Formulario W 4sp 2012

What is the Formulario W-4SP

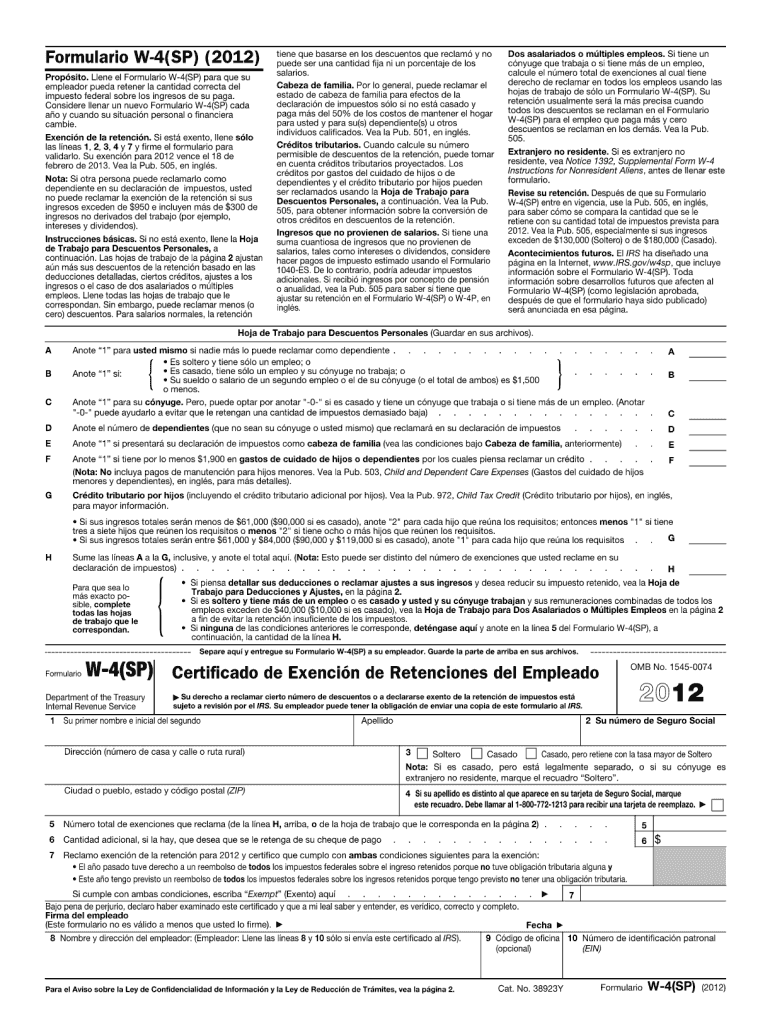

The Formulario W-4SP, officially known as the IRS Form W-4 for state-specific purposes, is a crucial document used by employees to indicate their tax withholding preferences. This form helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck. The W-4SP is particularly important for employees who have specific situations, such as multiple jobs or dependents, that may affect their tax liability. Understanding this form is essential for ensuring accurate tax withholding and compliance with federal tax regulations.

How to use the Formulario W-4SP

Using the Formulario W-4SP involves several straightforward steps. First, employees need to obtain the form from their employer or the IRS website. Once they have the form, they should fill it out by providing personal information, including their name, address, Social Security number, and filing status. Employees will also need to indicate the number of allowances they wish to claim, which directly impacts their withholding amount. After completing the form, it should be submitted to the employer, who will use the information to adjust the employee's tax withholding accordingly.

Steps to complete the Formulario W-4SP

Completing the Formulario W-4SP requires careful attention to detail. Here are the steps to follow:

- Obtain the Formulario W-4SP from your employer or the IRS website.

- Fill in your personal details, including your name, address, and Social Security number.

- Select your filing status, such as single, married, or head of household.

- Determine the number of allowances you wish to claim based on your tax situation.

- If applicable, indicate any additional amount you want withheld from each paycheck.

- Review the completed form for accuracy before signing and dating it.

- Submit the form to your employer for processing.

Legal use of the Formulario W-4SP

The legal use of the Formulario W-4SP is governed by IRS regulations. It is essential for employees to provide accurate information on this form to ensure compliance with federal tax laws. Incorrect or misleading information can lead to improper withholding, resulting in potential tax liabilities or penalties. Employers are also required to maintain the confidentiality of the information provided on the W-4SP, ensuring that it is used solely for the purpose of calculating tax withholding.

IRS Guidelines

The IRS provides specific guidelines for completing the Formulario W-4SP. These guidelines include instructions on how to determine the number of allowances to claim based on personal circumstances. The IRS also emphasizes the importance of reviewing and updating the form whenever there are significant life changes, such as marriage, divorce, or the birth of a child. Staying informed about IRS guidelines helps employees make informed decisions regarding their tax withholding and overall tax planning.

Filing Deadlines / Important Dates

While the Formulario W-4SP does not have a specific filing deadline, it is crucial for employees to submit it to their employer promptly to ensure accurate withholding for the current tax year. Employees should also be aware of important tax deadlines, such as the annual tax return filing date, which is typically April 15. Updating the W-4SP in advance of these deadlines can help avoid surprises during tax season.

Quick guide on how to complete formulario w 4sp 2012

Effortlessly create Formulario W 4sp on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Handle Formulario W 4sp on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign Formulario W 4sp with ease

- Locate Formulario W 4sp and click Get Form to initiate the process.

- Make use of the tools we offer to complete your document.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or mistakes that require new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Formulario W 4sp and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct formulario w 4sp 2012

Create this form in 5 minutes!

How to create an eSignature for the formulario w 4sp 2012

How to generate an eSignature for your PDF file in the online mode

How to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the Formulario W 4sp and why do I need it?

The Formulario W 4sp is a tax form that helps you with your withholding allowances for federal income tax. This form is essential for ensuring that the appropriate amount of tax is withheld from your paycheck. By accurately completing the Formulario W 4sp, you can avoid both under withholding and over withholding, making tax season smoother.

-

How does airSlate SignNow simplify the process of filling out the Formulario W 4sp?

airSlate SignNow provides an intuitive platform that allows you to easily fill out and eSign the Formulario W 4sp online. Our user-friendly interface guides you through each field, reducing the time and effort required. You can also save your progress and access your forms anytime for added convenience.

-

Is there a cost associated with using airSlate SignNow for the Formulario W 4sp?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business sizes and needs. Each plan provides access to essential features for managing forms, including the Formulario W 4sp, ensuring you only pay for what you need. We also offer a free trial, so you can explore our features before committing.

-

Can I integrate airSlate SignNow with other software to manage the Formulario W 4sp?

Absolutely! airSlate SignNow seamlessly integrates with various CRM and productivity tools, allowing you to manage the Formulario W 4sp alongside your other business documents. This means you can streamline workflows and keep all your tax and compliance forms in one accessible location.

-

What benefits does airSlate SignNow offer when dealing with the Formulario W 4sp?

Using airSlate SignNow for your Formulario W 4sp provides numerous benefits, including enhanced security for your sensitive data, quick and easy eSigning, and the ability to track the status of your forms in real time. These features help you expedite administrative tasks and maintain compliance efficiently.

-

Is the Formulario W 4sp compliant with IRS regulations when signed through airSlate SignNow?

Yes, the Formulario W 4sp signed through airSlate SignNow meets all IRS requirements for electronic signatures. We ensure that our platform adheres to regulatory standards so you can have peace of mind knowing your tax documents are valid and legally binding.

-

How can I access my completed Formulario W 4sp in airSlate SignNow?

Once you complete and eSign your Formulario W 4sp through airSlate SignNow, you can easily download it or access it from your account dashboard. The platform securely stores your documents, allowing you to retrieve them whenever needed, without hassle.

Get more for Formulario W 4sp

- Child care services package idaho form

- Special or limited power of attorney for real estate sales transaction by seller idaho form

- Closing real estate transaction 497305868 form

- Limited power of attorney where you specify powers with sample powers included idaho form

- Limited power of attorney for stock transactions and corporate powers idaho form

- Special durable power of attorney for bank account matters idaho form

- Idaho small business startup package idaho form

- Idaho property management package idaho form

Find out other Formulario W 4sp

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will