Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, the Commonwealth of the Northern Mariana Isla 2021

What is the Form 941 SS Rev June Employer's Quarterly Federal Tax Return?

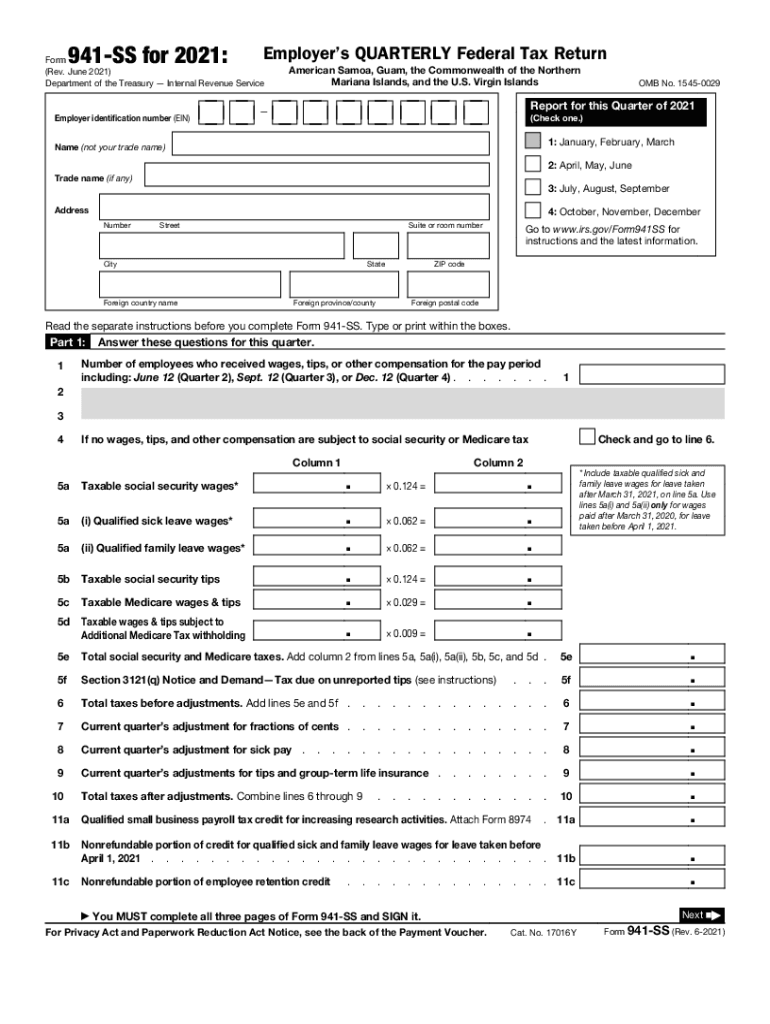

The Form 941 SS Rev June is a specialized version of the Employer's Quarterly Federal Tax Return designed specifically for employers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands. This form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages, as well as the employer's share of Social Security and Medicare taxes. It is essential for businesses operating in these territories to comply with federal tax regulations, ensuring accurate reporting and timely payments to the IRS.

Steps to Complete the Form 941 SS Rev June

Completing the Form 941 SS Rev June involves several key steps:

- Gather necessary information: Collect details about your business, including the Employer Identification Number (EIN), total wages paid, and taxes withheld.

- Fill out the form: Enter the required information in the appropriate fields, ensuring accuracy to avoid penalties.

- Calculate taxes: Determine the total taxes owed based on the wages and withholdings reported.

- Review the form: Double-check all entries for accuracy and completeness before submission.

- Submit the form: File the completed form with the IRS by the designated deadline.

Legal Use of the Form 941 SS Rev June

The Form 941 SS Rev June is legally binding when completed and submitted according to IRS guidelines. It must be signed and dated by an authorized representative of the business. The electronic submission of the form is permissible, provided it complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant regulations. This ensures that the form is recognized as a valid legal document in the eyes of the law.

Filing Deadlines for the Form 941 SS Rev June

Employers must file the Form 941 SS Rev June on a quarterly basis. The filing deadlines are as follows:

- For the first quarter (January to March): April 30

- For the second quarter (April to June): July 31

- For the third quarter (July to September): October 31

- For the fourth quarter (October to December): January 31 of the following year

It is crucial to meet these deadlines to avoid penalties and interest on unpaid taxes.

Form Submission Methods

The Form 941 SS Rev June can be submitted to the IRS through various methods:

- Online: Many employers choose to file electronically through IRS-approved e-file providers, which can streamline the submission process.

- Mail: The completed form can be mailed to the appropriate IRS address based on the employer's location and whether payment is included.

- In-Person: Although less common, employers may also deliver the form in person to their local IRS office.

Key Elements of the Form 941 SS Rev June

Understanding the key elements of the Form 941 SS Rev June is essential for accurate completion. The form includes sections for:

- Employer identification information

- Total number of employees

- Wages paid and taxes withheld

- Employer's share of Social Security and Medicare taxes

- Adjustments for any corrections from previous filings

Each section must be filled out carefully to ensure compliance with federal tax laws.

Quick guide on how to complete form 941 ss rev june 2021 employers quarterly federal tax return american samoa guam the commonwealth of the northern mariana

Effortlessly Prepare Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, The Commonwealth Of The Northern Mariana Isla on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the features you require to create, edit, and electronically sign your documents quickly and without complications. Handle Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, The Commonwealth Of The Northern Mariana Isla on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Modify and Electronically Sign Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, The Commonwealth Of The Northern Mariana Isla with Ease

- Find Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, The Commonwealth Of The Northern Mariana Isla and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with features specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or disorganized documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Revise and electronically sign Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, The Commonwealth Of The Northern Mariana Isla to ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 ss rev june 2021 employers quarterly federal tax return american samoa guam the commonwealth of the northern mariana

Create this form in 5 minutes!

How to create an eSignature for the form 941 ss rev june 2021 employers quarterly federal tax return american samoa guam the commonwealth of the northern mariana

The way to make an e-signature for a PDF document in the online mode

The way to make an e-signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an e-signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is Form 941 SS Rev June Employer's Quarterly Federal Tax Return?

Form 941 SS Rev June Employer's Quarterly Federal Tax Return is specifically designed for employers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands. This form is used to report income taxes, social security tax, and Medicare tax withheld from employee paychecks, making it essential for compliance with federal tax regulations.

-

How can airSlate SignNow assist with Form 941 SS Rev June submissions?

airSlate SignNow simplifies the submission process for Form 941 SS Rev June Employer's Quarterly Federal Tax Return by enabling users to easily fill out, sign, and send the document electronically. Our platform ensures that your submissions are secure, compliant, and can be completed in a fraction of the time compared to traditional methods.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Our pricing structure is competitive, providing cost-effective solutions for companies looking to handle Form 941 SS Rev June Employer's Quarterly Federal Tax Return efficiently while managing document signing and workflow needs.

-

What features does airSlate SignNow provide for handling Form 941 SS Rev June?

Key features for handling Form 941 SS Rev June with airSlate SignNow include easy document creation, custom templates, secure eSignature options, and compliance tracking. These tools enhance productivity and ensure that your Form 941 SS Rev June Employer's Quarterly Federal Tax Return is completed accurately and securely.

-

Are there any benefits to using airSlate SignNow for Form 941 SS Rev June?

Using airSlate SignNow for Form 941 SS Rev June Employer's Quarterly Federal Tax Return provides countless benefits, including time efficiency, reduced errors, and enhanced tracking capabilities. Our platform allows for a seamless eSignature experience, ensuring that your documents remain legally binding and compliant.

-

Can I integrate airSlate SignNow with other software for Form 941 SS Rev June?

Yes, airSlate SignNow offers various integrations with popular software solutions, allowing you to streamline your workflow while handling Form 941 SS Rev June Employer's Quarterly Federal Tax Return. Integrating with your current tools ensures a smooth process and increased efficiency within your organization.

-

Is airSlate SignNow secure for handling sensitive information on Form 941 SS Rev June?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your sensitive information when handling Form 941 SS Rev June Employer's Quarterly Federal Tax Return. Our platform encrypts all data and meets compliance standards to ensure the highest level of security for your documents.

Get more for Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, The Commonwealth Of The Northern Mariana Isla

- Georgia affidavit form

- Non foreign affidavit under irc 1445 georgia form

- Owners or sellers affidavit of no liens georgia form

- Affidavit financial status 497303907 form

- Complex will with credit shelter marital trust for large estates georgia form

- Marital legal separation and property settlement agreement where no children or no joint property or debts and divorce action 497303911 form

- Marital legal separation and property settlement agreement minor children no joint property or debts where divorce action filed 497303912 form

- Marital legal separation and property settlement agreement minor children no joint property or debts effective immediately 497303913 form

Find out other Form 941 SS Rev June Employer's Quarterly Federal Tax Return American Samoa, Guam, The Commonwealth Of The Northern Mariana Isla

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document