Get Form W 4 SP Employee's Withholding Certificate Spanish 2022

What is the W-4 Form 2023 Spanish?

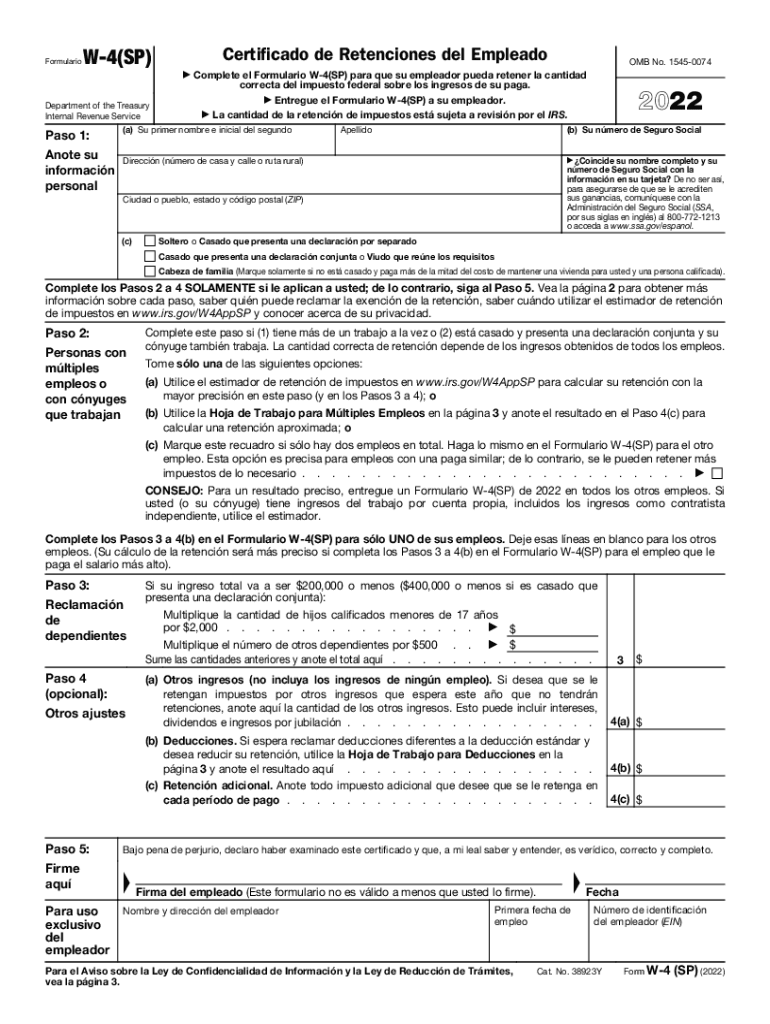

The W-4 Form 2023 Spanish, officially known as the Employee's Withholding Certificate, is a crucial document for employees in the United States. It allows employees to indicate their tax withholding preferences to their employers. By completing this form, workers can ensure that the correct amount of federal income tax is withheld from their paychecks, helping them avoid underpayment or overpayment of taxes. The Spanish version of this form is designed to assist Spanish-speaking employees in understanding their tax obligations and making informed decisions regarding their withholding allowances.

How to Complete the W-4 Form 2023 Spanish

Filling out the W-4 Form 2023 Spanish involves several key steps:

- Personal Information: Begin by providing your name, Social Security number, and address. This information is essential for your employer to process the form accurately.

- Filing Status: Indicate your filing status, which can be single, married filing jointly, married filing separately, or head of household. This choice affects your tax rates and withholding calculations.

- Allowances: Determine the number of allowances you are claiming. The more allowances you claim, the less tax will be withheld from your paycheck. Use the worksheet provided with the form to calculate the appropriate number.

- Additional Withholding: If you want to withhold an additional amount from your paycheck, specify this in the designated section.

- Signature: Finally, sign and date the form to certify that the information provided is accurate.

Legal Use of the W-4 Form 2023 Spanish

The W-4 Form 2023 Spanish is legally valid when completed correctly and submitted to your employer. It complies with the Internal Revenue Service (IRS) regulations, ensuring that the withholding amounts are appropriate for your financial situation. Electronic signatures are also accepted, provided that they meet the requirements set forth by the ESIGN Act and UETA. Using a reliable electronic signature platform can help ensure that your form is executed properly and securely.

Key Elements of the W-4 Form 2023 Spanish

Several key elements make up the W-4 Form 2023 Spanish:

- Personal Information: Essential for identification and processing.

- Filing Status: Determines tax rates and withholding amounts.

- Allowances: Affects the amount of tax withheld from your paycheck.

- Additional Withholding: Allows for extra tax withholding if desired.

- Signature and Date: Validates the form and confirms the accuracy of the information provided.

IRS Guidelines for the W-4 Form 2023 Spanish

The IRS provides specific guidelines for completing the W-4 Form 2023 Spanish. These include instructions on how to calculate allowances, the importance of keeping the form updated with any changes in personal circumstances, and the deadlines for submission. It is advisable to review these guidelines annually or whenever there is a significant life change, such as marriage, divorce, or the birth of a child, to ensure that your withholding remains accurate.

Form Submission Methods for the W-4 Form 2023 Spanish

The W-4 Form 2023 Spanish can be submitted to your employer through various methods:

- In-Person: Handing the completed form directly to your HR department or payroll administrator.

- Mail: Sending the form via postal service, although this method may take longer for processing.

- Electronic Submission: Utilizing an electronic signature platform to submit the form digitally, ensuring faster processing and secure handling of your information.

Quick guide on how to complete get 2021 form w 4 sp employees withholding certificate spanish

Prepare Get Form W 4 SP Employee's Withholding Certificate Spanish effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Get Form W 4 SP Employee's Withholding Certificate Spanish on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and eSign Get Form W 4 SP Employee's Withholding Certificate Spanish with ease

- Find Get Form W 4 SP Employee's Withholding Certificate Spanish and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Get Form W 4 SP Employee's Withholding Certificate Spanish and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get 2021 form w 4 sp employees withholding certificate spanish

Create this form in 5 minutes!

People also ask

-

What is the w 4 form 2023 Spanish and why is it important?

The w 4 form 2023 Spanish is the Spanish version of the IRS Form W-4, which employees use to inform their employers of their tax withholding preferences. It's crucial for ensuring that the correct amount of federal income tax is withheld from your paycheck, helping you avoid any unexpected tax bills during tax season. Understanding this form can signNowly impact your financial planning.

-

How can I access the w 4 form 2023 Spanish via airSlate SignNow?

With airSlate SignNow, accessing the w 4 form 2023 Spanish is easy. You can either upload your existing forms or use our library of templates, which includes the Spanish version of the W-4. This allows you to quickly facilitate collections and signatures without any hassle.

-

What features does airSlate SignNow offer for handling the w 4 form 2023 Spanish?

airSlate SignNow offers a variety of features that enhance the handling of the w 4 form 2023 Spanish. These include easy e-signature capabilities, customizable templates, and real-time tracking of document status. This ensures that your forms are completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the w 4 form 2023 Spanish?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Our pricing tiers are tailored to meet the needs of different organizations, ensuring that you get the best value for managing documents like the w 4 form 2023 Spanish.

-

Can I integrate airSlate SignNow with other tools for using the w 4 form 2023 Spanish?

Absolutely! airSlate SignNow provides integration capabilities with various tools that can enhance your workflow for the w 4 form 2023 Spanish. Whether you’re using CRM systems, accounting software, or other document management solutions, you can streamline your processes seamlessly.

-

What are the benefits of using airSlate SignNow for the w 4 form 2023 Spanish?

Using airSlate SignNow for the w 4 form 2023 Spanish offers numerous benefits, including time savings, reduced errors through automated workflows, and secure document storage. This all-in-one solution simplifies the signing and filing process, allowing you to focus on your core business activities.

-

Is the w 4 form 2023 Spanish compliant with IRS regulations?

Yes, the w 4 form 2023 Spanish provided by airSlate SignNow is compliant with IRS regulations. Our templates are regularly updated to ensure that they meet all legal requirements, giving you peace of mind when completing your tax withholding documentation.

Get more for Get Form W 4 SP Employee's Withholding Certificate Spanish

- Warranty deed from husband and wife to llc new jersey form

- Release of lien form nj

- Landlord tenant notice 497319203 form

- Nj letter notice form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497319205 form

- New jersey repair form

- Nj tenant notice form

- Letter tenant landlord 497319208 form

Find out other Get Form W 4 SP Employee's Withholding Certificate Spanish

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word