Form W 4 Sp Employee's Withholding Certificate Spanish Version 2024-2026

What is the Form W-4 SP Employee's Withholding Certificate Spanish Version

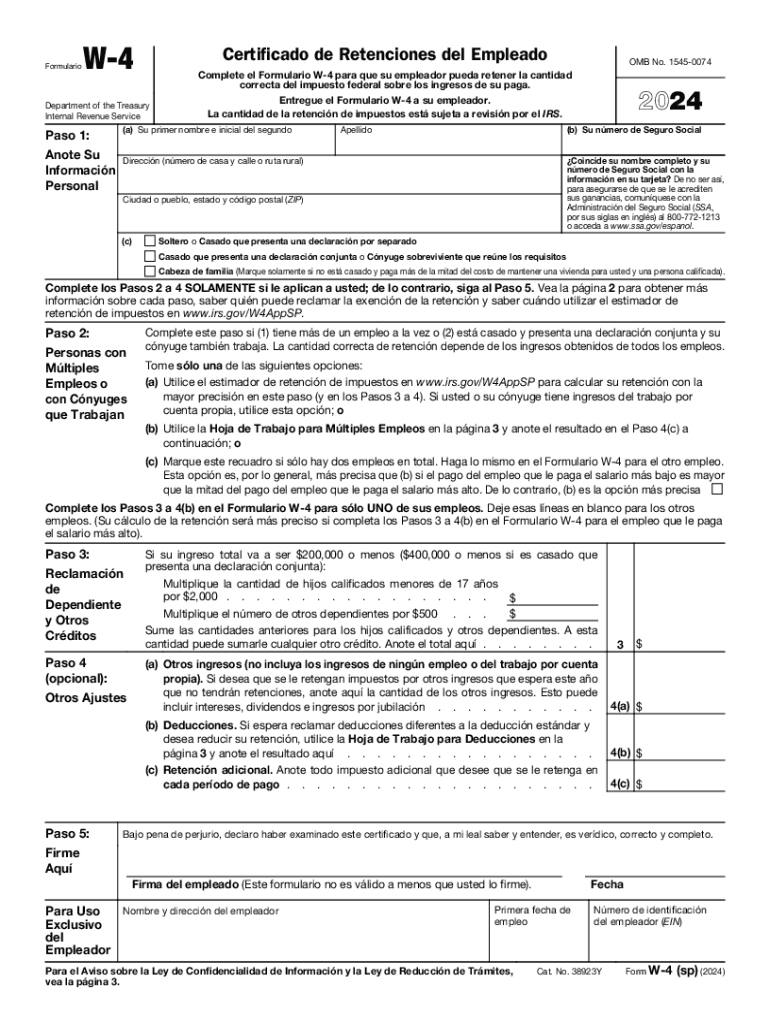

The Form W-4 SP, known as the Employee's Withholding Certificate in Spanish, is a crucial document for employees in the United States who prefer to complete their tax withholding information in Spanish. This form allows employees to communicate their tax withholding preferences to their employers, ensuring that the correct amount of federal income tax is withheld from their paychecks. The W-4 SP is specifically designed for Spanish-speaking individuals, making it more accessible for those who may not be comfortable with English.

How to use the Form W-4 SP Employee's Withholding Certificate Spanish Version

Using the Form W-4 SP involves several straightforward steps. First, employees must fill out their personal information, including their name, address, and Social Security number. Next, they will indicate their filing status, such as single or married. The form also includes sections where employees can claim allowances and specify any additional amount they wish to have withheld. Once completed, the form should be submitted to the employer, who will use it to adjust the employee's tax withholding accordingly.

Steps to complete the Form W-4 SP Employee's Withholding Certificate Spanish Version

Completing the Form W-4 SP is a simple process. Here are the key steps:

- Enter your personal details, including your name and Social Security number.

- Choose your filing status (e.g., single, married).

- Claim the number of allowances you are entitled to.

- Specify any additional amount you want withheld from your paycheck.

- Sign and date the form before submitting it to your employer.

It is essential to review the form for accuracy to ensure that your tax withholding aligns with your financial situation.

Legal use of the Form W-4 SP Employee's Withholding Certificate Spanish Version

The Form W-4 SP is legally recognized by the IRS as a valid method for Spanish-speaking employees to communicate their withholding preferences. Employers are required to accept this form in the same manner as the English version. It is important for employees to understand that submitting an accurate W-4 SP can help prevent under-withholding or over-withholding of taxes, which can lead to financial complications during tax season.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Form W-4 SP. Employees should refer to these guidelines to ensure compliance with tax regulations. The IRS recommends that employees review their withholding status annually or whenever they experience significant life changes, such as marriage or the birth of a child. This ensures that their withholding remains appropriate based on their current financial situation.

Filing Deadlines / Important Dates

While there are no specific deadlines for submitting the Form W-4 SP, it is advisable to complete it as soon as employment begins or when there are changes in personal circumstances. Employers typically process the form promptly to adjust withholdings in the upcoming pay periods. Additionally, employees should be aware of tax filing deadlines to avoid penalties for underpayment.

Create this form in 5 minutes or less

Find and fill out the correct form w 4 sp employees withholding certificate spanish version

Create this form in 5 minutes!

How to create an eSignature for the form w 4 sp employees withholding certificate spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w 4 Spanish form and why is it important?

The w 4 Spanish form is the Spanish version of the IRS W-4 form, which employees use to indicate their tax withholding preferences. It is important because it ensures that Spanish-speaking employees can accurately complete their tax information, helping them avoid under- or over-withholding of taxes.

-

How can airSlate SignNow help with the w 4 Spanish form?

airSlate SignNow provides an easy-to-use platform for businesses to send and eSign the w 4 Spanish form. With our solution, you can streamline the process, ensuring that employees can fill out and submit their forms quickly and securely.

-

Is there a cost associated with using airSlate SignNow for the w 4 Spanish form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solution ensures that you can manage the w 4 Spanish form and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing the w 4 Spanish form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of the w 4 Spanish form. These features help ensure compliance and improve efficiency in handling tax documents.

-

Can I integrate airSlate SignNow with other software for the w 4 Spanish form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the w 4 Spanish form alongside your existing tools. This integration capability enhances workflow efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for the w 4 Spanish form?

Using airSlate SignNow for the w 4 Spanish form provides numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. Our platform empowers businesses to manage tax documents efficiently, ensuring compliance and enhancing employee satisfaction.

-

Is airSlate SignNow user-friendly for completing the w 4 Spanish form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for employees to complete the w 4 Spanish form. The intuitive interface guides users through the process, ensuring that they can fill out and submit their forms without confusion.

Get more for Form W 4 sp Employee's Withholding Certificate Spanish Version

Find out other Form W 4 sp Employee's Withholding Certificate Spanish Version

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT