Www Irs Govpubirs Pdf2021 Form 8027 Internal Revenue Service 2021

What is IRS Form 8027?

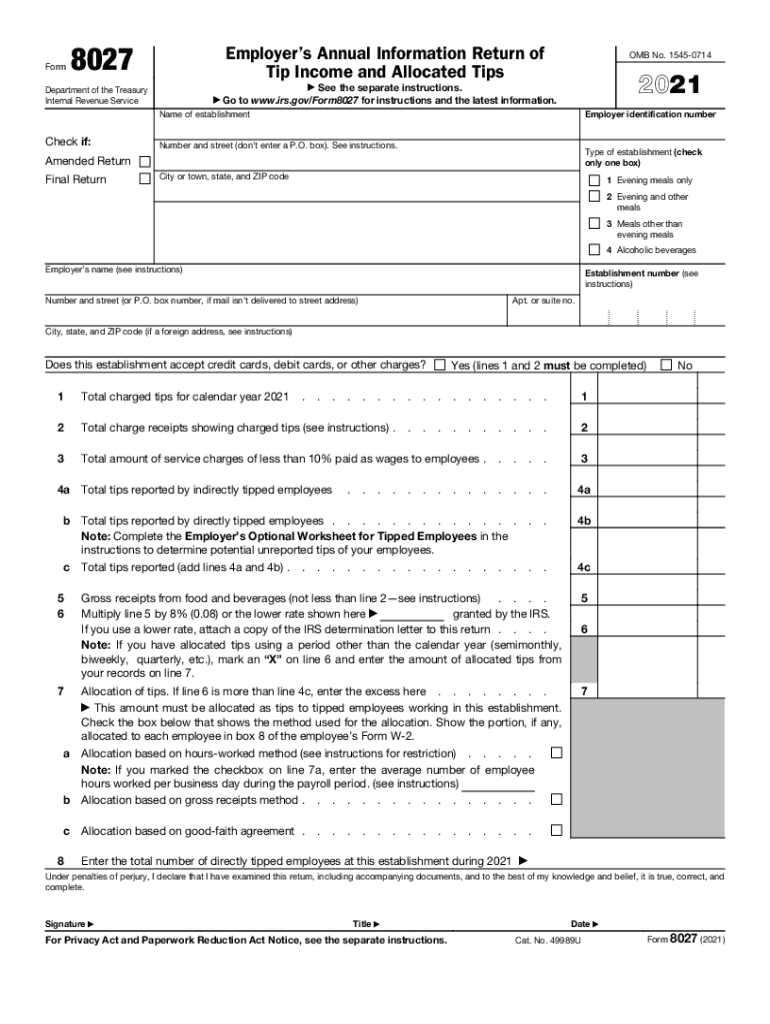

IRS Form 8027, also known as the Employee Tip Reporting Form, is a tax document used by businesses to report tips received by employees. This form is particularly relevant for establishments where tipping is customary, such as restaurants and bars. The purpose of the form is to ensure that tip income is accurately reported to the Internal Revenue Service (IRS) and that appropriate taxes are paid on this income. Businesses must file this form annually if they meet specific criteria, including having a certain number of employees who receive tips.

Steps to Complete IRS Form 8027

Completing IRS Form 8027 involves several key steps to ensure accuracy and compliance. First, businesses need to gather necessary information, including the total amount of tips received by employees during the reporting period. Next, they must calculate the percentage of tips reported by employees and provide this information on the form. The form requires details such as the employer's name, address, and Employer Identification Number (EIN). Finally, businesses must sign and date the form before submitting it to the IRS by the due date.

Filing Deadlines / Important Dates

IRS Form 8027 has specific filing deadlines that businesses must adhere to. Generally, the form must be submitted by the last day of February if filing on paper, or by March 31 if filing electronically. It is essential for businesses to be aware of these deadlines to avoid penalties and ensure compliance with IRS regulations. Keeping track of these dates can help businesses manage their reporting obligations effectively.

Legal Use of IRS Form 8027

The legal use of IRS Form 8027 is critical for businesses that rely on tips as part of their employees' income. Properly completing and submitting this form helps ensure compliance with federal tax laws. Failure to report tips accurately can lead to penalties, including fines and potential audits by the IRS. Businesses should maintain thorough records of tip income and employee reports to support the information provided on the form.

Key Elements of IRS Form 8027

IRS Form 8027 includes several key elements that businesses must complete accurately. These elements consist of the total tips received, the number of employees who received tips, and the percentage of tips reported by employees. Additionally, the form requires information about the employer, including their name, address, and EIN. Understanding these key components is essential for businesses to ensure that they report all necessary information correctly.

Examples of Using IRS Form 8027

IRS Form 8027 is commonly used in various scenarios, particularly in the hospitality industry. For example, a restaurant with several servers who receive tips from customers must report these tips using Form 8027. Similarly, a bar that employs bartenders who earn tips will also need to file this form. Each establishment must assess its tip income and employee reporting to determine its obligations under IRS guidelines.

Penalties for Non-Compliance

Businesses that fail to comply with IRS Form 8027 requirements may face significant penalties. Non-compliance can result in fines, interest on unpaid taxes, and potential audits. It is crucial for businesses to understand the importance of timely and accurate reporting to avoid these consequences. Maintaining proper records and ensuring that employees report their tips correctly can help mitigate the risk of penalties.

Quick guide on how to complete wwwirsgovpubirs pdf2021 form 8027 internal revenue service

Prepare Www irs govpubirs pdf2021 Form 8027 Internal Revenue Service effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, adjust, and eSign your documents swiftly and without interruptions. Manage Www irs govpubirs pdf2021 Form 8027 Internal Revenue Service on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and eSign Www irs govpubirs pdf2021 Form 8027 Internal Revenue Service with ease

- Locate Www irs govpubirs pdf2021 Form 8027 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to distribute your form—via email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, monotonous form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from any device of your choice. Modify and eSign Www irs govpubirs pdf2021 Form 8027 Internal Revenue Service and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2021 form 8027 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2021 form 8027 internal revenue service

The way to make an e-signature for a PDF file in the online mode

The way to make an e-signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The way to make an e-signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is IRS Form 8027?

IRS Form 8027 is a form used by certain employers to report annual information on tips received by employees. This form is essential for establishments that provide food or beverage services, helping them comply with the IRS regulations regarding tip reporting.

-

How can airSlate SignNow assist with IRS Form 8027 submissions?

airSlate SignNow simplifies the process of preparing and signing IRS Form 8027 by providing an intuitive platform for eSigning documents. Users can easily send and receive the completed form, ensuring timely submissions and compliance with IRS deadlines.

-

What features does airSlate SignNow offer for managing IRS Form 8027?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage for managing IRS Form 8027. These tools enhance collaboration and ensure your form is signed and submitted accurately and on time.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8027?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business sizes and needs. The cost is competitive and allows businesses to efficiently manage the eSigning process for IRS Form 8027 and other important documents.

-

Can airSlate SignNow integrate with other software for filing IRS Form 8027?

Absolutely! airSlate SignNow integrates seamlessly with a variety of business applications, making it easier to automate your workflow for IRS Form 8027. This integration allows for smoother data transfer and document management across platforms.

-

What are the benefits of using airSlate SignNow for IRS Form 8027?

Using airSlate SignNow for IRS Form 8027 offers numerous benefits, including enhanced efficiency, improved accuracy in submissions, and reduced paperwork. With its user-friendly interface, you can save time and ensure compliance with IRS regulations.

-

How secure is airSlate SignNow for handling IRS Form 8027?

airSlate SignNow prioritizes security, employing advanced encryption and compliance standards to protect your data. When managing IRS Form 8027, you can trust that your sensitive information is secure throughout the eSignature process.

Get more for Www irs govpubirs pdf2021 Form 8027 Internal Revenue Service

- Warranty deed for parents to child with reservation of life estate georgia form

- Warranty deed for separate or joint property to joint tenancy georgia form

- Warranty deed to separate property of one spouse to both as joint tenants with right of survivorship georgia form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries georgia form

- Warranty deed from limited partnership or llc is the grantor or grantee georgia form

- Georgia warranty deed form

- Warranty deed form 497304177

- Ga warranty deed 497304178 form

Find out other Www irs govpubirs pdf2021 Form 8027 Internal Revenue Service

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free