Form 13615 2016

What is the Form 13615

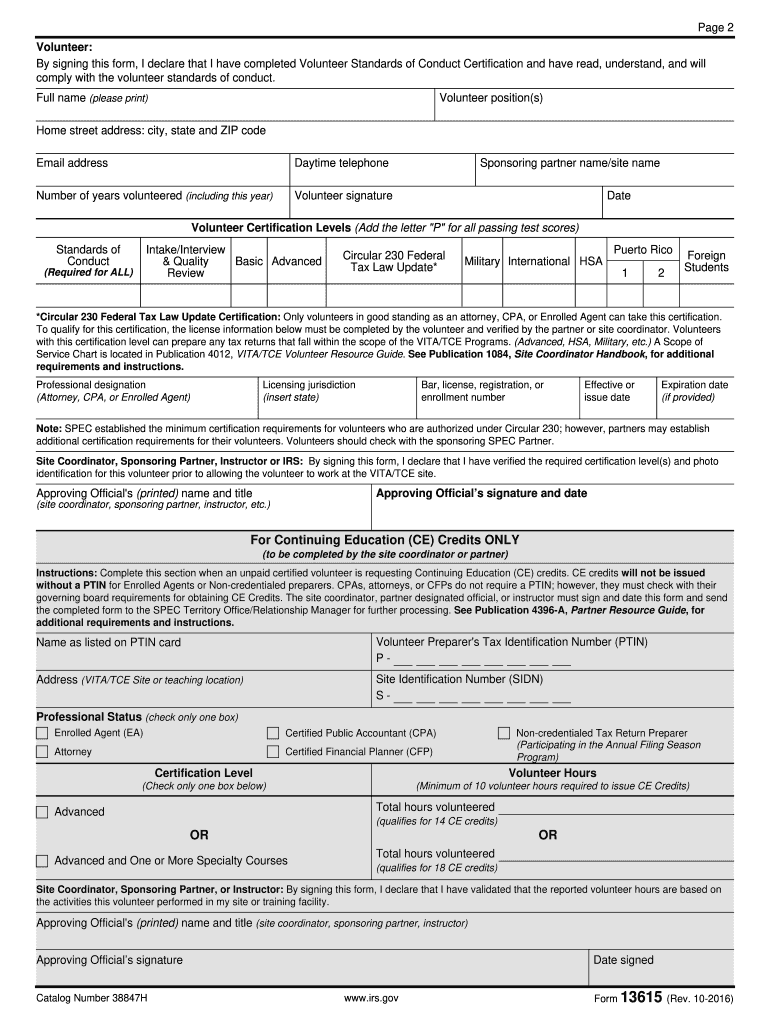

The Form 13615, also known as the Certification of a Qualified Tax Professional, is a document used in the United States to certify that a tax professional meets specific qualifications set by the IRS. This form is essential for individuals who wish to participate in certain IRS programs, including the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. Completing this form ensures that tax professionals are recognized for their expertise and can assist taxpayers effectively.

How to obtain the Form 13615

To obtain the Form 13615, individuals can visit the official IRS website or contact the IRS directly. The form is available for download in a PDF format, making it easy to access and print. Additionally, tax professionals involved in IRS programs may receive the form through training sessions or workshops organized by the IRS. Ensuring you have the latest version of the form is crucial, as updates may occur periodically.

Steps to complete the Form 13615

Completing the Form 13615 involves several key steps:

- Gather necessary information: Collect personal details, including your name, address, and Social Security number.

- Provide qualifications: Fill out sections that detail your qualifications and experience as a tax professional.

- Sign and date: Ensure you sign and date the form to certify that the information provided is accurate.

- Submit the form: Follow the submission guidelines provided by the IRS, either electronically or via mail.

Legal use of the Form 13615

The Form 13615 is legally binding when completed correctly and submitted in accordance with IRS guidelines. It serves as a certification that the tax professional has met the necessary qualifications to assist taxpayers. Compliance with all applicable laws and regulations is vital to ensure that the form is recognized by the IRS and can be used in official capacities.

Key elements of the Form 13615

Several key elements are essential to the Form 13615:

- Personal Information: Includes the tax professional's name, address, and Social Security number.

- Qualifications: Details regarding the professional's education, training, and experience in tax preparation.

- Signature: The form must be signed by the tax professional to validate the information provided.

- Date: The date of signing is required to establish the timeline of certification.

Form Submission Methods

The Form 13615 can be submitted through various methods depending on the IRS guidelines. Tax professionals may submit the completed form electronically through designated IRS platforms or by mailing a printed copy to the appropriate IRS address. It is important to verify the submission method that aligns with the specific IRS program for which the form is being used.

Quick guide on how to complete form 13615 2016

Effortlessly prepare Form 13615 on any device

Managing documents online has gained signNow traction among both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Form 13615 on any device using the airSlate SignNow applications for Android or iOS, simplifying any document-related process today.

How to edit and electronically sign Form 13615 with ease

- Obtain Form 13615 and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to finalize your changes.

- Choose how you want to send your form, whether via email, SMS, or invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow efficiently addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 13615 to maintain excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 13615 2016

Create this form in 5 minutes!

How to create an eSignature for the form 13615 2016

How to create an eSignature for the Form 13615 2016 online

How to create an eSignature for the Form 13615 2016 in Chrome

How to make an eSignature for putting it on the Form 13615 2016 in Gmail

How to generate an eSignature for the Form 13615 2016 from your smart phone

How to make an electronic signature for the Form 13615 2016 on iOS devices

How to make an electronic signature for the Form 13615 2016 on Android

People also ask

-

What is Form 13615 and how is it used with airSlate SignNow?

Form 13615 is a crucial document used for electronic signature verification and compliance. With airSlate SignNow, you can easily fill out and eSign Form 13615, ensuring that all necessary information is correctly submitted. This streamlined process saves time and enhances accuracy when handling important documents.

-

How much does it cost to use airSlate SignNow for Form 13615?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those requiring Form 13615. You can select from different subscription tiers, ensuring you only pay for the features you need. Check our pricing page for detailed information and find the plan that suits your budget.

-

What features does airSlate SignNow offer for managing Form 13615?

airSlate SignNow provides a comprehensive suite of features for managing Form 13615, including customizable templates, secure eSigning, and document tracking. These features help streamline the signing process and ensure that your Form 13615 is completed efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for Form 13615?

Yes, airSlate SignNow offers seamless integrations with various applications that can enhance your workflow for Form 13615. Whether you use CRM systems, cloud storage services, or project management tools, our platform allows you to connect and work efficiently across different applications.

-

What are the benefits of using airSlate SignNow for Form 13615?

Using airSlate SignNow for Form 13615 offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced compliance. The user-friendly interface simplifies the eSigning process, allowing you to focus on your core business tasks while ensuring that all signatures are collected in compliance with regulations.

-

Is airSlate SignNow secure for handling Form 13615?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your data, including Form 13615. We adhere to industry-leading security standards, ensuring that your sensitive information remains confidential and secure throughout the signing process.

-

How long does it take to eSign Form 13615 with airSlate SignNow?

eSigning Form 13615 with airSlate SignNow is a quick and efficient process that typically takes just a few minutes. Once you've uploaded the document and set up the necessary fields, you can send it for signature instantly, speeding up your workflow and minimizing delays.

Get more for Form 13615

- Citibank direct deposit authorization form

- Depository form

- Travelers mpl application form

- Loft board coverage application form

- Uniform health application

- Application for patients wishing to transfer gp within form

- Cattery booking form

- Rodent abatement declaration this form is used to capture the applicants acknowledgment of the kirkland municipal code

Find out other Form 13615

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate