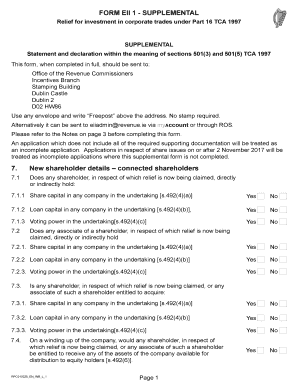

Form Eii 1 Supplemental Revenue Commissioners

What is the Form Eii 1 Supplemental Revenue Commissioners

The Form Eii 1 Supplemental Revenue Commissioners is a crucial document used in the context of Ireland relief investment. It serves as a declaration for individuals or entities seeking tax relief on investments made in eligible projects. This form is essential for ensuring compliance with tax regulations and for claiming the appropriate benefits associated with such investments. Understanding its purpose is vital for anyone looking to navigate the complexities of tax relief in Ireland.

How to use the Form Eii 1 Supplemental Revenue Commissioners

Using the Form Eii 1 Supplemental Revenue Commissioners involves several steps to ensure proper completion and submission. First, gather all necessary information, including details about the investment and personal identification. Next, fill out the form accurately, ensuring that all required fields are completed. After completing the form, review it for any errors before submission. This careful approach helps prevent delays in processing your application and ensures that you receive the tax relief you are entitled to.

Steps to complete the Form Eii 1 Supplemental Revenue Commissioners

Completing the Form Eii 1 Supplemental Revenue Commissioners requires a systematic approach:

- Gather relevant documents, including investment details and tax identification numbers.

- Fill out the form, ensuring that all sections are accurately completed.

- Double-check the information for accuracy and completeness.

- Submit the form through the appropriate channels, either online or by mail.

Following these steps carefully can facilitate a smoother application process and increase the likelihood of receiving the intended tax benefits.

Legal use of the Form Eii 1 Supplemental Revenue Commissioners

The legal use of the Form Eii 1 Supplemental Revenue Commissioners is governed by specific regulations that outline its validity and requirements. To be considered legally binding, the form must be filled out accurately and submitted in accordance with the relevant tax laws. Ensuring compliance with these regulations is essential for the form to be accepted by tax authorities and for the associated relief to be granted.

Required Documents

When completing the Form Eii 1 Supplemental Revenue Commissioners, certain documents are typically required to support your application. These may include:

- Proof of investment in eligible projects.

- Personal identification, such as a tax identification number.

- Any additional documentation that validates your claim for tax relief.

Having these documents ready can streamline the process and enhance your application’s credibility.

Filing Deadlines / Important Dates

Filing deadlines for the Form Eii 1 Supplemental Revenue Commissioners are critical to ensure timely submission and eligibility for tax relief. It is essential to be aware of these dates to avoid penalties or delays in processing. Typically, deadlines align with the tax year, and it is advisable to consult the latest guidelines or resources to confirm specific dates relevant to your situation.

Quick guide on how to complete form eii 1 supplemental revenue commissioners

Complete Form Eii 1 Supplemental Revenue Commissioners effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, edit, and electronically sign your documents without hurdles. Manage Form Eii 1 Supplemental Revenue Commissioners on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to alter and eSign Form Eii 1 Supplemental Revenue Commissioners with ease

- Obtain Form Eii 1 Supplemental Revenue Commissioners and click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to submit your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form Eii 1 Supplemental Revenue Commissioners to guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Ireland relief investment?

Ireland relief investment refers to financial initiatives designed to support companies that engage in business activities within Ireland. These investments are intended to stimulate economic growth and provide tax benefits to businesses while contributing to local job creation.

-

How can airSlate SignNow facilitate Ireland relief investment processes?

airSlate SignNow simplifies the documentation process for Ireland relief investment by allowing businesses to send and eSign necessary forms quickly. This streamlined approach ensures that all required documents are signed efficiently, which can accelerate the investment approval process.

-

What are the pricing options for using airSlate SignNow?

Our pricing for airSlate SignNow is competitive and designed to fit businesses of all sizes investing in Ireland relief investment. We offer various plans with features that cater to different needs, including essential eSigning functionalities and integrations with other platforms.

-

What features does airSlate SignNow offer for efficient document management?

airSlate SignNow offers a range of features to improve document management, including customizable templates, bulk send options, and real-time tracking of documents. These tools are particularly helpful for businesses involved in Ireland relief investment, ensuring that all transactions are smooth and compliant.

-

Can I integrate airSlate SignNow with other software I use?

Yes, airSlate SignNow supports integration with various software applications, including CRM and project management tools. This is especially beneficial for businesses managing Ireland relief investment projects, allowing for seamless workflow and document management across platforms.

-

What benefits does airSlate SignNow provide for businesses involved in investments?

Using airSlate SignNow offers many benefits, including increased efficiency, improved compliance, and reduced operational costs. For companies pursuing Ireland relief investment, these advantages translate to faster transactions and a more streamlined investment process.

-

Is airSlate SignNow secure for sensitive investment documents?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and robust data protection measures. Businesses handling sensitive documents related to Ireland relief investment can trust that their information remains confidential and secure.

Get more for Form Eii 1 Supplemental Revenue Commissioners

- Legal last will and testament form for single person with adult and minor children alaska

- Legal last will and testament form for single person with adult children alaska

- Legal last will and testament for married person with minor children from prior marriage alaska form

- Legal last will and testament form for married person with adult children from prior marriage alaska

- Legal last will and testament form for divorced person not remarried with adult children alaska

- Legal last will and testament form for divorced person not remarried with no children alaska

- Legal last will and testament form for divorced person not remarried with minor children alaska

- Alaska will 497295198 form

Find out other Form Eii 1 Supplemental Revenue Commissioners

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template