Form W 4SP Employee's Withholding Certificate Spanish Version 2021

What is the Form W-4SP Employee's Withholding Certificate Spanish Version

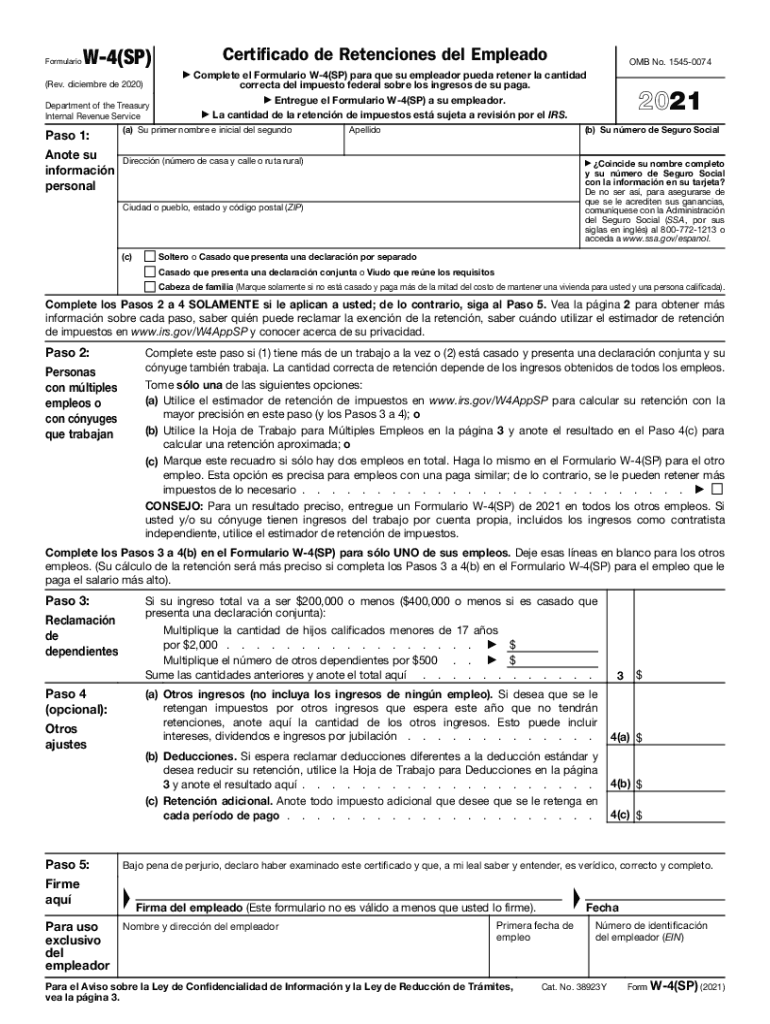

The Form W-4SP, also known as the Employee's Withholding Certificate in Spanish, is a crucial document for employees in the United States who prefer to complete their tax withholding information in Spanish. This form allows employees to indicate their tax withholding preferences to their employer, ensuring that the correct amount of federal income tax is withheld from their paychecks. The W-4SP is specifically designed to accommodate Spanish-speaking employees, making it easier for them to understand and complete their tax obligations.

How to use the Form W-4SP Employee's Withholding Certificate Spanish Version

Using the W-4SP is straightforward. Employees should first obtain the form from their employer or download it from the IRS website. Once they have the form, they should fill it out by providing personal information such as their name, address, and Social Security number. The form also requires employees to indicate their filing status and any additional withholding allowances they wish to claim. After completing the form, employees must submit it to their employer, who will use the information to adjust their tax withholding accordingly.

Steps to complete the Form W-4SP Employee's Withholding Certificate Spanish Version

Completing the W-4SP involves several key steps:

- Obtain the form from your employer or the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Select your filing status, such as single or married.

- Claim any allowances you wish to take, which may reduce your withholding.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Legal use of the Form W-4SP Employee's Withholding Certificate Spanish Version

The W-4SP is legally recognized by the IRS as a valid means for employees to communicate their tax withholding preferences. When completed accurately and submitted to the employer, it ensures compliance with federal tax laws. Employers are required to honor the information provided on the W-4SP, adjusting the withholding amounts accordingly. It is important for employees to keep a copy of the submitted form for their records, as it serves as proof of their withholding choices.

Key elements of the Form W-4SP Employee's Withholding Certificate Spanish Version

Several key elements are essential for the W-4SP:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Allowances: Employees can claim allowances to reduce their withholding.

- Signature: A signature is required to validate the form.

- Date: The date of completion must be included.

IRS Guidelines

The IRS provides specific guidelines for completing the W-4SP to ensure accurate tax withholding. Employees should refer to the IRS instructions for the W-4SP to understand how to calculate their allowances and determine the appropriate withholding amounts. These guidelines are crucial for maintaining compliance with tax regulations and avoiding under-withholding or over-withholding, which can lead to tax penalties or unexpected tax bills.

Quick guide on how to complete 2021 form w 4sp employees withholding certificate spanish version

Finish Form W 4SP Employee's Withholding Certificate Spanish Version effortlessly on any gadget

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Form W 4SP Employee's Withholding Certificate Spanish Version on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form W 4SP Employee's Withholding Certificate Spanish Version with ease

- Obtain Form W 4SP Employee's Withholding Certificate Spanish Version and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your files or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form W 4SP Employee's Withholding Certificate Spanish Version and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form w 4sp employees withholding certificate spanish version

Create this form in 5 minutes!

How to create an eSignature for the 2021 form w 4sp employees withholding certificate spanish version

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an e-signature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The best way to make an e-signature for a PDF document on Android OS

People also ask

-

What is the w4 form 2022 spanish and why is it important?

The w4 form 2022 spanish is a tax form that employees in the U.S. use to determine their federal income tax withholding. It's important for ensuring that the correct amount of tax is withheld from your paycheck, which can affect your tax refund or amount owed at the end of the year.

-

How can I fill out the w4 form 2022 spanish using airSlate SignNow?

You can easily fill out the w4 form 2022 spanish using airSlate SignNow's user-friendly interface. Simply upload your form, add the necessary fields, and fill it out electronically. This saves time and reduces the chances of errors.

-

Is there a cost to use airSlate SignNow for the w4 form 2022 spanish?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for businesses that require multiple document signings like the w4 form 2022 spanish. You can start with a free trial to see if it fits your requirements before committing.

-

Can I integrate airSlate SignNow with other tools for managing the w4 form 2022 spanish?

Absolutely! airSlate SignNow offers seamless integrations with various business applications. This means you can connect the platform with your existing tools to efficiently manage the w4 form 2022 spanish and streamline your document workflow.

-

What features does airSlate SignNow offer for electronic signing of the w4 form 2022 spanish?

airSlate SignNow provides features like secure electronic signatures, customizable templates, and document tracking that make signing the w4 form 2022 spanish easy. These tools help ensure a fast and compliant signing process.

-

How does airSlate SignNow ensure the security of the w4 form 2022 spanish?

The security of your documents, including the w4 form 2022 spanish, is a top priority for airSlate SignNow. The platform uses advanced encryption and authentication measures to keep your data safe from unauthorized access, ensuring confidentiality.

-

What benefits does using airSlate SignNow for the w4 form 2022 spanish provide?

Using airSlate SignNow for the w4 form 2022 spanish streamlines the signing process, reducing paperwork and saving time. It also ensures that your documents are legally compliant and securely stored, enhancing your overall efficiency.

Get more for Form W 4SP Employee's Withholding Certificate Spanish Version

- Letter tenant notice 497303701 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497303702 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair georgia form

- Letter tenant landlord agreement form

- Letter from tenant to landlord with demand that landlord repair broken windows georgia form

- Georgia repair form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497303707 form

- Letter tenant landlord demand form

Find out other Form W 4SP Employee's Withholding Certificate Spanish Version

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself