Form W 4 SP Certificado De Exencion De La Retencion 2023

What is the Form W-4 SP Certificado De Exencion De La Retencion

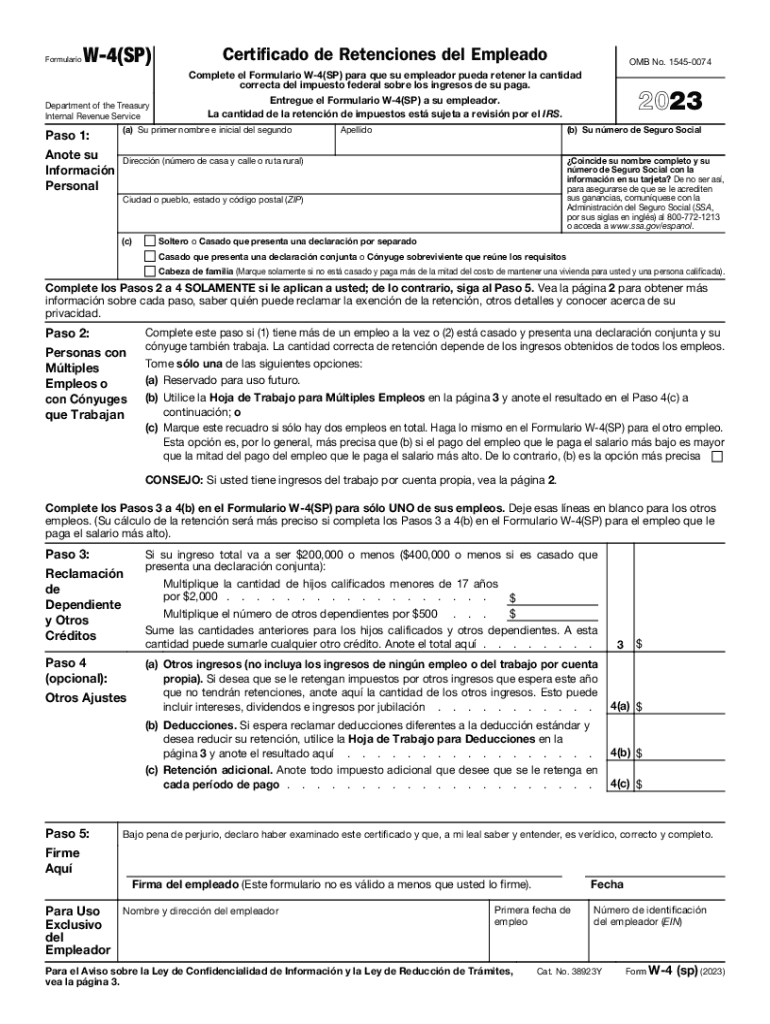

The Form W-4 SP, also known as Certificado De Exencion De La Retencion, is a crucial document for employees in the United States who wish to claim exemption from federal income tax withholding. This form is specifically designed for Spanish-speaking individuals, ensuring they can accurately communicate their tax withholding preferences. By submitting the W-4 SP, employees can inform their employers that they meet certain criteria for exemption, thus avoiding unnecessary tax withholding from their paychecks.

Steps to Complete the Form W-4 SP Certificado De Exencion De La Retencion

Completing the Form W-4 SP involves several straightforward steps:

- Personal Information: Fill in your name, address, and Social Security number at the top of the form.

- Exemption Claim: Indicate your eligibility for exemption. You must meet specific criteria, such as having no tax liability in the previous year and expecting none in the current year.

- Signature: Sign and date the form to certify that the information provided is accurate.

- Submission: Provide the completed form to your employer, who will use it to adjust your tax withholding accordingly.

Legal Use of the Form W-4 SP Certificado De Exencion De La Retencion

The W-4 SP is legally recognized by the IRS and must be filled out accurately to ensure compliance with federal tax laws. It is essential for employees to understand that claiming exemption when not eligible can lead to penalties. Employers are required to keep this form on file and use it to determine the appropriate amount of federal income tax withholding from employees’ paychecks.

Eligibility Criteria for the Form W-4 SP Certificado De Exencion De La Retencion

To qualify for exemption using the W-4 SP, individuals must meet specific criteria:

- Have had no federal income tax liability in the previous year.

- Expect to have no federal income tax liability in the current year.

- Be a resident alien or meet other IRS-defined criteria for exemption.

It is important to review these criteria carefully to ensure compliance and avoid potential tax issues.

How to Obtain the Form W-4 SP Certificado De Exencion De La Retencion

The Form W-4 SP can be easily obtained from the IRS website or through your employer. Many employers provide this form as part of the onboarding process for new employees. Additionally, it is available in printable format, allowing individuals to fill it out by hand if preferred. Always ensure you are using the most current version of the form to avoid any complications.

IRS Guidelines for the Form W-4 SP Certificado De Exencion De La Retencion

The IRS provides specific guidelines regarding the use of the W-4 SP. These guidelines outline who is eligible to claim exemption, the process for completing the form, and the responsibilities of both employees and employers. It is crucial to refer to these guidelines to ensure that all requirements are met and that the form is submitted correctly.

Quick guide on how to complete form w 4 sp certificado de exencion de la retencion

Effortlessly complete Form W 4 SP Certificado De Exencion De La Retencion on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without delays. Handle Form W 4 SP Certificado De Exencion De La Retencion seamlessly on any device with airSlate SignNow's Android or iOS applications and streamline your document processes today.

How to easily modify and eSign Form W 4 SP Certificado De Exencion De La Retencion

- Obtain Form W 4 SP Certificado De Exencion De La Retencion and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Form W 4 SP Certificado De Exencion De La Retencion and ensure exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 4 sp certificado de exencion de la retencion

Create this form in 5 minutes!

How to create an eSignature for the form w 4 sp certificado de exencion de la retencion

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the W4 Spanish 2024 form and why is it important?

The W4 Spanish 2024 form is a crucial tax document used by employees to determine the amount of federal income tax withheld from their paychecks. This form is available in Spanish for Spanish-speaking employees, ensuring clarity in tax matters. Completing the W4 accurately can help avoid tax underpayment or overpayment, making it essential for financial planning.

-

How can airSlate SignNow help in completing the W4 Spanish 2024 form?

airSlate SignNow simplifies the process of filling out the W4 Spanish 2024 form by providing an easy-to-use digital platform. Users can complete, sign, and send the form securely, ensuring compliance with IRS requirements. Additionally, our platform allows for instant access to signed forms, enhancing efficiency in managing tax documents.

-

What are the pricing options for using airSlate SignNow for the W4 Spanish 2024?

airSlate SignNow offers affordable pricing plans suitable for businesses of all sizes. Whether you need basic electronic signatures or advanced document management features for the W4 Spanish 2024, we have a plan that fits your needs. Our pricing is transparent with no hidden fees, allowing you to budget effectively for your document solutions.

-

Is the W4 Spanish 2024 form customizable on airSlate SignNow?

Yes, airSlate SignNow allows users to customize the W4 Spanish 2024 form to better meet their specific business needs. You can add logos, modify text fields, and include additional instructions for your employees. This customization capability helps ensure the form aligns with your company’s policies.

-

Are electronic signatures on the W4 Spanish 2024 form legally binding?

Absolutely! Electronic signatures on the W4 Spanish 2024 form via airSlate SignNow are legally binding, complying with the ESIGN Act and UETA regulations. Utilizing our platform ensures that the signed documents are valid and enforceable in court, giving you peace of mind.

-

What security measures does airSlate SignNow implement for the W4 Spanish 2024 form?

airSlate SignNow prioritizes your data security, using advanced encryption technology to protect your W4 Spanish 2024 form and other documents. We also comply with various security certifications and standards to ensure your information remains safe from unauthorized access. This commitment to security allows users to sign documents with confidence.

-

Can I integrate airSlate SignNow with other tools for managing the W4 Spanish 2024?

Yes, airSlate SignNow can be easily integrated with various business tools, enhancing the management of the W4 Spanish 2024 form. Whether you’re using platforms for HR, payroll, or project management, our integrations streamline your workflow and improve productivity. This connectivity allows you to maintain a seamless document management experience.

Get more for Form W 4 SP Certificado De Exencion De La Retencion

- Legal condition form

- Notice of discontinuance ucpr form

- Military shipping label template form

- Members savings scheme withdrawal form kanisa sacco

- Michigan wic special formulafood request form michigan

- Nj 1040 hw form

- New jersey amended resident income tax return form nj 1040x

- Company issued mobile phone agreement template form

Find out other Form W 4 SP Certificado De Exencion De La Retencion

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors