates when payments are due.

- Maturity Date: The date by which the full amount must be repaid.

- Default Terms: Conditions under which the borrower may default on the loan.

- Signatures: Signatures of both the borrower and lender to validate the agreement.

Steps to complete the installment promissory note document

Completing the installment promissory note document involves several important steps:

- Determine the loan amount and terms, including interest rate and repayment schedule.

- Obtain a blank installment promissory note document from a reliable source.

- Fill in the required information accurately, including names, addresses, and loan details.

- Review the document with the lender to ensure all terms are agreed upon.

- Both parties should sign and date the document to make it legally binding.

- Distribute copies to all parties involved for their records.

Legal use of the installment promissory note document

The installment promissory note document is legally recognized in the United States, provided it meets specific requirements. For it to be enforceable, it must include clear terms, be signed by both parties, and comply with state laws regarding lending and borrowing. It is important to ensure that the document is executed in good faith and that both parties understand their obligations to avoid potential disputes.

Digital vs. paper version of the installment promissory note document

Both digital and paper versions of the installment promissory note document are valid, but each has its advantages. A digital version allows for easier storage, sharing, and signing, especially when using secure eSignature solutions. Conversely, a paper version may be preferred for traditional transactions or for those who are less comfortable with technology. Regardless of the format, it is crucial to ensure that the document is completed accurately and signed by both parties to maintain its legal validity.

Quick guide on how to complete installment promissory note document

Effortlessly Prepare Installment Promissory Note Document on Any Device

Digital document administration has become increasingly popular among businesses and individuals alike. It offers a viable environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without hassle. Manage Installment Promissory Note Document on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

How to Alter and eSign Installment Promissory Note Document with Ease

- Obtain Installment Promissory Note Document and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require reprinting. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Installment Promissory Note Document and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an installment promissory note document?

An installment promissory note document is a legal agreement where a borrower promises to pay back a loan in a series of scheduled payments. This document outlines the terms, including interest rates and repayment timelines, ensuring both parties understand their obligations. Using airSlate SignNow, creating and signing this document is seamless and efficient.

-

How can I create an installment promissory note document using airSlate SignNow?

Creating an installment promissory note document with airSlate SignNow is straightforward. Users can select a template and customize it to fit their specific needs, including payment amounts and schedules. Once completed, the document can be securely sent for electronic signatures.

-

Is airSlate SignNow cost-effective for small businesses needing an installment promissory note document?

Yes, airSlate SignNow offers competitive pricing tailored for small businesses, making it an ideal solution for those needing an installment promissory note document. Plans are flexible, ensuring you only pay for what you need without compromising on quality or features. This affordability enables small businesses to streamline their document processes without breaking the bank.

-

What are the key benefits of using an installment promissory note document?

The key benefits of using an installment promissory note document include clear terms for repayment and legal protection for both lenders and borrowers. It ensures that all parties are held accountable, reducing the risk of misunderstandings. Additionally, using airSlate SignNow's electronic signing capabilities enhances the speed and efficiency of the entire process.

-

Can I integrate airSlate SignNow with other applications to manage my installment promissory note document?

Absolutely! airSlate SignNow supports integrations with various applications such as Google Drive, Microsoft Office, and CRM platforms. This capability allows you to seamlessly manage and store your installment promissory note document alongside other business documents and workflow tools, enhancing your productivity.

-

How secure are the installment promissory note documents signed through airSlate SignNow?

Security is a top priority at airSlate SignNow. All installment promissory note documents are encrypted and comply with industry standards to ensure your data is safe. Additionally, our platform provides audit trails, keeping records of who signed the document and when for added security and accountability.

-

Can I customize an installment promissory note document template in airSlate SignNow?

Yes, you can easily customize an installment promissory note document template in airSlate SignNow. The platform allows you to modify terms, payment schedules, and any other details to fit your specific situation. This customization ensures that each document meets your unique requirements.

Get more for Installment Promissory Note Document

- Wwwirsgovpubirs pdfinstructions for form 941 rev june

- 2020 instructions for form 8915 c internal revenue service

- Wwwirsgovpubirs pdf2021 form 8027 internal revenue service

- Wwwirsgovforms pubsabout schedule i form 990about schedule i form 990 grants and other assistance to

- Form 941 ss rev june 2021 employers quarterly federal tax return american samoa guam the commonwealth of the northern mariana

- Investment policy sdttccom form

- Form 8283pdf 8283 formrev december 2020 department of

- 124 printable 8843 form templates fillable samples in

Find out other Installment Promissory Note Document

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation