Form 13615 Rev 10 2021

What is the Form 13615 Rev 10

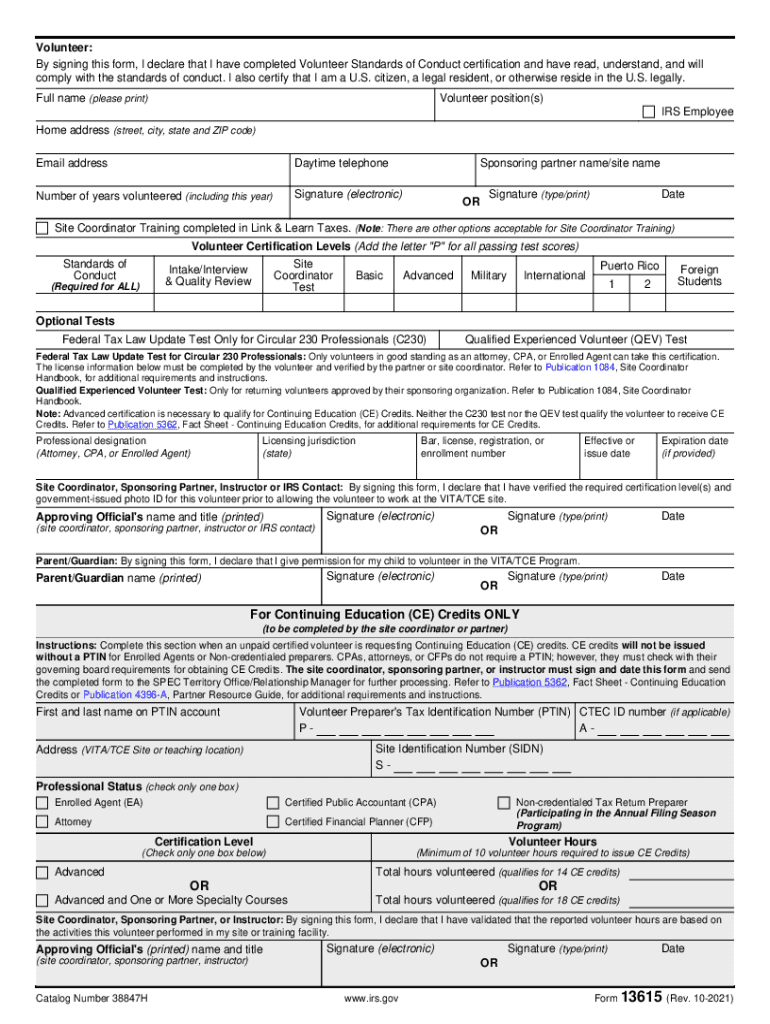

The Form 13615, also known as the Volunteer Agreement, is a document utilized by volunteers participating in the Volunteer Income Tax Assistance (VITA) program. This form is essential for establishing the responsibilities and expectations of volunteers who assist in preparing tax returns for low to moderate-income individuals. The latest version, Rev 10, includes updated guidelines and requirements to ensure compliance with IRS standards. Understanding the purpose of this form is crucial for volunteers to effectively contribute to the program while adhering to legal and ethical standards.

How to use the Form 13615 Rev 10

Using the Form 13615 involves several steps to ensure that volunteers are properly registered and understand their roles. First, volunteers must fill out the form with accurate personal information, including their name, contact details, and any relevant tax preparation experience. Once completed, the form should be signed to confirm the volunteer's commitment to the VITA program. This signed document helps maintain accountability and ensures that volunteers are aware of their obligations regarding confidentiality and ethical conduct while assisting clients.

Steps to complete the Form 13615 Rev 10

Completing the Form 13615 requires careful attention to detail. Here are the steps to follow:

- Begin by downloading the latest version of the form from the IRS website or obtaining it through your VITA coordinator.

- Fill in your personal information accurately, including your full name, address, and phone number.

- Indicate your availability and the specific role you will undertake as a volunteer.

- Review the form for any errors or omissions before signing it.

- Submit the completed form to your VITA program coordinator for processing.

Legal use of the Form 13615 Rev 10

The legal use of the Form 13615 is governed by IRS regulations that outline the responsibilities of volunteers within the VITA program. By signing the form, volunteers agree to adhere to the guidelines set forth by the IRS, which include maintaining client confidentiality and providing accurate tax assistance. This legal framework ensures that volunteers operate within the bounds of the law while offering essential services to the community.

Key elements of the Form 13615 Rev 10

Several key elements are crucial to the Form 13615. These include:

- Volunteer Information: Personal details that identify the volunteer.

- Commitment Statement: A declaration of the volunteer's agreement to follow the program's guidelines.

- Signature: The volunteer's signature, which signifies their understanding and acceptance of the terms outlined in the form.

- Coordinator Signature: The signature of the VITA program coordinator, confirming the volunteer's registration.

Form Submission Methods (Online / Mail / In-Person)

The Form 13615 can be submitted through various methods depending on the VITA program's specific requirements. Typically, volunteers may submit the form in person to their program coordinator during training sessions. Some programs may also allow for electronic submissions via email or secure online portals. It is important for volunteers to confirm the preferred submission method with their local VITA program to ensure timely processing and compliance with program guidelines.

Quick guide on how to complete form 13615 rev 10 2021

Complete Form 13615 Rev 10 effortlessly on any device

Digital document management has become increasingly favored by corporations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct forms and securely store them online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 13615 Rev 10 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign Form 13615 Rev 10 with ease

- Locate Form 13615 Rev 10 and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), an invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious searches for forms, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form 13615 Rev 10 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 13615 rev 10 2021

Create this form in 5 minutes!

How to create an eSignature for the form 13615 rev 10 2021

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

The best way to make an e-signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What is form 13615 and how do I use it with airSlate SignNow?

Form 13615 is a critical document for tax professionals that allows for the completion of tax returns. With airSlate SignNow, you can easily eSign and send this form securely, ensuring compliance and efficiency in your practices.

-

What features does airSlate SignNow offer for managing form 13615?

airSlate SignNow provides comprehensive features for managing form 13615, including easy eSignature capabilities, customizable templates, and document tracking. These features streamline the signing process, helping you manage your documents seamlessly.

-

Is there a cost associated with using airSlate SignNow for form 13615?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Whether you need basic features for form 13615 or advanced functionalities, you can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for handling form 13615?

Absolutely! airSlate SignNow supports integrations with many popular applications, allowing you to link your form 13615 processes with existing workflows. This ensures a seamless experience and enhances productivity across your tools.

-

How does airSlate SignNow ensure the security of my form 13615?

airSlate SignNow prioritizes security, utilizing encryption and secure cloud storage to protect your form 13615 and other sensitive documents. With compliance to industry standards, your data is safe and accessible only to authorized users.

-

What are the benefits of using airSlate SignNow for form 13615 over traditional methods?

Using airSlate SignNow for form 13615 eliminates paperwork, speeds up the signing process, and reduces errors associated with manual entry. These benefits lead to greater efficiency and a better overall experience for both clients and tax professionals.

-

Can I access form 13615 from mobile devices using airSlate SignNow?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing you to access and manage form 13615 from any device, anywhere. This flexibility ensures that you can handle important documents while on the go.

Get more for Form 13615 Rev 10

- Ct agreement 481379330 form

- Connecticut subpoena civil form

- Connecticut attorney retirement written notice form

- Connecticut sentence modification application motion and order form

- Connecticut motion to approve arbitration agreement in family cases form

- Connecticut affidavit consent to termination of parental rights form

- Connecticut order of notice petition termination parental rights form

- Connecticut small estate affidavit in lieu of administration form

Find out other Form 13615 Rev 10

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself