Form W 4SP Internal Revenue Service 2020

What is the Form W-4SP?

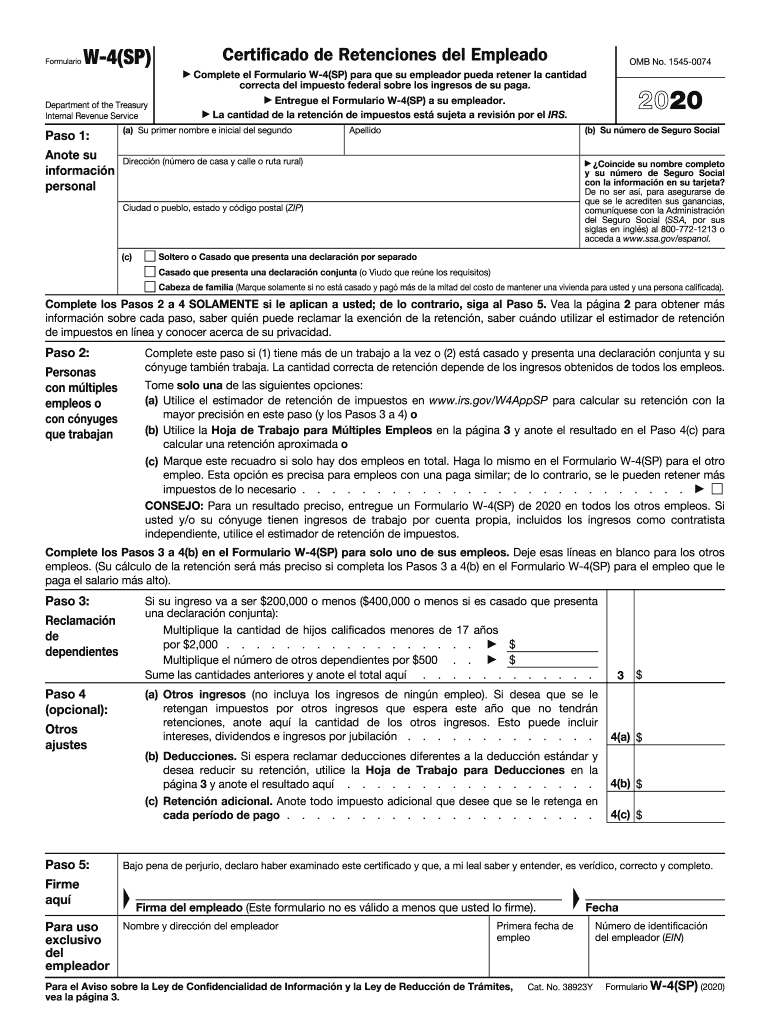

The Form W-4SP is a tax form provided by the Internal Revenue Service (IRS) specifically designed for individuals who are non-resident aliens. This form is used to determine the amount of federal income tax withholding from wages. It is essential for ensuring that the correct amount of tax is withheld from paychecks, which can help avoid underpayment penalties during tax filing season. Understanding this form is crucial for compliance with U.S. tax laws, especially for those who may have different tax obligations compared to resident citizens.

How to Use the Form W-4SP

Using the Form W-4SP involves several key steps. First, individuals must fill out the form accurately, providing their personal information, including name, address, and taxpayer identification number. Next, they should indicate their filing status and any applicable allowances. The form also allows for additional withholding if desired. Once completed, the form should be submitted to the employer, who will use it to calculate the withholding amount from the employee's paycheck. It is important to review and update the form as personal circumstances change, such as changes in employment or marital status.

Steps to Complete the Form W-4SP

Completing the Form W-4SP involves the following steps:

- Provide your full name and address in the designated fields.

- Enter your taxpayer identification number, which is typically your Social Security number.

- Select your filing status from the options provided.

- Claim any allowances you are eligible for, which can reduce your withholding amount.

- Indicate any additional amount you wish to withhold from each paycheck, if applicable.

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the Form W-4SP

The legal use of the Form W-4SP is governed by IRS regulations. It is essential that the information provided on the form is complete and accurate to ensure compliance with tax laws. Employers are required to maintain this form on file and use it to determine the appropriate amount of tax withholding. Failure to provide accurate information can result in penalties for both the employee and employer. It is advisable to consult with a tax professional if there are uncertainties regarding the completion or implications of the form.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form W-4SP is crucial for timely compliance. Generally, employees should submit this form to their employer before the first paycheck of the year or whenever there is a change in their tax situation that affects withholding. It is also advisable to review the form annually or whenever significant life events occur, such as marriage or the birth of a child, to ensure that withholding levels remain appropriate. Keeping track of these deadlines helps avoid underpayment penalties and ensures proper tax compliance.

Form Submission Methods

The Form W-4SP can be submitted to your employer through various methods. The most common method is to provide a printed copy directly to the payroll department. Many employers also accept electronic submissions, which can be sent via email or through an employee portal. It is important to confirm the preferred submission method with your employer to ensure that the form is processed correctly and in a timely manner. Keeping a copy of the submitted form for your records is also recommended.

Quick guide on how to complete 2020 form w 4sp internal revenue service

Prepare Form W 4SP Internal Revenue Service easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can locate the necessary form and safely store it online. airSlate SignNow supplies all the tools you require to create, modify, and eSign your documents quickly without delays. Handle Form W 4SP Internal Revenue Service on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form W 4SP Internal Revenue Service effortlessly

- Obtain Form W 4SP Internal Revenue Service and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark signNow sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form W 4SP Internal Revenue Service and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form w 4sp internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 form w 4sp internal revenue service

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the 4 Spanish form in airSlate SignNow?

The 4 Spanish form in airSlate SignNow refers to our user-friendly template designed specifically for Spanish-speaking users. It enables businesses to easily fill out and eSign documents in Spanish, streamlining the signing process while ensuring compliance and clarity.

-

How much does airSlate SignNow cost for using the 4 Spanish form?

The pricing for airSlate SignNow varies based on the plan you choose, but it includes access to the 4 Spanish form feature. We offer flexible subscription options to accommodate businesses of all sizes, ensuring that you get a cost-effective solution for your document signing needs.

-

What features does the 4 Spanish form offer?

The 4 Spanish form comes with features such as customizable templates, real-time tracking, and secure eSign capabilities. It simplifies document management for Spanish-speaking clients, allowing for easy collaboration and efficient signing processes.

-

Can I integrate the 4 Spanish form with other applications?

Yes, airSlate SignNow supports integrations with various applications like Google Workspace, Salesforce, and more. This means you can seamlessly use the 4 Spanish form in your existing workflows and enhance your document management experience.

-

Is the 4 Spanish form compliant with legal requirements?

Absolutely! The 4 Spanish form is designed to comply with electronic signature laws, ensuring that your signed documents are legally binding. We take security and compliance seriously, giving you peace of mind while using our platform.

-

How can the 4 Spanish form benefit my business?

Using the 4 Spanish form can signNowly streamline your document signing process for Spanish-speaking clients. By facilitating easier communication and understanding, your business can enhance customer satisfaction and boost conversion rates.

-

Do I need technical skills to use the 4 Spanish form?

No, you don't need any technical skills to use the 4 Spanish form in airSlate SignNow. The platform is designed to be intuitive and user-friendly, making it accessible for everyone, regardless of their technical expertise.

Get more for Form W 4SP Internal Revenue Service

- Refrigeration contractor package washington form

- Drainage contractor package washington form

- Tax free exchange package washington form

- Landlord tenant sublease package washington form

- Buy sell agreement package washington form

- Option to purchase package washington form

- Amendment of lease package washington form

- Annual financial checkup package washington form

Find out other Form W 4SP Internal Revenue Service

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed