W 4 Espanol Form 2005

What is the W-4 Español Form

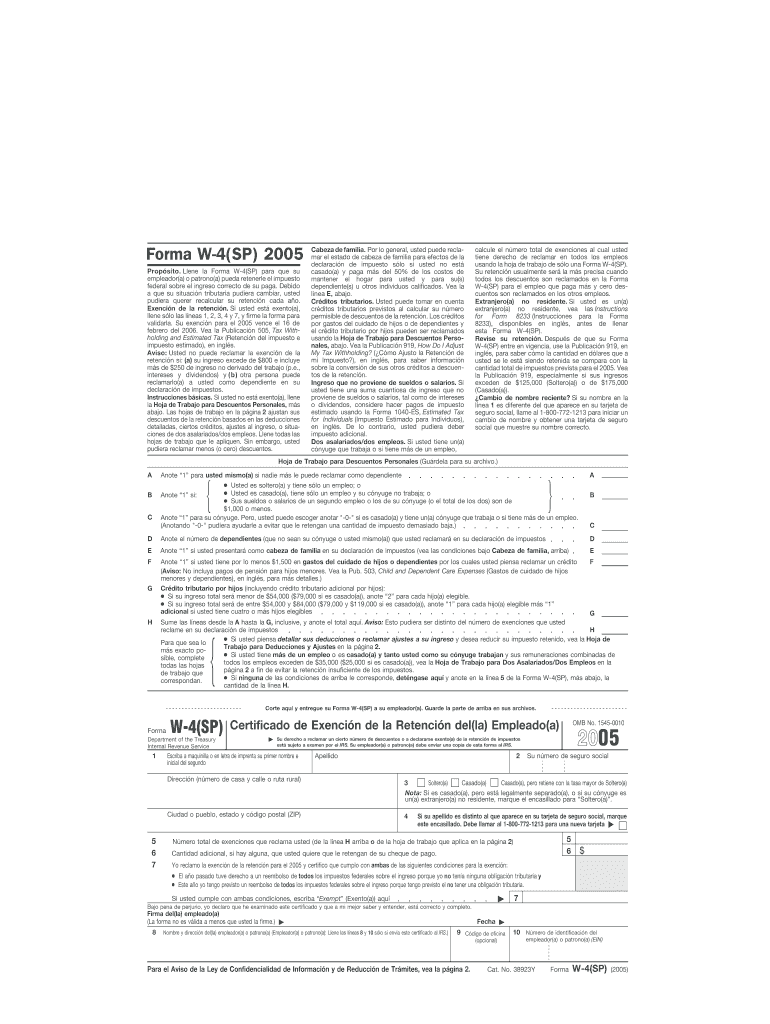

The W-4 Español Form is the Spanish version of the IRS Form W-4, which is used by employees in the United States to indicate their tax withholding preferences. This form helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck. By completing the W-4 Español Form, employees can ensure that their tax withholdings align with their financial situation, including factors such as marital status, number of dependents, and additional income.

How to Use the W-4 Español Form

Using the W-4 Español Form involves a few straightforward steps. First, download the form from a reliable source or obtain a physical copy from your employer. Next, fill out the required sections, including personal information, marital status, and any additional withholding allowances. Once completed, submit the form to your employer, who will use the information to adjust your tax withholdings accordingly. It is important to review and update the form whenever there are changes in your personal or financial circumstances.

Steps to Complete the W-4 Español Form

Completing the W-4 Español Form requires careful attention to detail. Follow these steps:

- Provide your personal information, including your name, address, and Social Security number.

- Select your filing status, such as single or married.

- Indicate the number of dependents you have.

- Specify any additional amount you want withheld from each paycheck, if applicable.

- Sign and date the form before submitting it to your employer.

Legal Use of the W-4 Español Form

The W-4 Español Form is legally recognized for tax withholding purposes in the United States. To be valid, the form must be completed accurately and submitted to your employer. Employers are required to maintain a copy of the form for their records and to ensure compliance with IRS regulations. It is essential to keep the information up to date, as any inaccuracies could lead to improper withholding and potential tax liabilities.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the W-4 Español Form, it is advisable to complete it as soon as you start a new job or experience a change in your financial situation. Additionally, if you wish to adjust your withholdings, submitting a new form at the beginning of the year or before a significant life event can help ensure that your tax situation remains optimal. Keeping track of important tax deadlines, such as the filing date for your annual tax return, is also crucial.

Examples of Using the W-4 Español Form

The W-4 Español Form can be utilized in various scenarios. For instance, a newly married individual may need to update their withholding status to reflect their new marital status, potentially lowering their tax liability. Similarly, a parent may complete the form to claim additional allowances for dependents, which can increase their take-home pay. Each situation is unique, and understanding how to use the W-4 Español Form effectively can lead to better financial management.

Quick guide on how to complete w 4 espanol 2005 form

Complete W 4 Espanol Form effortlessly on any gadget

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow furnishes you with all the resources required to create, modify, and electronically sign your documents swiftly without hindrances. Manage W 4 Espanol Form on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign W 4 Espanol Form with ease

- Find W 4 Espanol Form and then click Get Form to begin.

- Utilize the resources we provide to finish your form.

- Emphasize important sections of the documents or obscure sensitive data with the tools airSlate SignNow provides specifically for these tasks.

- Craft your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a standard wet ink signature.

- Review the information and then hit the Done button to retain your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form searches, or mistakes that require new document reproductions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign W 4 Espanol Form to ensure outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 4 espanol 2005 form

Create this form in 5 minutes!

How to create an eSignature for the w 4 espanol 2005 form

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What is the W 4 Espanol Form?

The W 4 Espanol Form is the Spanish version of the standard W-4 form used for tax withholding. It allows Spanish-speaking employees to accurately complete their tax information in their preferred language, ensuring clarity and understanding. Using the W 4 Espanol Form can help prevent mistakes in tax withholding.

-

How can I fill out the W 4 Espanol Form using airSlate SignNow?

You can easily fill out the W 4 Espanol Form using airSlate SignNow by uploading the form and inviting your employees to complete it digitally. Our platform provides intuitive editing tools and the ability to sign electronically. This streamlines the process and ensures that the W 4 Espanol Form is submitted correctly and quickly.

-

Is there a cost associated with using the W 4 Espanol Form on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it offers flexible pricing plans based on the features you need. You can choose a plan that suits your business size and document volume. The investment ensures that you'll have access to an efficient and reliable way to manage your W 4 Espanol Form and other documents.

-

What are the benefits of using the W 4 Espanol Form with airSlate SignNow?

Using the W 4 Espanol Form with airSlate SignNow provides numerous benefits, such as easy accessibility, time savings, and electronic storage for future reference. It enhances communication with Spanish-speaking employees and minimizes errors compared to traditional paper forms. Additionally, it helps keep your company compliant with IRS regulations.

-

Can I integrate airSlate SignNow with other software for managing the W 4 Espanol Form?

Yes, airSlate SignNow offers various integrations with popular business applications, making it easy to incorporate the W 4 Espanol Form into your existing workflows. You can connect with tools like CRM systems, HR software, and cloud storage services. This integration helps streamline the document management process, ensuring all your paperwork is in one place.

-

Is the W 4 Espanol Form legally valid if filled out electronically?

Yes, the W 4 Espanol Form filled out electronically via airSlate SignNow is legally valid. Our platform complies with electronic signature laws, ensuring that all signed documents meet legal requirements. This allows you to process your W 4 Espanol Form quickly and safely, without the need for physical paperwork.

-

How Secure is the W 4 Espanol Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The W 4 Espanol Form and all your documents are protected with industry-standard encryption protocols. We also implement authentication measures and compliance with data protection regulations to ensure that your information remains confidential and secure.

Get more for W 4 Espanol Form

Find out other W 4 Espanol Form

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement