Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate Washington Form

What is the Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington

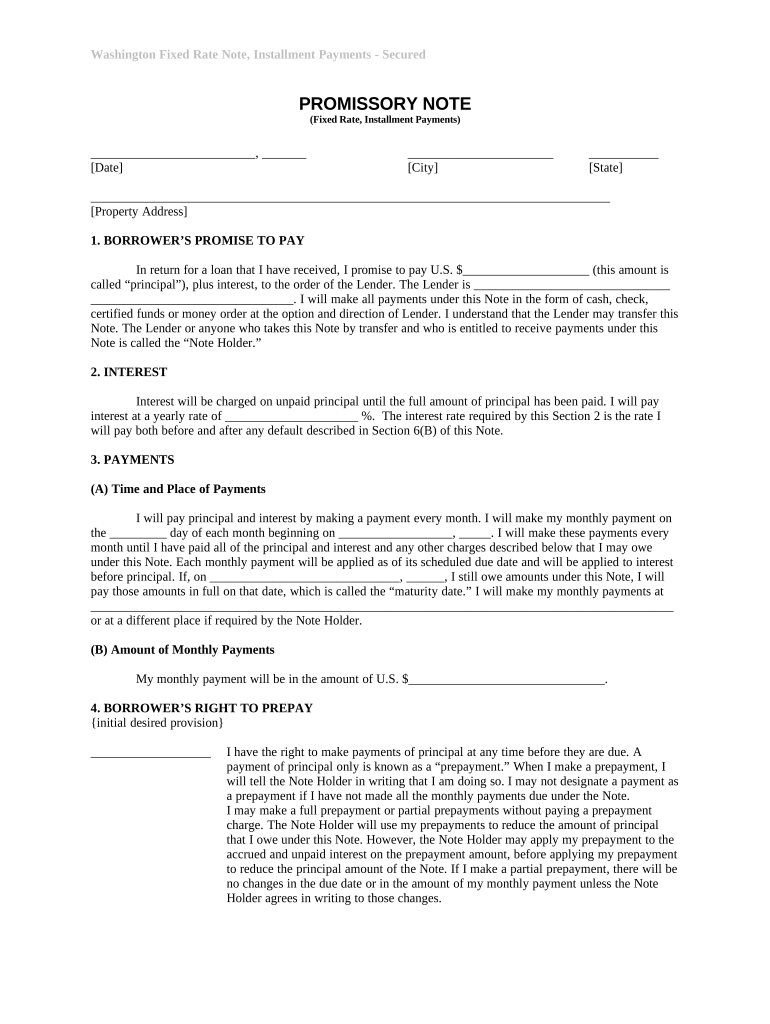

The Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines the terms of a loan secured by real estate in Washington state. This note specifies the borrower's obligation to repay the loan amount, including interest, over a predetermined period. It is a crucial instrument for lenders to ensure repayment while providing borrowers with a clear understanding of their financial commitments. The document is typically used in real estate transactions where property serves as collateral, ensuring that lenders have a legal claim to the property in case of default.

How to use the Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington

Using the Washington Installments Fixed Rate Promissory Note involves several key steps. First, both the lender and borrower should review the terms of the note, including the interest rate, repayment schedule, and any penalties for late payments. Next, the parties must fill out the note with accurate information, ensuring that all required fields are completed. Once the document is filled out, both parties should sign it, ideally in the presence of a witness or notary to enhance its legal standing. After signing, the lender should securely store the original document, while the borrower should retain a copy for their records.

Steps to complete the Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington

Completing the Washington Installments Fixed Rate Promissory Note involves several important steps:

- Gather necessary information, including borrower and lender details, loan amount, interest rate, and repayment terms.

- Fill out the document accurately, ensuring all fields are completed to avoid confusion.

- Review the terms and conditions to ensure mutual understanding between both parties.

- Sign the document, preferably in front of a notary or witness to enhance its validity.

- Distribute copies to all parties involved, ensuring that everyone has access to the signed agreement.

Key elements of the Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington

Key elements of this promissory note include:

- Loan Amount: The total amount borrowed by the borrower.

- Interest Rate: The fixed rate at which interest will accrue on the loan.

- Repayment Schedule: The timeline for repayment, including the frequency of payments (monthly, quarterly, etc.).

- Collateral Description: Details about the residential real estate securing the loan.

- Default Clauses: Conditions under which the lender can take action if the borrower fails to meet their obligations.

Legal use of the Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington

The legal use of the Washington Installments Fixed Rate Promissory Note is governed by state laws and regulations. For the document to be enforceable, it must meet specific legal requirements, such as being signed by both parties and containing all essential terms. Additionally, it must comply with federal and state laws regarding lending practices. Proper execution of the note ensures that it can be upheld in a court of law, providing protection for both the lender and borrower in the event of a dispute.

State-specific rules for the Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington

Washington state has specific regulations that govern the use of promissory notes. These rules include requirements for interest rates, disclosures, and the rights of borrowers and lenders. It is essential for both parties to be aware of these regulations to ensure compliance and avoid potential legal issues. For instance, Washington law may limit the maximum interest rate that can be charged, and lenders must provide clear disclosures regarding the terms of the loan to protect borrowers.

Quick guide on how to complete washington installments fixed rate promissory note secured by residential real estate washington

Effortlessly Prepare Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, as you can find the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The Easiest Way to Modify and eSign Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington with Ease

- Find Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Adjust and eSign Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington?

A Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington is a legal document used in real estate transactions. It outlines the terms of a loan agreement, with fixed repayments over a specified period, ensuring that the loan is secured by the residential property in Washington. This type of note provides clarity and protection for both lenders and borrowers.

-

What are the benefits of using a Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington?

Using a Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington provides numerous advantages, such as predictable payment schedules and legal security for real estate transactions. This fixed-rate agreement minimizes financial risk for borrowers, while lenders benefit from a guaranteed return on investment. It streamlines the borrowing process for residential properties in Washington.

-

How does airSlate SignNow facilitate the creation of a Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington?

airSlate SignNow offers an intuitive platform that simplifies the drafting and signing of a Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington. With customizable templates, users can quickly input specific details and generate a legally binding document. The platform ensures that all signatures are securely captured and stored.

-

Is it cost-effective to use airSlate SignNow for a Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington?

Yes, using airSlate SignNow for a Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington is a cost-effective solution. The platform reduces expenses associated with traditional paperwork and notary services. Additionally, the efficiency of electronic signing can save signNow time, allowing for quicker transactions.

-

Can I customize my Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily customize your Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington. The platform allows you to input specific terms, payment details, and relevant parties to suit your transaction needs, ensuring that the document meets all legal requirements.

-

What integrations does airSlate SignNow offer for creating a Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington?

airSlate SignNow integrates seamlessly with various popular business applications, enhancing the process of creating a Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington. You can easily connect with CRM systems, document management tools, and more, streamlining your workflow and increasing efficiency.

-

What security measures are in place for Washington Installments Fixed Rate Promissory Notes created with airSlate SignNow?

airSlate SignNow prioritizes security for its users. When you create a Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington, it is safeguarded with robust encryption and compliance standards. All data is stored securely, ensuring that your sensitive information remains protected throughout the entire signing process.

Get more for Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington

- Itemized and verified account of lien claim individual form

- To wit form

- Warranty deed is form

- Payment of adjusted compensation certificates hearings form

- Bank one deposit account control agreement secgov form

- Quitclaim deed is form

- To have and to hold the same together with all the hereditaments and appurtenances form

- Individual to three 3 individuals without alternative beneficiaryies form

Find out other Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate Washington

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe